To open long positions on EURUSD you need:

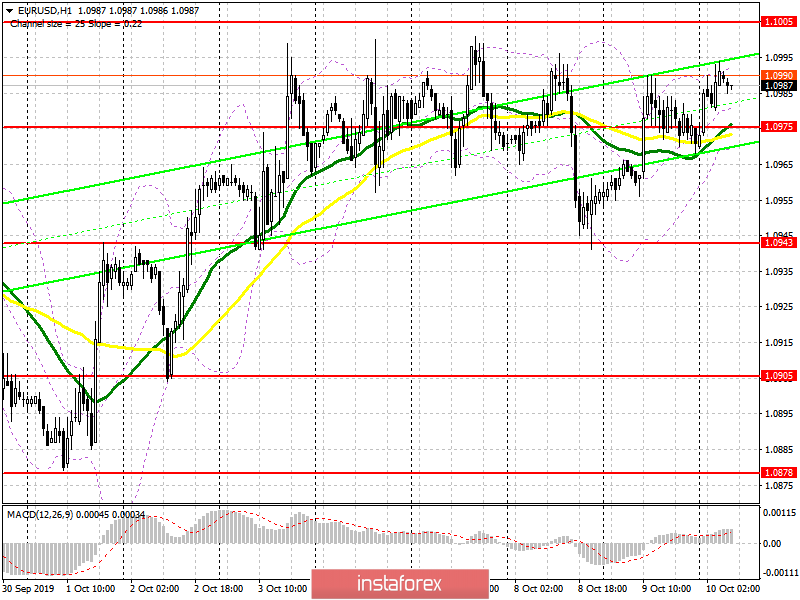

Yesterday's minutes of the US Federal Reserve did not clarify the situation regarding a further interest rate cut, which led to a slight strengthening of the euro today at the Asian session. Optimism regarding the US-China trade deal also contributes to higher demand for the euro. Today, in the morning, buyers need to keep the level of 1.0975. The formation of a false breakdown on it will be the first signal to open long positions in the hope of updating the high in the area of 1.1005 and its breakthrough, which will lead to new levels 1.1033 and 1.1067, where I recommend taking profits. In case the euro falls to the level of 1.0975 after the publication of the minutes of the European Central Bank, one can look at long positions on the test of the lower boundary of the side channel near 1.0943, or buy immediately on the rebound from the low of 1.0905.

To open short positions on EURUSD you need:

Sellers will expect the formation of a false breakdown at the upper boundary of the side channel at 1.1005, but a more important task will be to return to the intermediate support level of 1.0975, under which the pressure on the pair will increase, which will lead to an update of the low of 1.0943. However, we can talk about the resumption of the bearish trend only after breaking 1.0943 and updating support at 1.0905, where I recommend taking profits. The publication of the minutes of the European Central Bank may lead to the euro's growth above the resistance of 1.1005, as well as good news on the US-China deal. In this scenario, it is best to consider short positions in EUR/USD for a rebound from a high of 1.1033.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving average, which indicates the lateral nature of the market.

Bollinger bands

Volatility is very low, which does not provide signals on entering the market.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română