To open long positions on EURUSD you need:

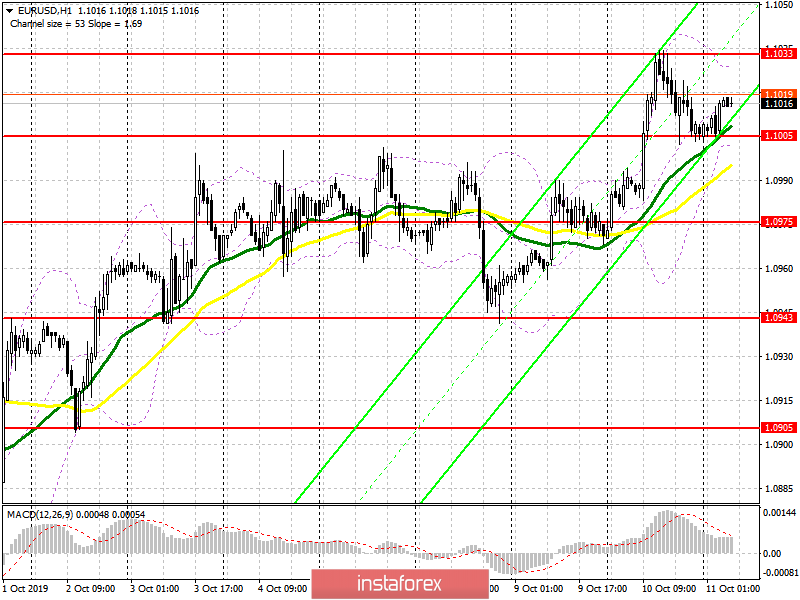

Data on inflation in the US yesterday did not support the US dollar, which left the market on the side of buyers of the euro. Today, all attention will be focused on the inflation report in Germany and the statement by the President of the European Central Bank Marie Draghi. At the moment, EUR/USD growth is limited by the resistance of 1.1033, and only going beyond its margins will keep the growth, which will lead to the renewal of the highs of 1.1067 and 1.1109, where I recommend taking profits. In the scenario of a downward correction, which can be formed after the fundamental data is released, it is best to return to long positions on the update of support at 1.1005, provided that there is a false breakdown there, or a rebound from a larger low of 1.0975.

To open short positions on EURUSD you need:

Sellers are in no hurry to return to the market, focusing on the inflation report and on negotiations between the US and China. Only bad news can increase the pressure on the euro, and the formation of a false breakdown in the resistance area of 1.1033 will be a direct signal to open short positions, in the hope of updating support at 1.1005. However, a more important task, which is realized under the scenario of failed negotiations between the US and China, will be consolidating below this support, which will quickly pull down EUR/USD to the lows of 1.0975 and 1.0943, where I recommend taking profit. If the demand for the euro continues in the morning, and inflation data in the eurozone countries, especially Germany, will please traders, it is best to return to short positions only after a test of a high at 1.1067 and a rebound from 1.1109.

Signals of indicators:

Moving averages

Trading is slightly higher than 30 and 50 moving averages, which indicates that the bullish momentum will be maintained.

Bollinger bands

A break of the lower boundary of the indicator at 1.1005 will increase pressure on the euro.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română