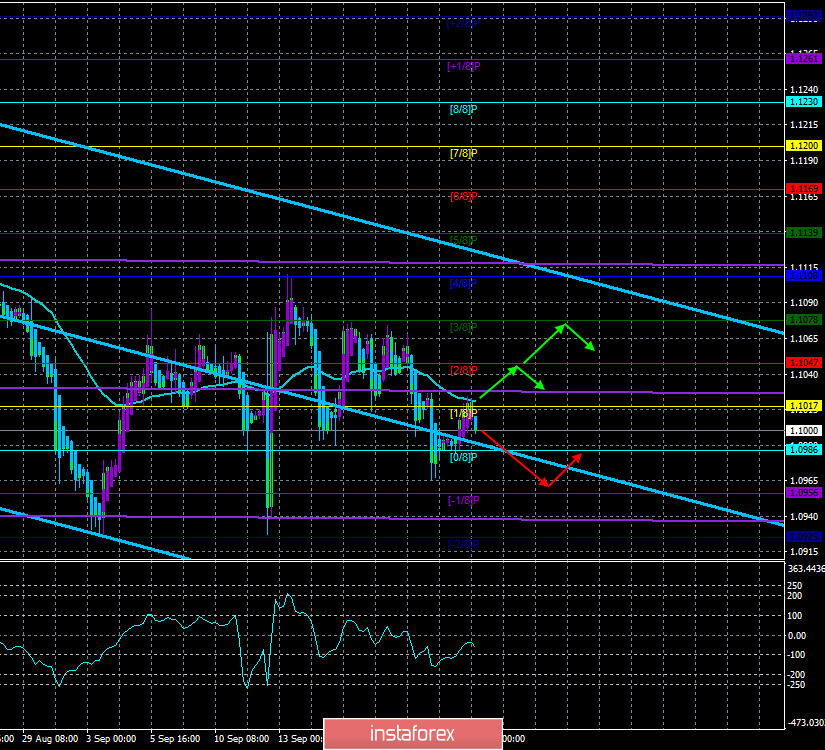

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – down.

The lower channel of linear regression: direction – sideways.

The moving average (20; smoothed) – down.

CCI: -61.1028

After the disastrous Monday, the euro managed to recover and adjust to the moving average line, but it failed to consolidate above, so a rebound followed and now the chances of resuming the downward movement of the EUR/USD pair are quite high. Yesterday, there were no important macroeconomic publications either in the eurozone or in the States. Today, the situation is no better. The calendar of macroeconomic events is empty, except for one or two secondary reports. Today, we can see firsthand the mood of the bears on the new sales of the pair. Since the fundamental background will not interfere today, the pair's decline during the day will show that traders are ready to continue forming a downward trend. From a technical point of view, the rebound from the moving average is a signal to open sales of the euro/dollar pair. Thus, today we can witness a decline in the area of two-year lows, around which the pattern of "double bottom" was formed, which remains more formal. In general, today, we expect another decline in the European currency.

As for the fundamental events, we can only wait for them. Mario Draghi once again shared his vision of the state of the EU economy with traders on Monday, the prospects for the euro currency did not get any better. Over the remainder of the week, the United States will report on GDP, durable goods orders, personal spending and income, and consumer confidence from the University of Michigan. All news – from the USA. Is it possible to expect a failure from them to save the euro from the next update of the lows? It is possible, for example, a rather important indicator of orders for durable goods is expected with a reduction of 3.1% in August. For other reports – forecasts are neutral. Thus, of course, there are certain chances for the euro not to fall below 1.0930 this week, but the euro is waiting, as usual, not from the European Union (strong news), but from overseas (weak news).

Meanwhile, in America, the impeachment procedure of Donald Trump quite unexpectedly begins. Very unexpected. Although the behavior and actions of the odious leader very often raised questions in Congress and among citizens, impeachment will not be imposed because of this. The US President is accused of violating his oath and betraying national interests. This was stated by House Speaker Nancy Pelosi. She reports that Donald Trump has admitted that he asked the President of Ukraine Vladimir Zelensky to perform actions beneficial to him in a political context, and the Chamber begins an official investigation as part of the impeachment procedure. "The president must be held accountable. No one can be above the law," Pelosi said. Trump himself reacted with restraint, writing on Twitter: "They didn't even see the transcript of the call. Total witch hunt!".

Nearest support levels:

S1 – 1.0986

S2 – 1.0956

S3 – 1.0925

Nearest resistance levels:

R1 – 1.1017

R2 – 1.1047

R3 – 1.1078

Trading recommendations:

The euro/dollar currency pair rebounded from the moving average and can now resume its downward movement. Thus, it is recommended to sell the euro with the targets of 1.0986 and 1.0956 before the next reversal of the Heiken Ashi indicator upwards, which will signal a new round of correction.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) – the blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română