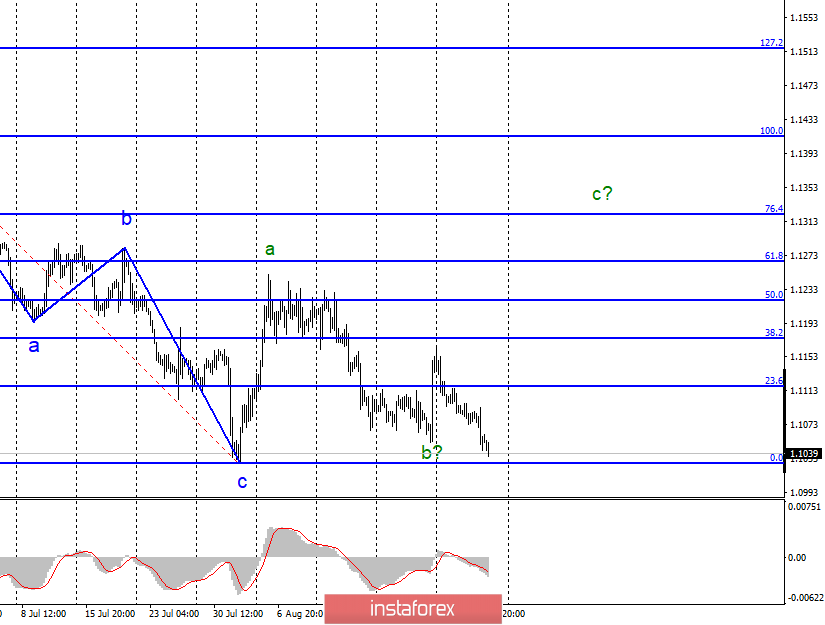

EUR / USD

Thursday, August 29, ended for the EUR / USD pair with a decline of another 20 basis points. Thus, the euro-dollar pair made a successful attempt to break through the minimum of the expected wave b and approaches the minimums of wave c, leaving below which means the need for adjustments and additions to the current wave marking. The reasons for the non-fulfillment of the "working scenario", which involves the construction of an upward trend section, are only news from the EU. Yesterday, inflation in Germany showed a negative trend. Today, inflation will come out in the EU as a whole, and the markets also do not expect anything good from it. Also, any new decrease in inflation brings the ECB closer to immediate stimulation of the economy, and the euro exchange rate - to new falls. Of course, even if the minimum of wave c is broken, the chances of building an ascending wave c will continue, but the wave picture in this connection will take a more complex and confused look. In any case, it is definitely not recommended to buy a euro-dollar pair before the MACD signal "up". Selling a pair at current minimums is also quite risky.

Purchase goals:

1.1264 - 61.8% Fibonacci

1.1322 - 76.4% Fibonacci

Sales goals:

1.1027 - 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar continues to be part of the construction of a bearish wave, presumably b. I recommend buying a pair with targets located above the level of 1.1250 with a Stop Loss order under the minimum of August 1 on a MACD "up" signal. Meanwhile, I recommend selling the instrument not earlier than a successful attempt to break through the minimum of wave c, but even in this case, I recommend selling the pair very carefully.

GBP / USD

On August 29, the pair GBP / USD lost about 40 b.p, and the attempt to break through the 38.2% Fibonacci level remained the only and unsuccessful one. Thus, the pound-dollar pair began to build the proposed wave b within the upward set of waves. If this is true, then after the completion of the construction of the current downward wave, the continuation of raising the instrument is expected with targets located above 23 figure. Negative news background from the UK can hinder the execution of this option, as always. Events related to Brexit "strangle" the pound, and the markets are left with nothing else but to sell the pound faster. The latest news from Britain brings the country closer to tough Brexit, and only the adoption of a law prohibiting Brexit without an agreement with the European Union can stop Boris Johnson. Or his voluntary resignation, a vote of no confidence. Nobody believes in the second option, and the parliament has about a week and a half to implement the first. A tough Brexit for the pound means falling below the 20 figure with a 95% probability.

Sales goals:

1.2016 - 0.0% Fibonacci

Purchase goals:

1.2306 - 38.2% Fibonacci

1.2401 - 50.0% Fibonacci

General conclusions and recommendations:

The downward section of the trend is previously considered completed. Thus, now, an upward trend correction section is expected to be built with the first goals located near the calculated levels of 1.2306 and 1.2401, which corresponds to 38.2% and 50.0% Fibonacci. You can buy a pound, but I do not recommend doing it in large volumes firstly, and secondly, you should do it after the completion of the current correctional wave down, by the MACD signal "up".

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română