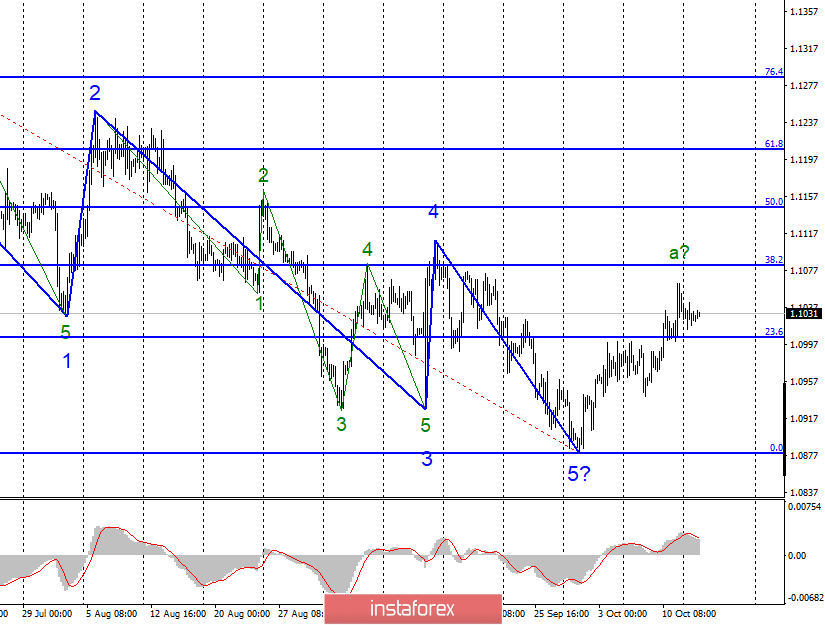

EUR / USD

Monday, October 14, ended for the EUR / USD pair with a decrease of 10 basis points. Since the news background was empty that day, such a low activity of the markets is quite logical. The wave pattern suggests the continuation of the construction of the upward trend section within the 3-wave structure. At the moment, we are observing the construction of the alleged wave a. If this is true, either directly from the current position, or after building correctional wave b, the increase in quotations will resume with targets located near the levels of 38.2% and 50.0% Fibonacci.

Fundamental component:

The fundamental background for the EUR / USD pair is now uncertain. On Monday, even analyzing any report fails, since there were almost none. The only indicator of industrial production in the European Union in August, which was expected to decline more than expected by the foreign exchange market. Thus, a slight decline in the euro could be caused by this report. Today, the situation in the European Union will be even worse and more boring. Several indices reflecting the mood in the business environment of Germany and the European Union, and all. It is unlikely that markets will actively rush to buy or sell a pair of euro-dollar based on these indices. Thus, today, most likely, low market activity, which is not suggesting a change in the current wave marking, will continue.

Purchase goals:

1.1083 - 38.2% Fibonacci

1.1145 - 50.0% Fibonacci

Sales goals:

1.0879 - 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build a new upward set of waves. At the same time, the news background can "turn" the instrument down at any moment, but so far, I expect a moderate increase in quotes with targets located near the levels of 1.1083 and 1.1145. An unsuccessful attempt to break the level of 1.1083 may lead to a departure of quotes from the reached highs and the construction of wave b.

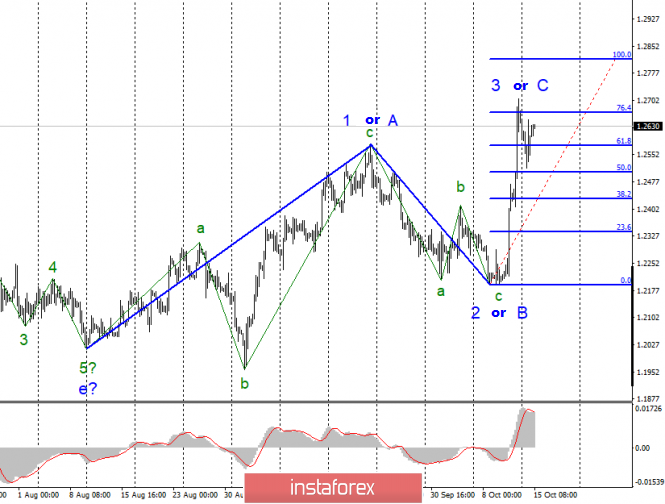

GBP / USD

The GBP / USD pair on October 14 lost only 20 base points, although it went much lower than these 20 points during the day. Despite the strong growth of the pound on Thursday and Friday, the correctional wave took a shortened form. The proposed construction of wave 3 or C can be continued, but an unsuccessful attempt to break through the level of 76.4% suggests that the markets are not ready to further increase the instrument. At the same time, some invisible force continues to push the British pound up, as today's trading began with a rise again. Thus, a successful attempt to break through the level of 76.4% will indicate the continuation of the construction of the third wave.

Fundamental component:

If the euro does not have the necessary news background and the pair froze in one place, then the GBP / USD pair does not experience a lack of news. Yesterday, the Queen of Great Britain, Elizabeth II, delivered a throne speech, who also said that the government's priority is to leave the European Union until October 31. She did not say a word about the Brexit negotiations or the deal. However, her words can be interpreted in different ways. We can say that the British Monarch himself believes that the country should leave the EU as soon as possible, respectively, Boris Johnson is doing everything right, and even Brexit must be completed on October 31 without a deal, although, the British Monarch in fact does not make any decisions related to the management of the state, so her words about "priority" may simply be a request from Boris Johnson. The same request as the suspension of Parliament earlier, which Elizabeth II also granted.

Sales goals:

1.2191 - 0.0% Fibonacci

Purchase goals:

1.2666 - 76.4% Fibonacci

1.2817 - 100.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument has transformed the wave markings. Thus, now, I can recommend new purchases of the instrument in case of a successful attempt to break through the 76.4% Fibonacci level, which will indicate the readiness of the markets for new purchases. However, current levels are very high for the pound, and if Brexit does not end in favor of the UK this week, then there is a high probability of building a new downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română