Good day, dear traders. Congratulations to all on the new trading week!

So, last week ended with traditional statistics on the US labor market. It would seem that the drop in unemployment at the 50-year low should be positive for the dollar, but in general the state of the labor market is worrying. The fact is that big employment implies the absence of positive dynamics of job growth and suggests that there will also be no further growth at least. The number of new jobs is falling - this is a mathematical fact. The rate reduction in October and December is 73% and 90%, and this can be earned on instruments with USD.

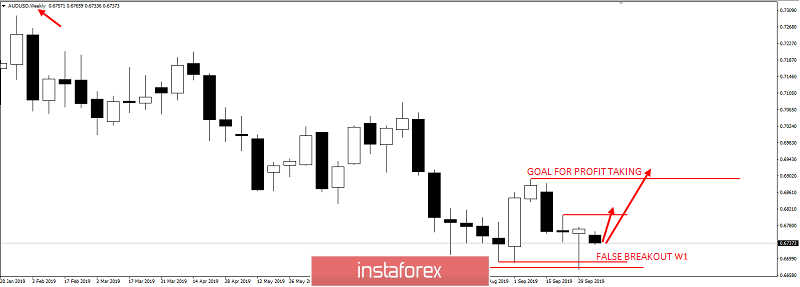

In my opinion, the most oversold instrument from the "majors" is AUDUSD. The last blow to this instrument was a decrease (albeit predicted, but still) in the interest rate on AUD by a quarter basis point. The pair fell for the third time to the lows of the year, exposing a false breakout. On the weekly TF, the "pin-bar at the extreme" pattern has formed, which I propose to work on increasing.

Let me remind you that the AUDUSD pair is not only AUD. News on USD sometimes affects it more than on the base currency. And by and large, the rebound from the lows on Thursday was due to disastrous data on the index of business activity in the non-productive sector. Therefore, to maintain the bullish trend for the AUDUSD pair, it is necessary to follow the negative news from the US, which will push this pair up.

Observe risk management and success in trading!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română