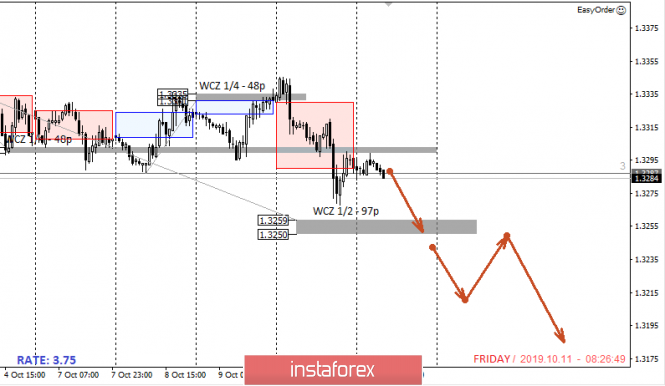

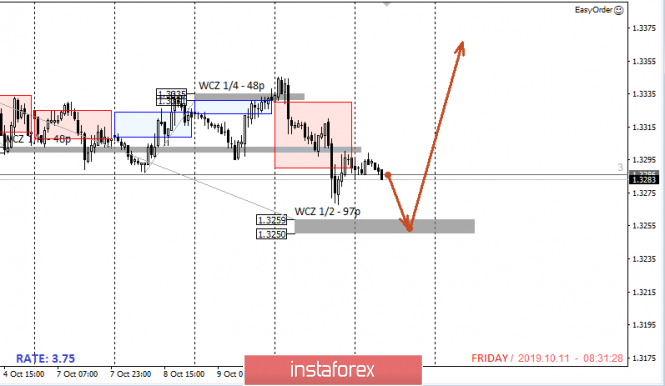

Yesterday's move may be decisive for next week. Closing trades below WCZ 1/4 1.3303-1.3299 indicates an increase in the likelihood of a decline to 70%. The purpose of the fall is WCZ 1/2 1.3259-1.3250. Testing this area will close part of the sales. The rest should be transferred to breakeven in case of continued downward movement.

The medium-term outlook for the decline can be assessed as updating the October low. This model will become relevant if the pair consolidates below the WCZ 1/2.

An alternative growth model will be developed if the pair stops at WCZ 1/2 and a false breakout pattern is formed. This will lead to a sharp increase in demand and the resumption of upward movement. This model should be considered along with the bear one

Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română