After serious shocks in mid-September, the oil market stabilized. The Bulls are surprised at the low-risk premium, since, in their opinion, attacks on Saudi Arabia can be repeated at any time. "Bears" pay attention to the fact that prices are far from April highs and nobody canceled the factor of a slowdown in global demand. Opponents are sensitive to reports from Riyadh, which promises to quickly restore damaged production. However, according to insider information of the Wall Street Journal, this may take several months, not several weeks.

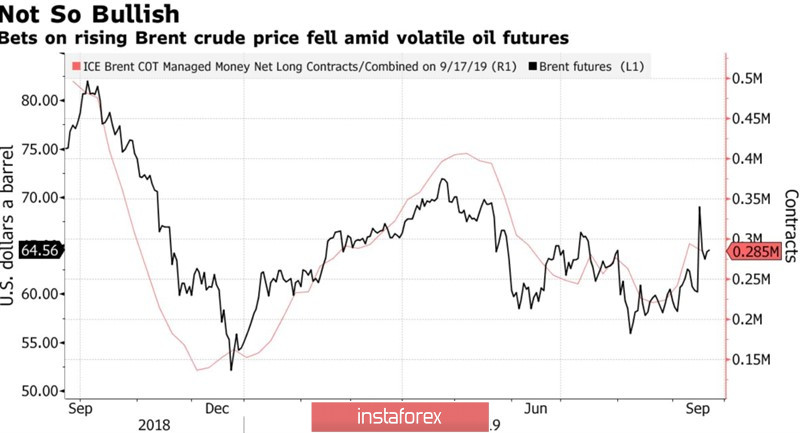

The oil market as a self-regulatory mechanism: the higher price rises, the lower the demand from importing countries, especially if their economies are damaged by trade wars. In this regard, the fall in business activity in the German manufacturing sector to the lowest level in September for more than a decade is an alarming signal for the Brent and WTI bulls. Europe and China are the largest consumers of black gold and the growing risks of a slowdown in their economies cannot but affect global demand. The decrease in growth forecasts for this indicator has served oil sellers in April-August. Therefore, a decrease in long speculative positions by 2.5% after a sharp take-off for looks logical Brent. Financial managers are not sure about the continuation of the rally and prefer to take profits. Net longs by the end of the week by September 17 decreased by 3.1% to 284,653 contracts, while short positions increased by 0.2%.

Oil dynamics and speculative positions

In contrast, the Bulls are convinced that the crisis in the Middle East is far from being resolved. The United States, Britain, and Saudi Arabia accuse Iran of financing the attack on industrial facilities, and each of them has its own reasons. The states intend to punish Tehran for failure to comply with nuclear agreements, Foggy Albion avenges tankers captured in the Strait of Hormuz (one of them released Iran recently), and Riyadh itself may be involved in the attack. As a result, the situation is heating up: the White House imposed sanctions against the central bank of the Islamic state and sent troops to the Allied camps in the Middle East while Tehran replied that the US president closed the door for further dialogue.

If we take into account the possible repetition of attacks on Saudi Arabia or other black gold producing countries in this region, as well as possible military operations against Iran, the premium for geopolitical risk really looks insignificant. According to BofA Merrill Lynch, these factors and the delay in Riyadh's restoration of damaged facilities can push North Sea prices up to $70 per barrel.

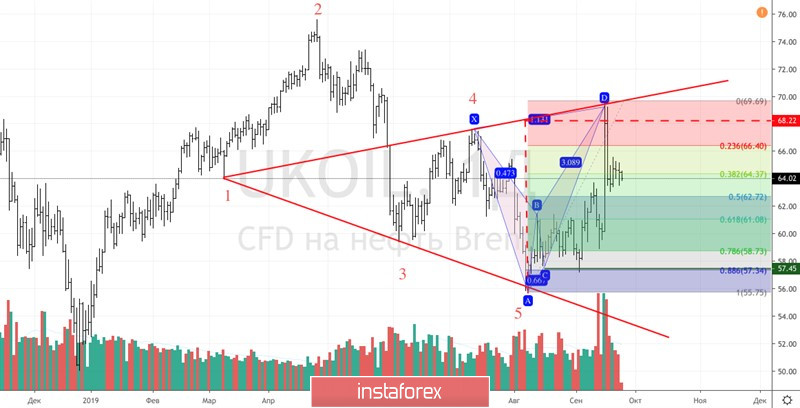

Technically, after reaching the targets for the "Wolfe Waves" and "Bat" patterns, regular rollback and consolidation in the range of $ 63-65.5 per barrel followed. A break of its lower border with the subsequent assault on support at $62.7 will increase the risks of a downward recovery. On the contrary, a successful resistance test of $65.5 will allow the bulls to continue their upward campaign.

Brent daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română