Over the past four weeks, the Canadian dollar has been in a flat against the US currency, the scope of which covers an almost 100-point range. The loonie does not fall below the 32nd figure, but does not rise above the middle of the 33rd level. In this band, the price "walks" all of August, despite high-profile events of a geopolitical nature. Nevertheless, with a high degree of probability it can be assumed that very soon the pair will leave the indicated price niche.

The only question is what kind of movement vector the traders will choose - either return to the bottom of the 30th figure with the intention of entering the area of the twentieth figures, or repeat the upward course to the annual high of 1.3560. This intrigue will not torment traders of the pair for too long - next week we will learn about the further intentions of the members of the Canadian central bank. If they join the ranks of the rest of the central banks of the leading countries of the world, embarking on the path of easing monetary policy, the loonie will collapse throughout the market. But an alternative scenario will help the loonie not only catch up on lost points, but also update the annual low.

Let me remind you that the Bank of Canada spent five rounds of raising the rate since July 2018, essentially following its "southern neighbor" from the USA. However, over the past six meetings, the regulator has not taken any action. In addition, at the April meeting, the central bank deleted from the text of its accompanying statement a phrase about the further need to tighten monetary policy. Rumors about the likelihood of reversing steps in the direction of easing monetary policy were quite expected on the market. Against the backdrop of such conversations, the USD/CAD pair in late spring grew to the middle of the 35th figure, thereby setting the annual high. But over time, these conversations calmed down: moreover, the Canadian regulator remained "neutral" even after the head of the Fed, Jerome Powell, actually announced a rate cut at the July meeting.

Traders of the USD/CAD pair expected similar hints from Stephen Poloz, however, his rhetoric at the last (July) meeting was "optimistic and restrained". Although he noted the economic risks from trade conflicts, he did not dramatize the situation. Unlike Powell, he announced a possible cut in interest rates - even as a preventative measure. Moreover, the head of the Bank of Canada noted that the regulator's forecast is "balanced" and does not require revision. At the same time, Poloz rather peculiarly allowed a rate cut in the future - according to him, the regulator will take this step if faced with "unaccounted for risks".

Given this vague wording, the question emerged among traders - can the recent events of a geopolitical nature be classified as "unaccounted for risks"? Unfortunately, the opinions of analysts on this subject were divided. Some of them refer to the rhetoric of representatives of the Canadian regulator, who spoke after the July meeting of the BC. In particular, according to the First Deputy Governor of the Bank of Canada, Caroline Wilkins, further escalation of trade conflicts will be the "greatest risk" for both the global and Canadian economies, as the effects of the global trade war are becoming more tangible.

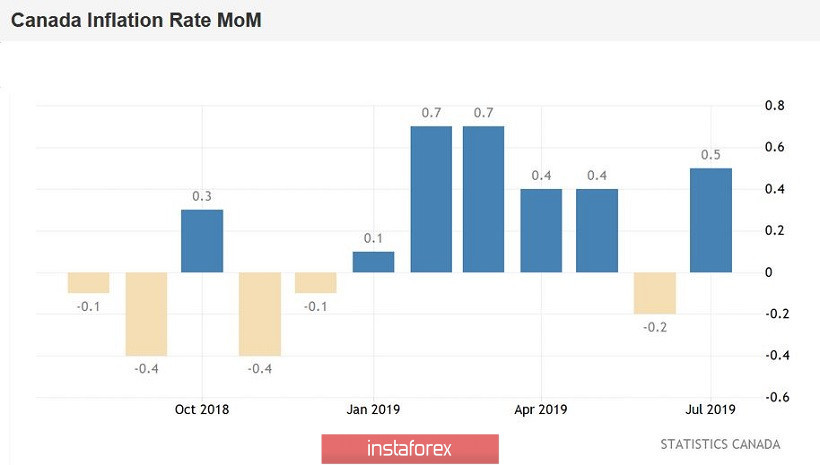

However, not all currency strategists are certain that the Canadian central bank will follow the Fed's example, at least in the near future. Proponents of a wait-and-see attitude point to key macroeconomic reports. For example, the July consumer price index unexpectedly came out better than expected: on a monthly basis, the indicator left the negative area and reached 0.5% (with a forecast of growth to 0.1%). In annual terms, the indicator remained at a two percent level, although, according to the general opinion of economists, it should have dropped to 1.7%. Core inflation also grew: over the course of five months (from February to June) the core index exceeded 1.8%, but in July exceeded expectations and rose to 1.9%.

Given such an ambiguous fundamental picture for the USD/CAD pair on the eve of the next meeting of the Bank of Canada (which will take place on September 4), tomorrow's data plays a special role. This is a growth indicator for the Canadian economy in June. Over the course of two months, Canada's GDP declined: in April, the indicator reached 0.3%, in May - 0.2% (in monthly terms). The consensus forecast suggests that in June the indicator will also show negative dynamics, falling to 0.1%. In annual terms, the key indicator should remain at the May level, that is, at around 1.4%.

If, contrary to forecasts, real numbers are higher than expected, the Canadian dollar will receive substantial support. This circumstance will increase the likelihood that the Canadian central bank will take a wait and see attitude next week - especially against the background of ongoing trade negotiations (consultations) between Beijing and Washington. Given the lack of consensus on the possible position of the Bank of Canada, a positive report on the growth of the national economy may provoke a decrease in the price of USD/CAD at least to the bottom of the 32nd figure, that is, to the lower line of the Bollinger Bands indicator on the daily chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română