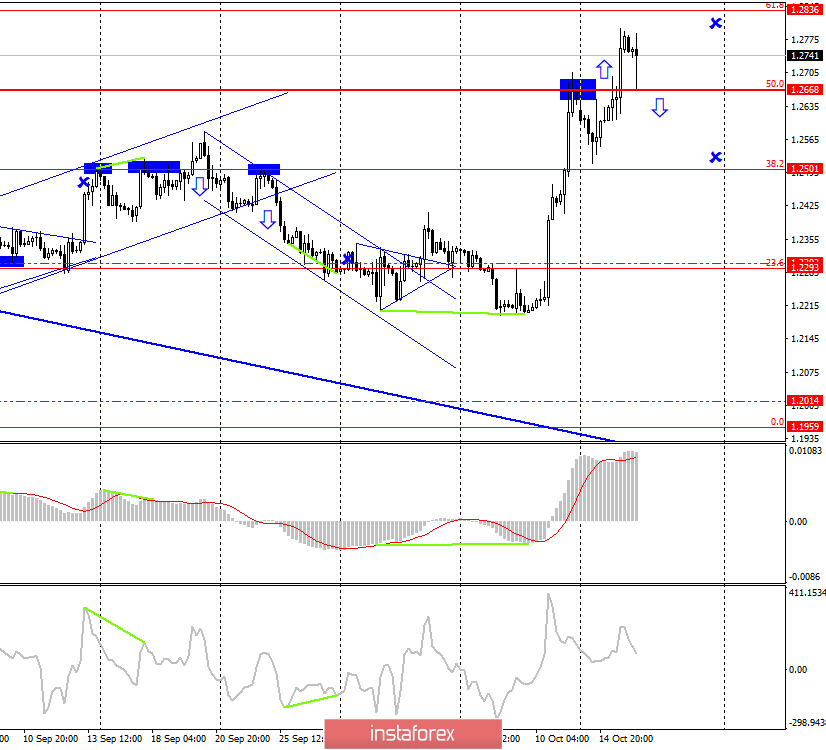

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a consolidation above the correction level of 50.0% (1.2668) and calmly continued the growth process in the direction of the correction level of 61.8% (1.2836). Only today, bear traders slightly lowered the pound/dollar pair back to the level of 50.0%. However, the rebound of the pair from this level will again work in favor of the pound. The reasons for the continued growth of the UK currency is slightly lower. In this paragraph, I just want to say that the chances of bears traders will appear only below the level of 50.0%.

The pound continues to grow in tandem with the US currency thanks to, as stated in the preview, pure rumors, speculation, and conjecture. Previously, this has happened with the pound, but now – the most pronounced growth, based on nothing specific. I have already said that in the coming days, the pound may fall by the same 600 points that went up. This may happen if the deal is not signed by London and Brussels at the summit on October 17/18 or the UK Parliament will block this version of the agreements between the UK and the EU. By the way, which version of the agreements can block the House of Commons, it is also quite difficult to say, because no details are received by the press. That is, the parties claim to progress, but what it consists of, what concessions Boris Johnson made, where the European Union conceded – all this remains a mystery, covered with darkness. Accordingly, it is very difficult to make at least some forecast about the results of the EU summit, when there is no information at your disposal. It seems that the parties agreed on the border between Ireland and Northern Ireland, which will now pass through the Irish Sea. Perhaps this is even a solution to the problem that both sides have been looking for so long, but will there be enough time to formalize everything legally, will there be enough time for the multi-page document to be considered by the deputies of the House of Commons, and then vote for it? All this also remains an absolute mystery. And in such a situation, any trade is conducted at random.

Economic reports from the UK, by the way, have not been of much concern to traders recently, but they could not ignore the inflation report. It turned out that inflation in September was the same 1.7% y/y as a month earlier. This explains the pullback of the pound/dollar pair down this morning. But this report is already behind, thus, now the focus of traders is Brexit again and everything related to it.

What to expect from the pound/dollar currency pair today?

The pound/dollar pair can perform one rebound from the correction level of 50.0% (1.2668), but now from below. Thus, I expect today to resume the growth of quotations in the direction of the Fibo level of 61.8% (1.2836). Only the closing of the pair rate under the Fibo level of 50.0% will work in favor of the US dollar and will allow traders to count on some fall in the direction of the correction level of 38.2% (1.2501). The bearish divergence of the CCI indicator also worked in favor of the US currency, but the level of 50.0% keeps the pound from falling again.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair with a target of 1.2836 if the rebound from the Fibo level of 50.0% is performed with the stop-loss order below the level of 1.2668.

I recommend considering the pair's sales with the target of 1.2501 today if the closure under the Fibo level of 50.0% is performed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română