The British pound and the euro remained in the side channel after the data on the American labor market was released on Friday, as well as after a clearer EU position regarding the new Brexit plan proposed by Boris Johnson.

As it became known, French President Emanuel Macron recommended that Boris Johnson radically revise his Brexit plan before the end of the week, which seriously increases the chances of failure of negotiations. Macron noted that the plan proposed by Britain last week was not considered in Brussels as the basis for the deal, and advised Johnson to think again before the upcoming EU summit.

Let me remind you that the French president officially refused to meet with the Prime Minister personally, and during a telephone conversation, he insisted that negotiations should be advanced only through Michel Barnier, the EU's chief negotiator.

Macron's message to Johnson was repeated by Dutch Prime Minister Mark Rutte, who said the EU would not accept an agreement that would create a customs border in Ireland. "There are a number of unresolved issues in the proposed UK plan," said Rutte.

Thus, opposition of the Parliament are expected to push for a vote calling for the publication of a full 40-page legal text of the Brexit alternative plan, which was partially introduced last week by Boris Johnson. Brexit Secretary Keir Starmer said it's important to see the legal details because there are doubts that a government proposal inevitably means the introduction of infrastructure on the Northern Ireland border, contrary to the Prime Minister's assurances made last Thursday.

From all this, it is worth concluding that the confrontation is only intensifying, which could negatively affect the quotations of the British pound in the near future. However, if official that London makes concessions and manages to clarify the situation around the proposal, and it is likely that demand for the pound will continue.

As regards the technical picture of the GBP/USD pair, major support remains in the region of the minimum of 1.2275. The breakthrough of which can quickly push the trading instrument to the minimum of the month in the area of 1.2200. If the buyers of the pound manage to break above the resistance of 1.2350, then this scenario can lead to a larger upward correction to the area of maximums 1.2410 and 1.2480.

EUR/USD

Friday's data that employers in the US last month maintained fairly high rates of employment and unemployment reached a 50-year low did not provide strong support for the US dollar.

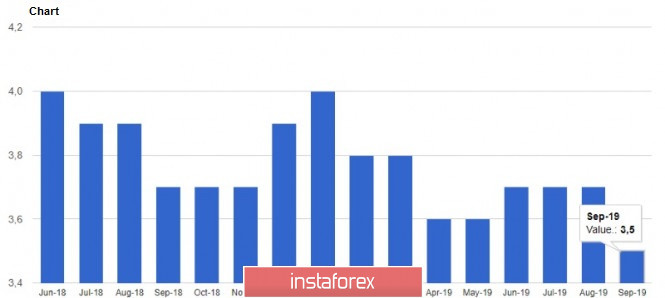

According to a report by the U.S. Department of Labor, the number of non-farm jobs in September 2019 increased by 136,000, while the unemployment rate fell to a record 3.5%. Back in August, unemployment was 3.7%. However, economists predicted a larger increase in the number of jobs by 145,000, and the unemployment rate unchanged.

On the other hand, the good news for the Federal Reserve was the data that the average hourly earnings in the United States showed a growth of 2.9% compared with September 2018. However, this is a bit slower than in the last few months. The good condition of the American labor market leaves a chance for inflation to reach a target level of about 2.0% in the near future. Unfortunately, the decline in production activity within the country and beyond is a negative factor for the economy.

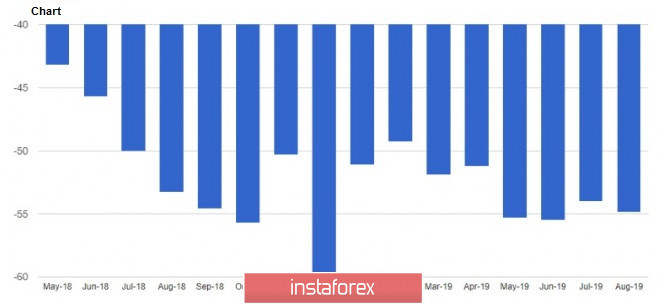

The US trade deficit increased in August, which clearly did not please the American president. According to the US Department of Commerce, the deficit in trade in goods and services in August 2019 increased by 1.6% compared to the previous month and amounted to $ 54.9 billion. Economists had expected the deficit to reach $ 54.5 billion in August. Imports in August, in turn, grew by only 0.5% compared with the previous month, while exports increased by 0.2%.

In his speech last Friday, the Fed chairman said that the US economy is in good shape despite the risks present, and the Fed's task is not to "juggle interest rates," but to make US economic growth as long as possible. Jerome Powell also noted that low inflation and low interest rates leave the Fed less space to lower rates during recessions. "The Committee needs to explore new strategies for more sustainable achievement of the target inflation rate of 2%," the head of the Fed added. Powell also once again drew attention to the fact that the Fed has strong protection against short-term political pressure, hinting at independence from criticism of the American president.

As for the technical picture of the EUR/USD pair, it remained unchanged. Only a breakthrough of resistance level 1.0995 will provide an entry of new large buyers, which will lead to risky assets to new maximums in the region of 1.1030 and 1.1070. If the bears cope with the support in the area of 1.0955, then its break will provide new pressure on the trading instrument, as well as lead the pair to update the minimums of 1.0930 and 1.0900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română