The Canadian dollar paired with the US currency significantly appreciated last week, gaining nearly 200 points - the USD/CAD pair tumbled two days from the middle of the 33rd almost to the bottom of the 31st figure. This week there was a price pullback, but overall, the pair still retains bearish potential. Tomorrow, October 16, the loonie can resume its downward impulse - it all depends on the dynamics of September inflation in Canada.

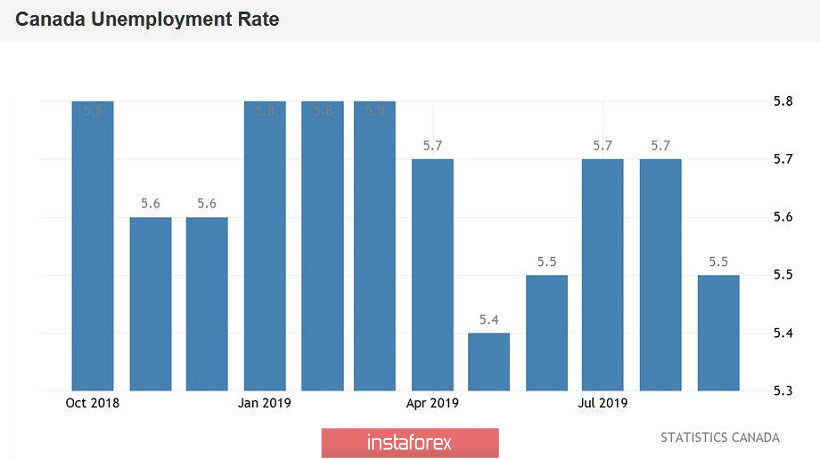

The reason for the rise in the Canadian dollar last week was not only the results of US-Chinese trade negotiations. Data on the labor market of Canada, which was surprisingly strong, became a catalyst for the loonie's fall. Contrary to neutral forecasts, the unemployment rate fell to 5.5%. The increase in the number of employees was also pleasantly surprising: this indicator exceeded the forecast values five times (!), reaching 53 thousand, instead of the forecasted 11 thousand.

Although this dynamics was largely achieved due to the relatively unstable sector of our own businesses (self-employment) and public service, this increase was mainly due to the increase in the number of full-time employees (+70 thousand), while partial employment decreased by 16 thousand . This is certainly a positive signal, including for inflation indicators, since regular positions require a higher level of salaries and a level of social protection. By the way, the growth rate of wages accelerated to 4.3% against the previous value of 3.8%, signaling a strengthening of the wage scale: the average hourly rate increased by 2.6% from $27.66 to $28.13.

This was an important release for the Canadian dollar, which has recently been under pressure from the downward dynamics of the oil market, amid a slowdown in the growth of the national economy. Canada's GDP growth data, which was published in early October, again returned concerns about further actions by the Canadian central bank. The indicator came out in the "red zone", not justifying the forecasts of most analysts: on a monthly basis, the indicator was at zero level (with a weak forecast of growth to 0.1%), while in annual terms it dropped to 1.3% (with the forecast growth up to 1.4%). Such weak dynamics discouraged USD/CAD traders, as the previous macro indicators showed a contradictory result, and the Bank of Canada maintained a wait-and-see position.

Only two meetings of the Canadian regulator remained before the end of the year: one of them will be held on October 30, the last on December 4. According to some analysts, at the October meeting, the central bank may take a softer position, up to the announcement of a rate cut in December. Strong data on the labor market offset concern about this, but this scenario cannot be ruled out. That is why tomorrow's data on inflation in Canada play such a big role for the loonie: against the backdrop of uncertainty about the prospects for a trade war, as well as amid conflicting statistics, these figures will help tip the scales in one direction or another.

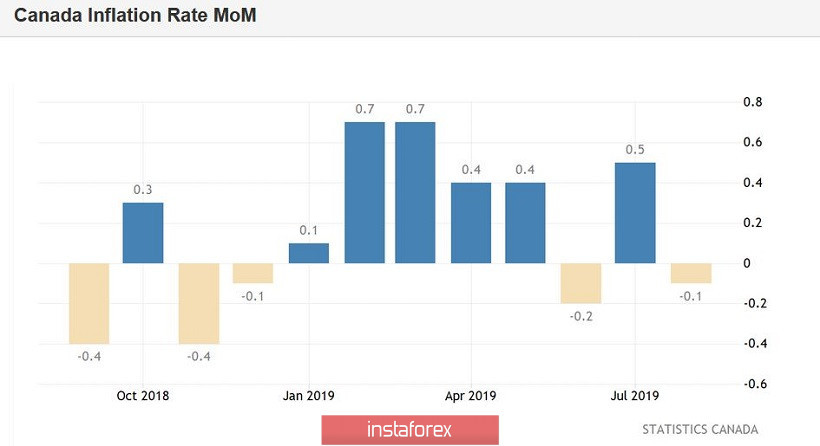

Judging by preliminary forecasts, tomorrow we will not see any distinct and confident breakthrough. The general consumer price index (in monthly terms) may go deeper into the negative area: after falling to -0.1% in August, analysts expect it at -0.3% in September. In annual terms, the indicator, on the contrary, can demonstrate positive dynamics, rising to the level of 2.1% (after the first time since May this year it fell below the 2% target). As for core inflation, a mixed picture is also expected here: on a monthly basis, the core CPI should grow from -0.1% to zero, and in annual terms, remain at the level of August, that is, at around 1.9%.

As you can see, the forecast is rather weak. For USD/CAD bears, it is important that the real numbers turn out to be better than expectations in all respects: only in this case will the Canadian dollar be able to resume its path to the 30th figure. Otherwise, the price will return to the range of 1.3270-1.3350, in which the pair traded for almost two weeks, in early October.

Also, do not forget that the Canadian dollar is guided by the dynamics of the oil market. At the end of last week, the price of December futures for Brent brand rose to $60 per barrel, and WTI by - to $54 per barrel. This dynamic was driven by an attack on an Iranian tanker, just 60 miles off the coast of Saudi Arabia. Today we are seeing a price pullback - oil quotes show a downward trend, and this fact has an indirect negative effect on the Canadian dollar.

But in general, the USD/CAD pair will soon be guided by macroeconomic reports - both the United States and Canada. In this context, tomorrow's data on the growth of Canadian inflation occupies a leading role.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română