4-hour timeframe

Amplitude of the last 5 days (high-low): 58p - 43p - 39p - 55p - 37p.

Average volatility over the past 5 days: 46p (average).

The EUR/USD pair sharply grew against the US dollar on Thursday, October 10. There were no important macroeconomic reports and publications this morning in either the United States or the European Union. Only one single report on inflation in the United States for September, but it was published, as you might guess, during the US trading session, while the pair's main growth fell on the European session. Thus, there are only two options: either rumors or insider information about the weakness of inflation in the United States fell into the hands of traders before the official report (especially in the hands of large players), or the current set of circumstances is a banal coincidence. One way or another, the euro currency grew without reason today, and the almost zero reaction of traders during the official publication of the consumer price index in the US, which recorded the absence of changes in the main indicator (1.7% against the forecast of 1.8% y/y), is explained by the euro's earlier growth.

On the topic of a trade war between China and the United States, it can be said that the expected next round of negotiations between the countries ended in nothing. Lack of progress. We still believe that the trade war itself and any details from its fronts have a very indirect effect on the movement of the euro/dollar pair. Of course, perhaps the situation has now changed, but before the dollar bulls did not pay any attention to the failures in the negotiations, the introduction of new duties on one or the other hand, and certainly there was no negative impact on the US currency. Thus, we do not associate the euro's growth in the morning with the failure in the negotiations between the Chinese and American delegations.

At the same time, Vice President of the European Central Bank Luis de Guindos said in an interview that the regulator could lower rates even further. "The side effects of monetary policy are becoming more tangible," said de Guindos. Also, Deputy Mario Draghi does not exclude the adjustment of monetary policy at the next meeting in October, despite the fact that this will be the last meeting for Draghi himself, who is resigning. We believe that there will be no changes at the October meeting, for sure, in the QE program, since it starts only in November, when Christine Lagarde will already be in power. "My opinion: the current level of rates is correct, but we will look at what will happen with downward risk and forecasts, and after a detailed discussion in the board of governors, we will make a decision," said de Guindos.

If we take a look at all of today's news as a whole, the question arises: has the fundamental picture for the euro changed for the better? From our point of view, no. Even if we hypothetically imagine that the Beijing-Washington trade war still affects the movement of the pair, today there were no reports of an escalation of the conflict, and new duties were announced by the United States only on October 15 and December 15. So, traders had no reason to sell the dollar today, except for inflation in the United States. Accordingly, the fundamental background supported the euro only in the short term. In the long run, nothing has changed.

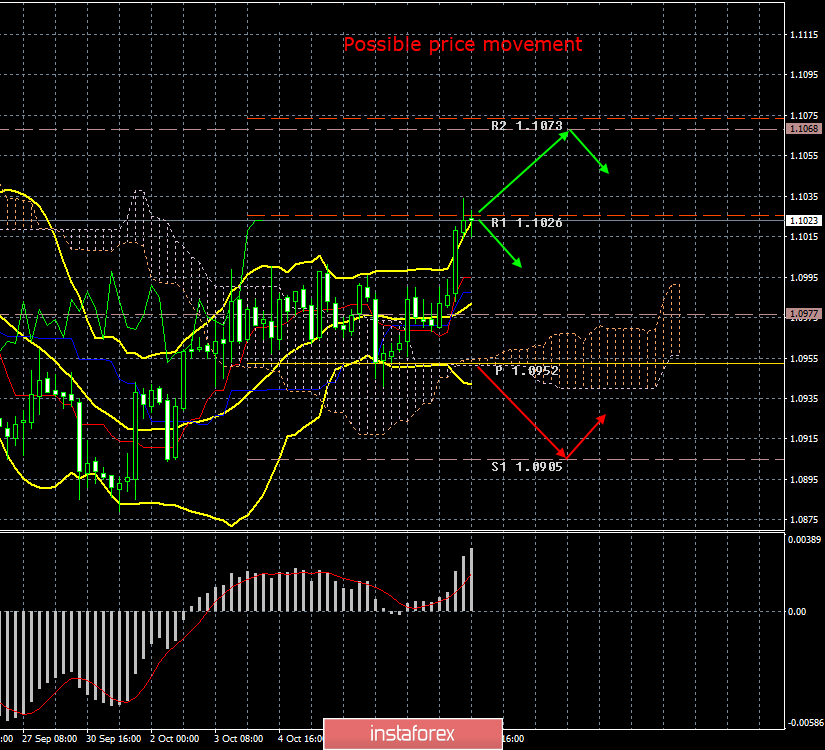

Well, the technical picture shows the development of the first resistance level of 1.1026, so far the bulls have failed to gain a foothold above this level. A rebound from this level can trigger not only a downward correction, but also the beginning of a new downward trend, which is more preferable from our point of view.

Trading recommendations:

The EUR/USD pair resumed its upward movement and completed the level of 1.1026. Thus, it is recommended that traders now again consider long positions in small lots with the target of 1.1068 if the first target is overcome. It is not recommended to return to sales, although they are more preferable from the point of view of a long-term fundamental background.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română