Yesterday, there was news that Speaker of the House of Representatives of the US Congress Nancy Pelosi announced an official consideration of the impeachment of Trump, as, in her opinion, the president violated the constitution by his actions. We are talking about the fact that Donald Trump deliberately delayed the allocation of aid to Ukraine, putting pressure on the authorities of this country. The main purpose of Trump, according to Pelosi, was to force the authorities to launch an investigation into Joe Biden, the Democratic presidential candidate, and his son.

Yesterday, Trump said that the delay in aid was directly related to the fact that the administration would like to see more active actions from Europe, which does not help Ukraine enough compared to the United States. Trump also tied his decision not to allocate aid to Ukraine to the high level of corruption in the country.

By the end of the week, the White House will allow the US Congress to review the complaint against President Trump. A transcript of a recent conversation between the US President and Ukraine will also be published. Saying that Trump may lose his presidency due to the situation in Ukraine makes no sense since it is unlikely that impeachment will become very high. All this is done on the eve of a political race and elections in the United States next year, and, apparently, this is only the beginning.

As for yesterday's fundamental statistics, it harmed the US dollar but did not cause serious problems.

According to the report, US house price growth is losing momentum, which is good news for buyers. The decline in prices is due to mortgage interest rates, which have declined slightly, which may support the recent increase in sales in the housing market.

According to S&P-CoreLogic and Case-Shiller, the average US home price rose to 3.2% in July. The index itself was unchanged from the previous month, while economists had expected the index to rise by 2.1%.

The report indicates that compared to the same period of the previous year, prices continued to grow, but the pace has weakened slightly. As noted above, this is because the rate on 30-year mortgages with a fixed interest rate fell below 4%.

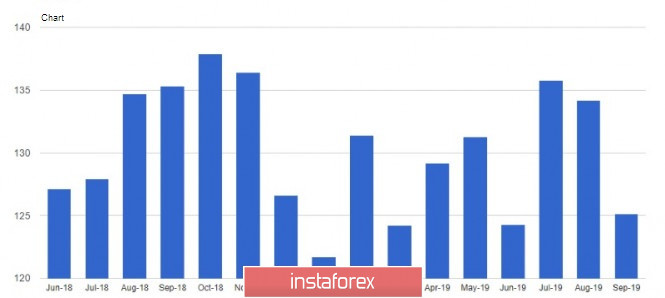

The pressure on the dollar in the second half of the day was exerted by data on consumer confidence in the US, which declined in September this year. The fall marks the second month in a row and is directly related to the slowdown in global economic growth and trade tensions.

According to a report by the Conference Board research group, the consumer confidence index fell to 125.1 points in September from 134.2 points in August. Economists had expected the index to decline to 133 points in September. The expectations index also fell to 95.8 points from 106.4 points, which is a bad leading signal.

Investors also did not like the report on the slowdown in production activity in the area of responsibility of the Federal Reserve Bank of Richmond. Due to the reduction in the supply index and the volume of new orders, activity was weaker compared to August.

According to the data, the Fed-Richmond calculated index fell to -9 points in September from 1 point in August. Economists had expected the indicator to reach 0 points in September.

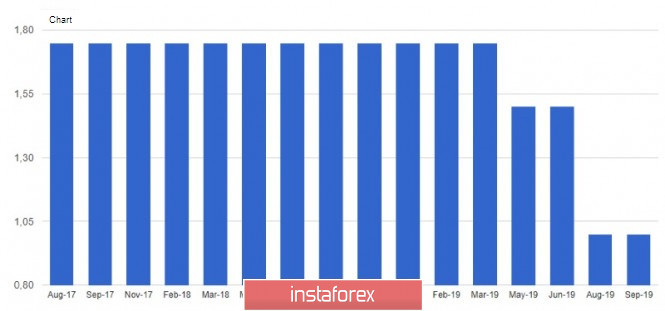

As for the technical picture of the EURUSD pair, only the level of 1.0985 keeps the pair from falling. Its breakthrough will lead to the renewal of a larger range of 1.0950, as well as to the return to the area of the monthly minimum – 1.0925, where buyers of risky assets will become more active. The breakout of the resistance of 1.1025 may lead to an increase in demand for the trading instrument, which will return it to the level of 1.1070, and then to the maximum of the month in the area of 1.1110.

NZDUSD

The New Zealand dollar rose slightly against the US dollar during Asian trading after the Reserve Bank of New Zealand left the official interest rate unchanged at 1.00%.

The RNBZ said that there is still room for further monetary and fiscal stimulus measures, and noted the persistence of increased tension in world trade and politics.

The problem for the economy remains the low confidence of business in New Zealand, which limits the investment of companies. Among the positive factors, domestic demand was noted, which is expected to grow next year. The Central Bank also noted that they expect lower interest rates to continue for a longer time.

As for the technical picture of the pair, the upward correction in the pair NZDUSD may end in the area of a large resistance of 0.6340, but the bulls will again declare themselves after the correction to the support of 0.6290, from which it will be possible to build a new lower border of the upward channel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română