Yesterday was supposed to be incredibly calm and quiet, but apparently, this is what annoys the British, who can not calm down with their Brexit. One of the British magazines has published a letter from an anonymous official from Downing Street 10 regarding how negotiations are progressing with Brussels. More precisely, how these very negotiations are in place. This letter clearly states that negotiations have long reached an impasse from which it is impossible to get out through the fault of Brussels, which refuses to even discuss anything related to the border between Ireland and Northern Ireland. However, this is almost the most important issue for the UK, due to the fact that it is because of it that the House of Commons has repeatedly rejected the divorce agreement with the European Union. It is for the reason that if the Emerald Isle after Brexit will preserve the existing customs and border regime, which is simply not there, it is the British economy that will suffer the greatest losses, and even completely lose its independence. Therefore, it is not surprising that in the published letter, the idea is expressed that the next postponement of Brexit will not do anything, since the European Union still refuses to discuss this issue. So Boris Johnson has no choice but to announce his withdrawal from the European Union without an agreement and immediately introduce border controls between Ireland and Northern Ireland. And although such reports clearly increase the hysteria about the unregulated Brexit, the weakening pound was obviously moderate largely for the simple reason that it's unclear whether the position expressed in the letter is the official point of view or even invented by journalists.

At the same time, the pound still had a weak but still a reason for the decline. Halifax data showed a slowdown in property price growth from 1.8% to 1.1%, while they expected a slowdown to only 1.6%.

Housing Price Index (UK):

Today, with statistics, it's a bit more fun than yesterday. In particular, data on industrial production in Germany have already been released, where industry has already declined by 3.9%. Now, its decline has intensified to 4.0%. But not only because of this, it is worth sad for Europe, since in the Netherlands, and this is the fifth economy of the euro area, inflation fell from 2.8% to 2.6%. What can I say, when in Italy, by the way, the third economy of the euro area, the growth rate of retail sales, instead of increasing from 2.6% to 3.1%, showed a terrifying result. Not only have the previous data has been reviewed for the worse which is to 2.4%, but also the growth rate of sales slowed to 0.7%. To simply put it, in Europe, obviously, not everything is so smooth.

Industrial production (Germany):

Across the Atlantic, data on producer prices will be published today, whose growth rates should remain unchanged at 1.8%. Against the background of what is happening in the Old World, it looks very good. But in general, the market should remain fairly stable, since the data itself is not so important. Tomorrow, the text of the minutes of the meeting of the Federal Committee for Operations on the Open Market will be published, so it is better to be careful and maintain endurance. Also, we expect the continuation of a lateral movement, unless Boris Johnson somehow comments on yesterday's publication of an unnamed official letter from Downing Street 10. And to be honest, these comments are likely to have a negative impact on both the pound and the single European currency.

Manufacturer Price Rates (United States):

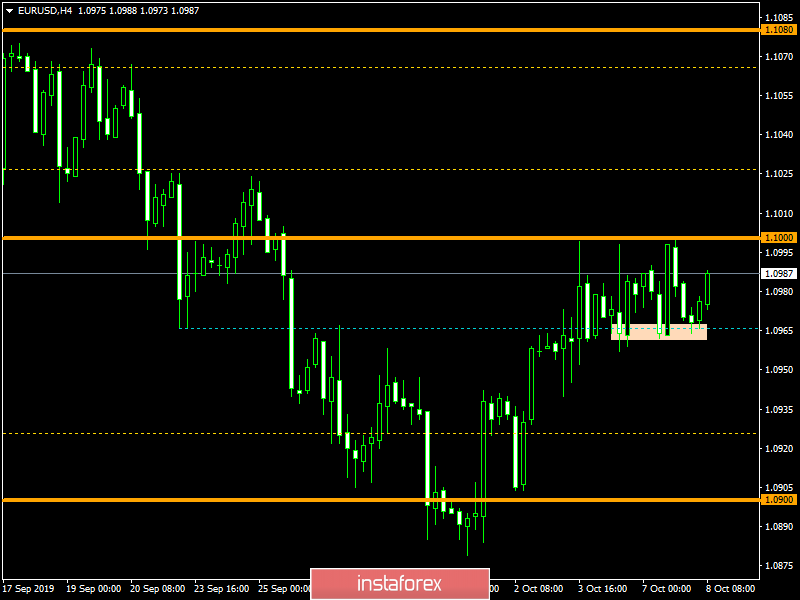

The euro / dollar currency pair continues with its sluggish movement in a narrow range of 1.0965 / 1.0990, sequentially working out the borders. It is likely to assume that the movement relative to the given frames will still remain for some time, where it is worthwhile to carefully analyze the price fixation points. Against which, the market can already enter.

The pound / dollar currency pair is sluggish, but confidently trying to restore the main course, fluctuating near the periodic level of 1.2270. It is likely to assume that if the quote manages to fix lower than 1.2270, we can see a local decline to 1.2220-1.2215. Otherwise, the sluggish movement within 1.2270 / 1.2350 will continue.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română