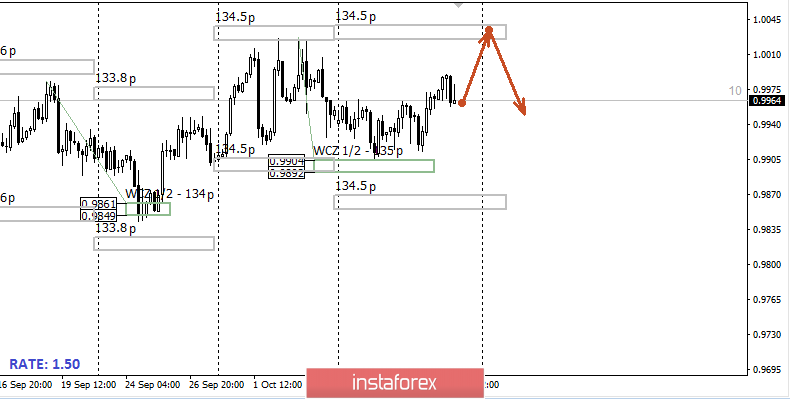

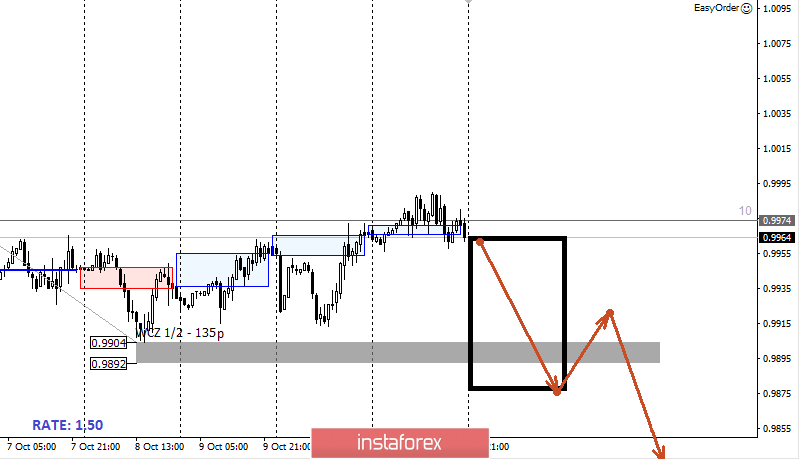

At the beginning of last week, the WCZ 1/2 test 0.9904-0.9892 took place. This made it possible to enter the purchase. Holding a long position is the main trading plan at the beginning of the current week. The first growth target is the October high. Its test will take part of the position, and the rest of the transfer to breakeven.

Work in the upward direction has been going on for the third month, which indicates a long-term bull trend. The probability of a reversal of such an impulse in a short period of time is possible with a small probability, therefore it is more profitable to focus on updating monthly highs. The formation of a false breakdown pattern will be required to start a long-term bearish impulse, which will lead to an update of the monthly extremum.

An alternative model will be developed if the closure of one of the next US sessions occurs below the WCZ 1/2. This will indicate the need to exit a long position and find favorable prices for selling the instrument.

Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română