4-hour timeframe

Technical data:

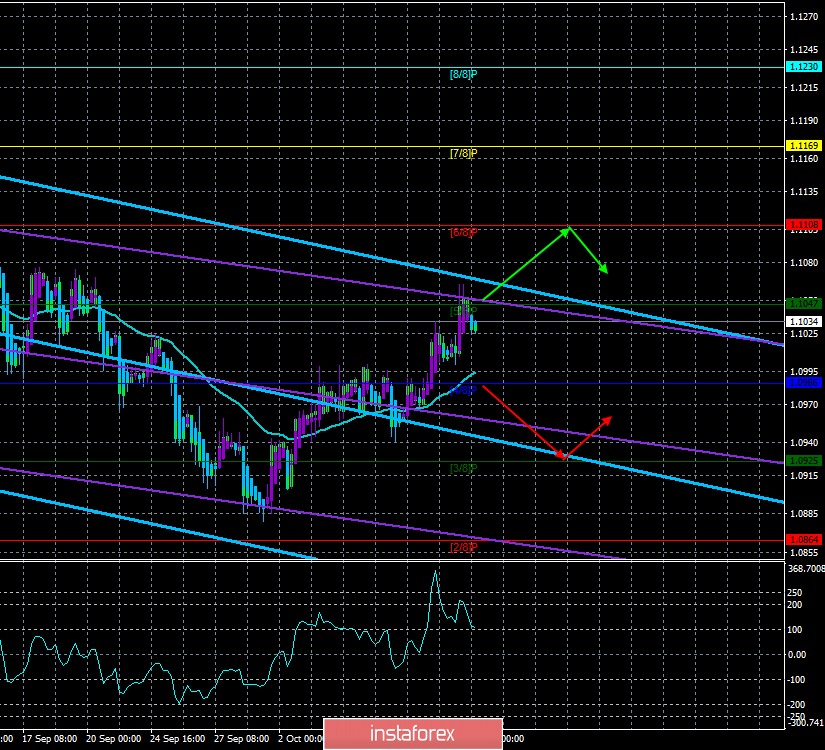

The upper channel of linear regression: direction – down.

The lower channel of linear regression: direction – down.

The moving average (20; smoothed) – up.

CCI: 106.8612

Although the EUR/USD currency pair has been showing an upward movement for two weeks, both channels of linear regression continue to be directed downward, which signals the continuation of the downward trend in the medium and long term. We have repeatedly said that from a fundamental point of view, the euro currency has very few chances and opportunities for the formation of an upward trend. By and large, all that the euro can count on now is the local support of traders from individual macroeconomic reports or news, as well as technical factors that cause forex market participants to close deals from time to time, which leads to corrections.

Today, October 14, the euro currency will try to find support from traders thanks to the industrial production report for August. However, looking at the forecasts, which predict a fall of 2.5% in annual terms, it becomes clear that it will be difficult to continue the growth of the euro/dollar pair today. Next, the speech of the Vice President of the European Central Bank, Luis de Guindos, will take place today. Mario Draghi usually catches the attention of traders, but it was de Guindos who said last time that the ECB could continue to cut key rates, causing a slight panic in the market. Something similar can be expected now, given that Mario Draghi will leave his post at the end of the month, and a split in opinion is brewing in the ECB monetary Committee itself.

Meanwhile, as a result of the China-US talks at the highest level, which took place in Washington last week, no agreements were signed, but US President Donald Trump said that "agreement was reached in principle," "China has already begun to purchase agricultural products from America production in large volumes ", as well as "the parties are close to signing the agreement in the first phase." Trump also decided not to raise duties on Chinese imports to 30%, which is currently subject to 25% duties, since Beijing seems to have begun to meet Washington. Of course, these are statements made for the masses. According to insider information or rumors, Donald Trump had to make concessions to China, as the topic of possible impeachment greatly reduces the political ratings of the US leader. China feels this and is getting tougher in negotiations. In principle, both parties understand that Trump most of all want to be re-elected for a second term. And for this, he needs strong support from the electorate, since right now, because of his trade wars, many Americans are not happy with the president. Thus, Trump needs to end the trade war with China as soon as possible and sign an agreement. Accordingly, Trump will have to concede now. And in public, you can say anything.

Well, the EUR/USD pair worked out the Murray level of "5/8" – 1.1047 and at the moment rebounded from it. Today, there is a high probability of the beginning of a downward correction to the moving average line, as the fundamental support of the euro currency is unlikely to receive. At the same time, euro purchases may continue by inertia, which can be identified by overcoming the level of 1.1047.

Nearest support levels:

S1 – 1.0986

S2 – 1.0925

S3 – 1.0864

Nearest resistance levels:

R1 – 1.1047

R2 – 1.1108

R3 – 1.1169

Trading recommendations:

The euro/dollar pair continues to be located above the moving average line but may begin to adjust. Thus, it is recommended to wait for the completion of the current correction and resume buying the euro currency in small lots with targets of 1.1047 and 1.1108. It is recommended to buy the US dollar if the bears overcome the moving average.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue lines of the unidirectional movement.

The lower channel of linear regression – the purple lines of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) – blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi – an indicator that colors bars in blue or purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română