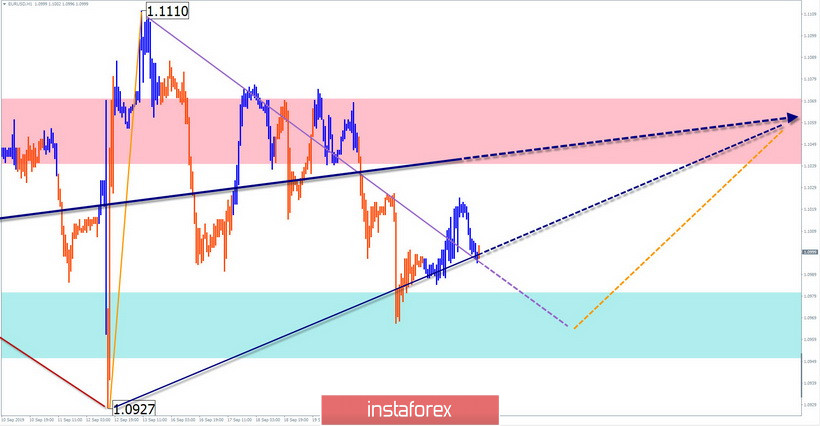

EUR/USD

Analysis:

The bullish wave construction of September 3 is incomplete. It completes a larger upward wave and has the potential for further development. In recent weeks, a correction is formed. The price reached a level of strong support.

Forecast:

Today, the lateral nature of the movement is expected to continue. The downward mood of the first half of the day can be replaced by an upward stage by the end of the day. A hint of the probable time of the reversal can serve as a calendar of news blocks.

Potential reversal zones

Resistance:

- 1.1040/1.1070

Support:

- 1.0980/1.0950

Recommendations:

When selling the euro today, it is wiser to lower the lot and be ready to close the position at the first reversal signals. The best tactic is to ignore the pullback and search for signals to enter long positions.

AUD/USD

Analysis:

The main direction of the "Aussie" price is set by the wave of August 7. Two weeks ago, a correction that has not been completed so far began to develop on the chart. Within its framework, a rollback has been formed since the end of last week.

Forecast:

The most likely scenario of the pair's movement today will be a flat mood in the price corridor between the opposite zones. In the first half of the day, there may be pressure on the support zone. By the end of the day, a change in the motion vector and an increase in the rate are expected.

Potential reversal zones

Resistance:

- 0.6830/0.6860

Support:

- 0.6770/0.6740

Recommendations:

Until the entire rollback is completed, trades can only be relevant for intra-session trading. It is safer to refrain from entering the market at this time and the end of the upcoming price increase, monitor the signals of the sale of the instrument.

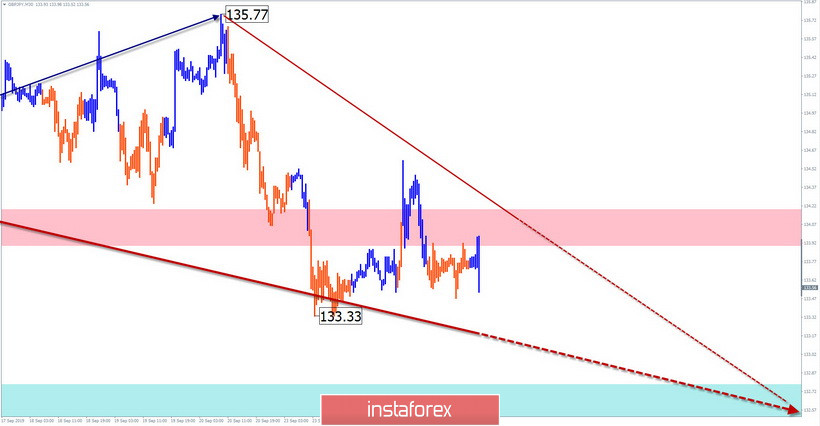

GBP/JPY

Analysis:

The current wave model of the pair is ascending, from August 5. The wave looks fully formed. The price reached the reversal level of a large TF. In recent weeks, the rate decreases, forming a correction of the last section of the main wave.

Forecast:

Today, the downward trend that began last Friday is expected to continue. In the next session, a short-term rise of the price to the boundaries of the settlement resistance is possible. The preliminary phase of correction completion indicates the support area.

Potential reversal zones

Resistance:

- 133.90/134.20

Support:

- 132.80/132.50

Recommendations:

Until the current decline is completed, the instrument may be of interest only to supporters of the intraday. When purchasing, be careful. It is recommended that the main attention be paid to the sales of the pair.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background arrows are shown formed in the structure for determining the expected movement.

Attention: The wave algorithm does not take into account the length of time the tool moves!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română