To open long positions on EURUSD, you need:

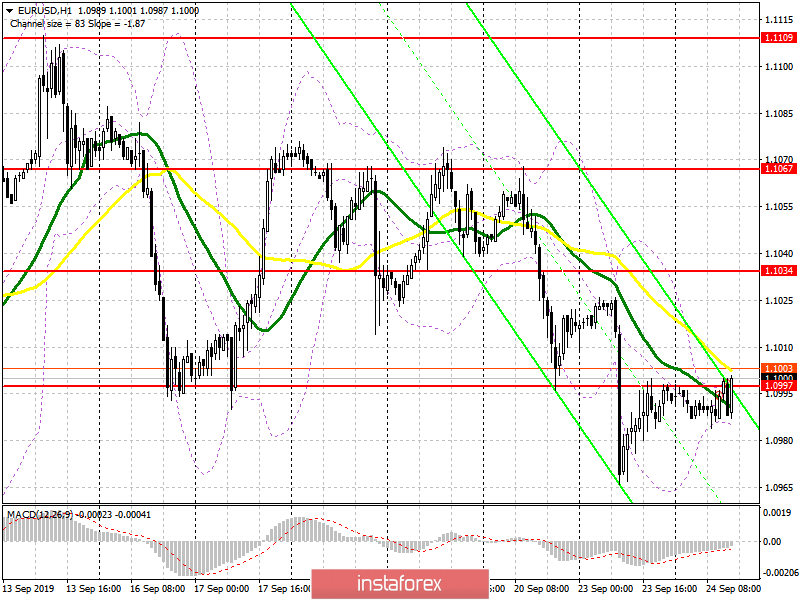

Data on the conditions of the German business environment supported the euro in the first half of the day, not allowing the bears to continue the downward trend. However, as we can see from the chart, volatility is very low, and the technical picture has not changed at all. Buyers today only have to rely on a false breakdown in the support area of 1.0960 and recommend to open long positions immediately for a rebound at the minimum of a month in the area of 1.0927. A more important task for the bulls to break the current short-term downward trend will be to consolidate above the resistance of 1.0997, which can lead to an upward correction to the high of 1.1034, where I recommend taking the profit.

To open short positions on EURUSD, you need:

Sellers of the euro will count on a good report on consumer confidence in the US, which will return the market to bearish momentum and lead to a return to the minimum area of 1.0960. However, only the breakdown of this range will increase the pressure on the pair, which will lead to the renewal of larger support in the area of 1.0927, where I recommend taking the profit. If the data turn out to be worse than economists' forecasts, the bulls can take advantage of this moment and return to the resistance of 1.1034, from where I recommend opening short positions immediately for a rebound.

Signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the possible formation of a bullish correction.

Bollinger Bands

Volatility is very low, which does not give signals to enter the market.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română