After a significant activity in the global financial markets, caused by the expectation and the fact of new trade negotiations between the US and China, the new week began with a partial closure of positions.Investors, in turn, took profits, which caused a weakening of global stock indices, increased demand for protective assets, and some stabilization in the Forex market.

The behavior of the market clearly indicates that the fact of negotiations is not enough. Since it already wants to see some kind of result, and preferably a positive one. That is why on Monday, stock indices corrected, oil sank in price, and protective assets received some support. This resurgence of investor attention on the subject of US-Chinese trade negotiations is due to fears that the global economy will not just slow down, but may fall into recession. These fears have already provoked new apocalyptic forecasts that threaten an even more severe crisis than they did in 2008-09. However, while the market does not look so far, still counting on the trading power of the Chinese and Americans, as well as on the fact that the economies of the United States and China, still manage to stay in the growth phase.

On the other hand, the data on inflation in the "heavenly places" released on Tuesday somewhat inspired the market, however, this did not have a significant positive effect on the Chinese stock market, which traded in different directions.

According to the data presented, the consumer price index in annual terms in China grew by 3.0% against 2.8% and the forecast increase by 2.9%. On a monthly basis, the indicator added 0.9% in September against the August growth of 0.7% and the forecast to maintain the same growth rate. At the same time, production inflation went even lower to negative territory to -1.2% from -0.8%, which coincided with the forecast.

In general, observing the development of events in the markets, we can say that investors took a wait-and-see position and i seems that they are no longer occupied by the topic of the actual start of QE4 in the States, as well as the detailed details of Brexit. They concentrated on the topic of world economic growth prospects, trade wars, which is the basis for the attenuation of market activity. Perhaps, the markets will get some reason for intensifying trade against the background of the Fed members: Bostic, Daly and Bullard. If their rhetoric is full of "dovish" notes - this may support the demand for risk and lead to a local weakening of the dollar.

Forecast of the day:

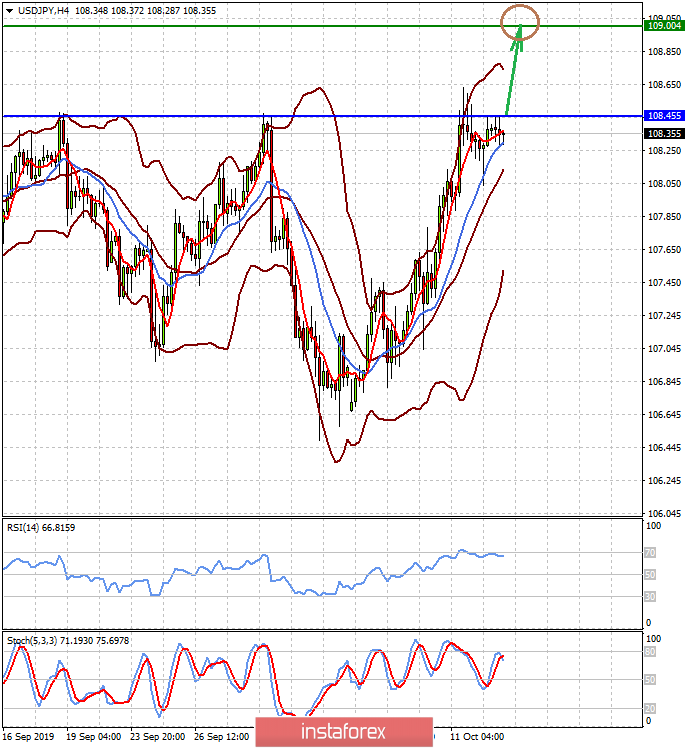

USD/JPY is trading below a strong resistance level of 108.45. If the market demand for risky assets increase, and while futures for major US stock indices show positive dynamics, then a breakthrough of this level will lead to a resumption of price growth to 109.00.

Gold on the spot seems to be showing a local reversal in the wake of a possible increase in demand for risky assets. It could not rise to the upper line of the downward short-term trend. If the price consolidates below the level of 1488.75, it is likely that it will continue to decline to 1473.50, and then, possibly, to 1461.90.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română