The euro fell against the US dollar in the morning, failing to cling to the level of 1.1035 after the release of weak fundamental statistics, indicating a slowdown in economic expectations in Germany in October this year.

EURUSD

The decline in the index is directly related to the deteriorating situation in the German economy, which has been seriously affected by the decline in the production sector. A number of experts expect the situation to continue to worsen further.

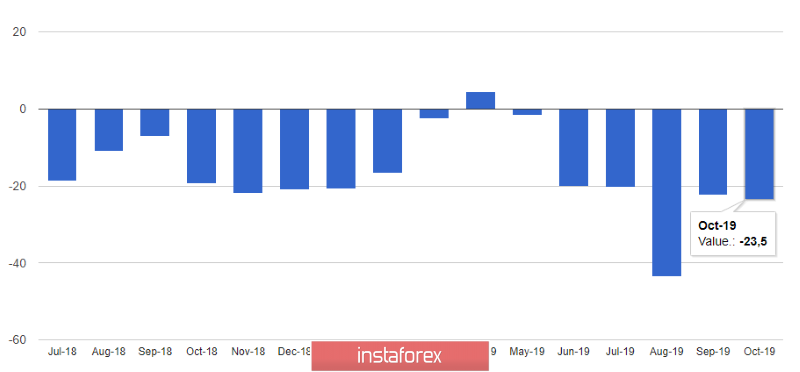

According to a report from a ZEW research institute, the German Economic Expectations Index dropped to -22.8 points in October from -22.5 points in September. Economists forecast an immediate decline to -27.0 points. The index of the current situation in Germany dropped to -25.3 points from -19.9 points, while economists had expected its decline to -28.0 points.

Traders were not pleased with the same indicator in the eurozone, which dropped to -23.5 points in October against 22.5 points in September.

The speech of the President of the Federal Reserve Bank of St. Louis James Bullard, which took place at the beginning of the European session, did not put serious pressure on the US dollar, even though the Fed representative spoke about the need to further reduce interest rates. In general, it is no longer surprising.

So, Bullard said that the main risk is to slow down the economy, which can be much stronger than most economists' forecasts. "Timely rate cuts helped mitigate risks for future prospects, but the Fed may decide to lower rates again," Bullard said. In his opinion, much more could be done to protect against bearish risks. During his speech, the President of St. Louis touched on the topic of trade conflicts, saying that it is impossible to respond to all the changes that occur during the negotiations, and trade uncertainty is unlikely to disappear in the next two years.

As for the technical picture of the EURUSD pair, the break of support 1.1005 led to the demolition of a number of stop orders of buyers, and, accordingly, the pressure on risky assets increased even more. Now you can only rely on an intermediate level of 1.0975, however, bigger players will show themselves only after updating the low of 1.0940.

GBPUSD

The British pound ignored the report on the number of unemployed in the UK, which has grown over the summer period, as well as the overall unemployment rate. According to the National Bureau of Statistics, the number of unemployed from June to August 2019 increased by 22,000, and the unemployment rate rose to 3.9% from 3.8%.

However, in August the number of unemployed fell by 49,000 compared with the same period of the previous year. Slowing economic growth also affects wage growth. Over the reporting period, wage growth slowed to 3.8% against 3.9% from May to July.

Today's surge in pound volatility is also directly related to the negotiations that are now ongoing between EU and UK representatives. EU negotiator Michel Barnier, before today's meeting of the bloc's foreign ministers, said that intensive negotiations with Britain on the Brexit agreement took place yesterday and there is a high probability of reaching an agreement this week. Despite a number of disagreements and the fact that work is becoming increasingly difficult, Barnier continues to look with optimism at the current situation.

Let me remind you that representatives are trying as soon as possible before the EU summit, which begins this Thursday, to prepare a legal document, which will mainly fix the solution to the problem of the customs border in Ireland. However, so far it is only known that the divergence of positions between them by representatives of the parties has narrowed.

As for the technical picture of the GBPUSD pair, the growth is limited by the resistance of 1.2675, a breakthrough of which should provide an influx of new buyers capable of updating the local highs of this week around 1.2740 and 1.2780.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română