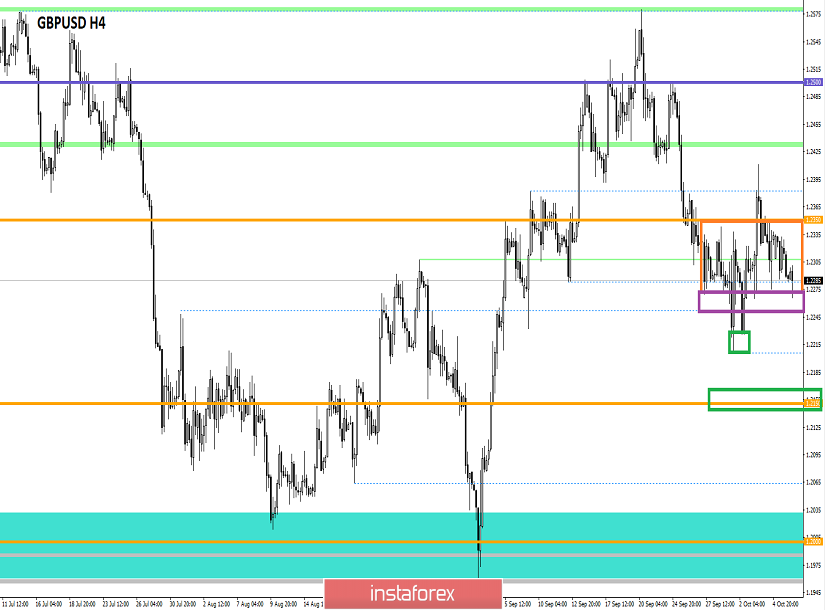

Over the past trading day, the pound / dollar currency pair showed an extremely low volatility of 49 points. As a result of which, the quotation continued to move within the specified frames. From the point of view of technical analysis, we see a sluggish movement in the previously set limits of 1.2270 / 1.2350. Analyzing the past day in detail, we see that the amplitude of the oscillation has waned, where those with boundaries have received a temporary shift of 1.2270 / 1.2350 ---> 1.2285 / 1.2338. The compression of the amplitude can be characterized as a willingness to jump in where the boundaries will eventually fall.

As discussed in the previous review, traders continue to analyze the downward move in terms of strategic positions that many market participants already have. Thus, being in a variable profitability does not particularly worry traders when the fundamental basis signals a downward trend.

Considering the trading chart in general terms [the daily period], we see a characteristic stagnation in the recovery phase, where the quote hovered at 46% relative to an oblong correction. In turn, traders noticed an interesting picture that the last week characterized itself not just as stagnation / pullback, but as a cluster of versatile candles, with high shadows and small bodies, which reflects the possibility of a vigilant surge. I remind you that GBP/USD pair has an oblong correction in the global downward trend, where the historical support point is located in the region of 1.1957 / 1.2000.

The news background of the past day did not have any relevant statistics for the UK and the United States, thereby all the emphasis was on the information background.

So what pleased us with the information flow?

The divorce process is increasingly pouring a variety of information onto the market, and this is understandable, less and less time is left until the day "X". Thus, the session court in Edinburgh rejected the request of opponents of hard Brexit to take additional measures against Boris Johnson so that the prime minister could not circumvent the law, forcing him to ask for a delay of three months in the absence of an agreement with the EU until October 19. In turn, the British Prime Minister asks the European bloc to show a detailed response to his generous proposal on Brexit.

"We tell our friends that we made a very generous, fair and reasonable proposal, and that now we would like to know what you think about them. If you have problems with any of our proposals, let's study the details and discuss them." Boris Johnson told reporters [October 7].

The most interesting information of the past day was the release of data regarding the existing proposal, as written above. An anonymous source from Downing Street 10 said that the existing negotiations could fail, because Irish Prime Minister Leo Varadkar does not want to negotiate with Britain on the terms of London. At the same time, Europeans are also skeptical of Johnson's existing proposal, and rejection is very possible. This message is even more interesting information, and so, if negotiations with the EU are not successful and we are talking about delaying the exit, then London will go to bribe the EU countries. Bribery will be expressed in the fact that those countries that oppose the postponement will go ahead of the line for future cooperation. Those who support the postponement will go at the end of the line. An anonymous source made it clear that defense and security cooperation would inevitably be affected if the EU tried to hold the UK against the will of its government.

Today, in terms of the economic calendar, we only have data on producer prices in the United States, which, according to preliminary forecasts, should remain unchanged - 1.8% [y / y]. In terms of informational background, it is possible to continue the discussion regarding Johnson's proposal and clarification regarding the data provided by an anonymous source. Thus, the pound may be under pressure.

