To open long positions on GBP/USD you need:

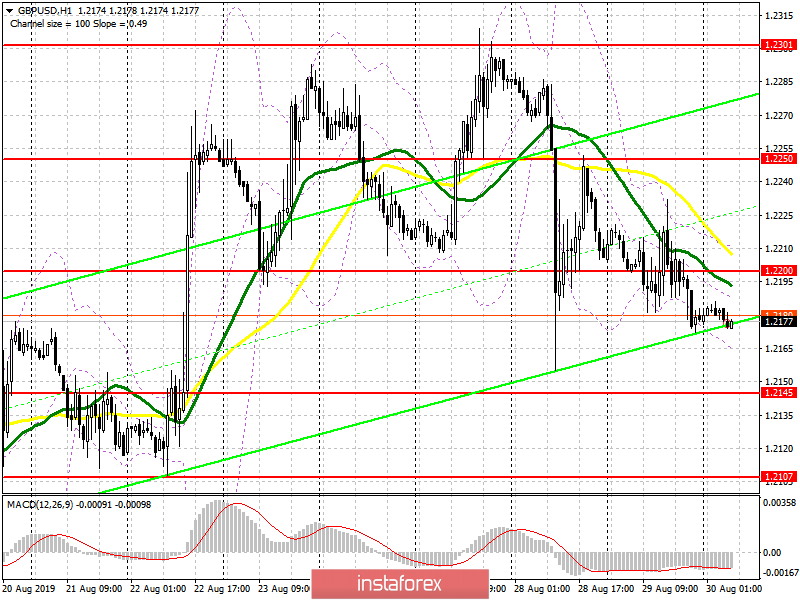

Tensions over the Brexit situation and the suspension of the UK Parliament continue to put pressure on the pound, however, the bears are in no hurry to return to the market, which leaves buyers with a chance to continue growth. To do this, you need to return to the level of 1.2200 today and gain a foothold there, which will lead to a larger upward correction to the area of important resistance at 1.2250, where I recommend taking profits. If the bears continue to pull down the pound, I recommend to open long positions immediately on the rebound from the major support of 1.2145, or from a low of 1.2107. However, an update of 1.2107 will indicate a complete turnaround of the upward trend, so strong growth from this range can hardly be expected.

To open short positions on GBP/USD you need:

The main task of the pound sellers is to maintain the level of 1.2200, and the formation of a false breakdown on it in the first half of the day will be a direct signal to open short positions in the hope of updating weekly lows in the areas of 1.2145 and 1.2107, where I recommend taking profits. Today's data on the UK economy is unlikely to significantly affect the pair, so everything will depend on news related to Brexit. In the scenario of a return and consolidation above the resistance of 1.2200, it is best to consider new short positions for a rebound from a larger high of 1.2250, which is a serious problem for pound buyers.

Signals of indicators:

Moving averages

Trading is below 30 and 50 moving averages, which indicates that the pound might continue to fall.

Bollinger bands

In case the pound grows, the upside of the indicator will be limited by the upper boundary of the indicator in the region of 1.2215. A break of the lower boundary at 1.2165 will increase pressure on the British pound.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română