Demand for safe haven assets slightly decreased, and the US dollar strengthened its position after good news emerged regarding trade negotiations between the US and China, which are likely to continue in September this year.

The Ministry of Commerce of China said today that they maintain effective communication on trade issues with the United States, and have sufficient means to respond if necessary. Negotiations are expected to continue in September this year in Washington. The ministry also called on the United States to create the necessary conditions for continuing negotiations, hinting at the abolition of new trade duties, which will take effect literally a few days in early autumn.

Data on Germany further strengthened traders' expectation that the European Central Bank will nevertheless go on easing monetary policy at the next meeting this fall.

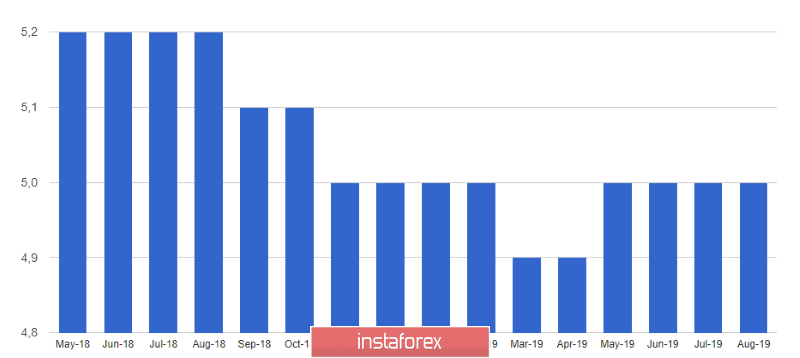

Thus, applications for unemployment benefits in Germany rose in August this year. This once again confirms the fact of a slowdown in economic growth, which affects the labor market. The report of the Federal Employment Agency shows that the number of applications for unemployment benefits were up by 4,000 in August 2019 after an increase of 1,000 in July, while economists expected an increase in applications of 3,000. Unemployment in August remained unchanged, at level 5.0%

Preliminary inflation data also suggests the need for the ECB's intervention. According to the report, preliminary CPI of Germany fell by 0.2% in August compared with July, while a decrease of only 0.1% was expected. Compared to the same period of 2018, inflation grew by 1.4% with a forecast of growth of 1.5%.

As for inflation harmonized by EU standards, the German consumer price index fell by 0.1% in August and increased by 1.0% compared to last year.

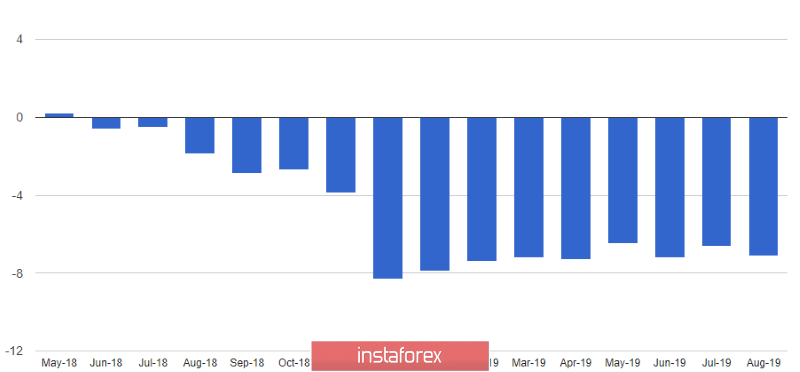

We pass from Germany to the eurozone. Here, the consumer confidence index in August this year fell even further to -7.1 points versus -6.6 points in July, which indicates the growth of skeptical households amid a slowdown in the global economy and aggravation of trade conflicts. Economists had expected consumer confidence to drop to -7.1 points.

The eurozone economic sentiment index rose slightly in August, thanks to a slight improvement in the industrial sector, which suffered most this year from trade conflicts due to a sharp decline in exports. According to the data, the eurozone industry confidence index in August was -5.9 points versus -7.3 points in July. The confidence index in the eurozone services sector, by contrast, fell to 9.3 points from 10.6 points. The total index was 103.1 points.

As for the technical picture of EURUSD, a bearish dynamics is clearly visible. Sellers are still looking at the support level of 1.1050 and at its update, which will lead to the formation of a new bearish trend, capable of pulling down risky assets in the area of lows 1.1020 and 1.0960.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română