Further development

Analyzing the current trading chart, we see that the quotation has already overcome the expected shift of the border of 1.2285 and rested against the main frame of 1.2270. In fact, we see a shadow puncture up to 1.2266, possibly against the background of the information background, as written above. In turn, traders continue to work down, having already a small profit from the main short positions. Speculators, in turn, are waiting for a clear breakdown of the 1.2270 border for local entry into short positions.

It is likely to assume that pressure on the British currency will continue, and perhaps, the existing negative background will entail a breakdown of the existing borders. Thus, traders need to be prepared by analyzing the behavior of quotes and price fixing points relative to the existing 1.2270 / 1.2350 boundaries. Do not forget that the subsequent periodic support point is in the region of 1.2200 / 1.2210, where the quote has moved to the current phase of stagnation/pullback.

Based on the above information, we concretize trading recommendations:

- We consider buying positions in two versions: the first, speculative flight at 1.2300, with a prospect of 1.2340-1.2350; The second option, waiting for the fixation point is above 1.2360, with the prospect of a movement to 1.2400.

- Traders have selling positions already and they are sent towards the subsequent level of 1.2210-1.2150. If we do not have positions, then it makes sense to wait until the price fixation is lower than 1.2270, with the prospect of a movement to 1.2210-1.2150.

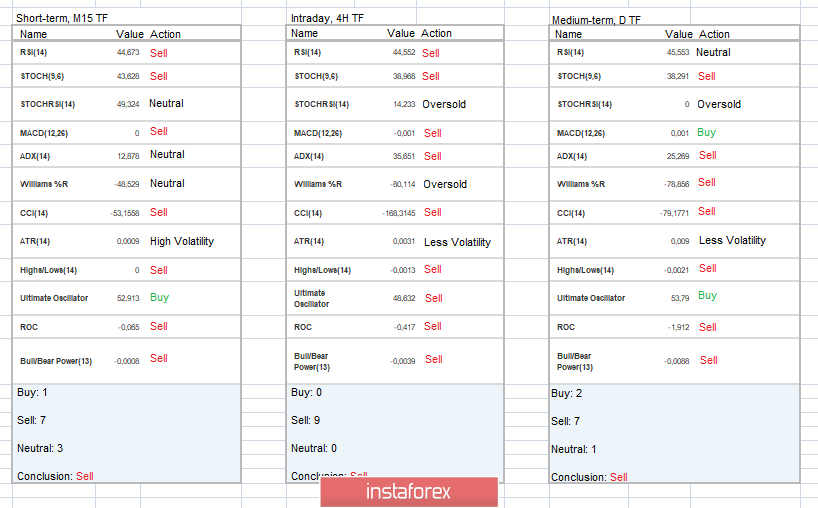

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that indicators on all the main time sections continue to signal a decrease, which to some extent reflects the current market sentiment. It is worth considering that if the breakdown of the lower boundary does not occur, then the movement within the given framework will continue, and, as a matter of fact, the minute and hour intervals will be under pressure of varying interest.

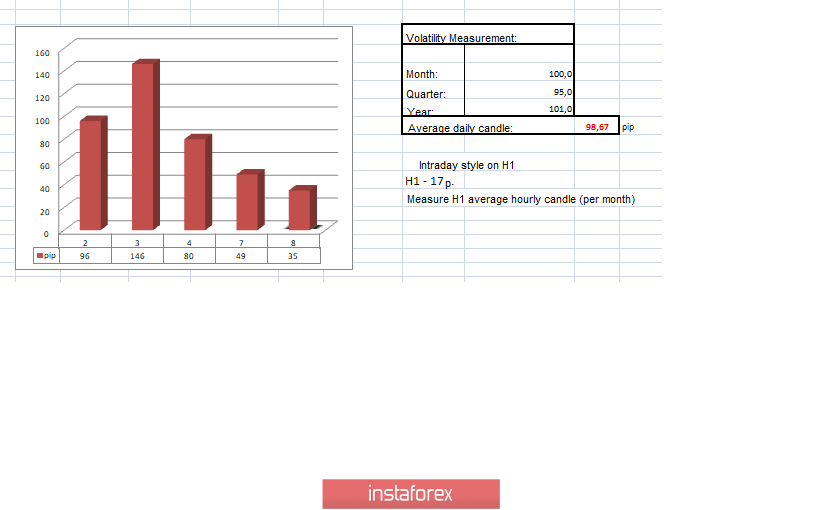

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(October 8 was built taking into account the time of publication of the article)

The volatility of the current time is 35 points, which is still a low indicator. It is likely to assume that in case of breakdown of the existing boundaries, volatility can increase by several times, exceeding the daily average. The reverse picture reflects the preservation of the existing framework, but also the volatility in this case will be low.

Key levels

Resistance zones: 1.2350 **; 1.2500 **; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) **.

Support areas: 1.2205 (+/- 5p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** The article is built on the principle of conducting a transaction, with daily adjustment

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română