4-hour timeframe

Amplitude of the last 5 days (high-low): 64p - 60p - 58p - 43p - 39p.

Average volatility over the past 5 days: 53p (average).

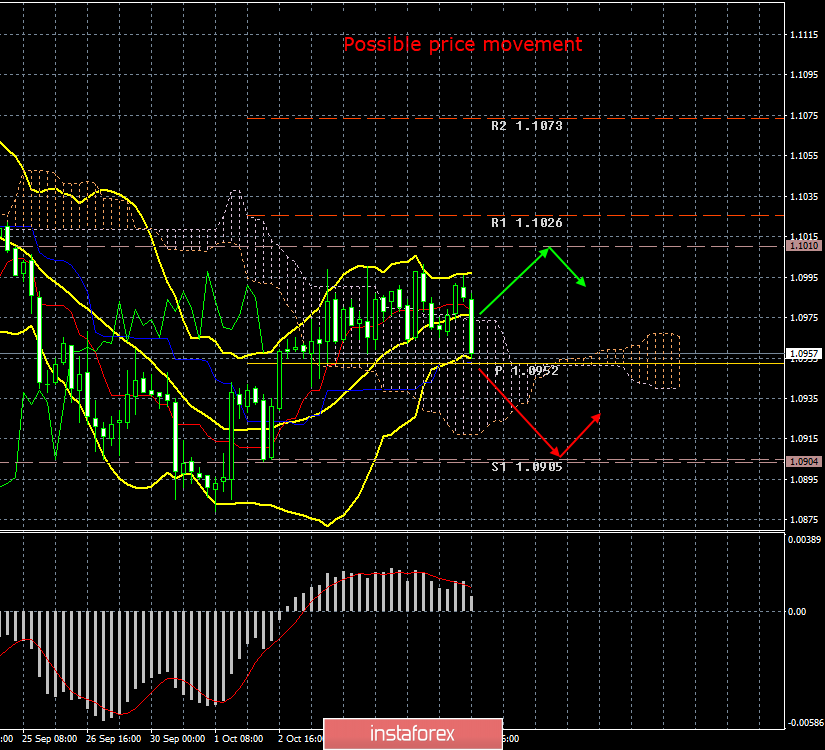

Just this morning, we drew the attention of traders to the purely corrective growth of the European currency with very little potential. We said that there are very few fundamental factors supporting the euro, and the topics of the impeachment of Donald Trump, the trade war with China are interesting, but not so much that traders work them out. Therefore, the decline in the EUR/USD currency pair during the US trading session is not surprising at all. Bulls, as they have repeatedly done before, quickly exhausted their growth potential, barely crossed the Ichimoku cloud, and even if you look closely at the illustration, it becomes clear that this Senkou Span B line went down, allowing the price to gain a foothold. If we take the initial position of the Senkou Span B line, it turns out that the price bounced four times from it and now has a high chance of resuming a downward trend, unless strong fundamental data are received in the near future that will support the single European currency.

The fundamental background today is zero for the euro/dollar pair. All the most interesting events took place today in the UK, but traders of the EUR/USD pair were deprived of news feeds. However, as we can see, this did not prevent them from resuming the pair's sales too much. Macroeconomic reports this week are generally disastrously small. Jerome Powell speaks every day, however, he doesn't tell the markets anything new. However, one should not lose sight of his speeches, since if Powell did not say anything yesterday, this does not mean that his rhetoric will continue today. Let me remind you that traders are mainly waiting for hints from the head of the Federal Reserve on the future actions of the regulator. The agenda now is not just the question "Will the Fed lower the rate at the end of October?", But the question "Will the Fed lower the rate for the third time in a row at the end of October?". Three consecutive easing of monetary policy will unequivocally talk about the course of the US regulator on easing monetary policy, and not about adjusting the rate after a cycle of increasing it.

In addition, we would like to draw the attention of traders that Donald Trump, despite Powell's assurances of "independence of the Fed", has, in our opinion, a huge impact on the members of the monetary committee, criticizing the Fed as a whole for its inappropriate current economic and geopolitical conditions. Moreover, we believe that Trump can put pressure on individual members of the monetary committee, just as he put pressure on the president of Ukraine on the issue that ultimately led the American president to start the impeachment procedure in Congress against him. Pressure on the unwanted is generally Trump's favorite policy. If the US leader does not like how a country or a single politician acts, then verbal pressure begins, then verbal threats, then the president moves from words to action. Thus, it is possible that after several months of tireless criticism on the Fed, Trump took up individual members of the FOMC committee, which led to a fairly quick rate cut, as Trump wanted. Jerome Powell can only tell reporters that the Fed is not subject to Trump, although in fact the Fed is doing exactly what the US president is demanding from it.

From a technical point of view, it is recommended to wait for quotes to consolidate below the Kijun-sen line, which will weaken the current "golden cross". The lower boundary of the Ichimoku cloud is considered a weak line and no problems should arise with its overcoming. Thus, overcoming the critical line is almost guaranteed to return the euro/dollar pair into a downward trend.

Trading recommendations:

The EUR/USD pair started to move down. Thus, it is recommended that traders wait for the pair to consolidate below the Kijun-sen line and sell the euro with the goal of the first support level of 1.0905. It will be possible to return to purchases in small lots in the event of a price rebound from the critical line.

In addition to the technical picture, fundamental data and the time of their release should also be considered.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română