To open long positions on EURUSD, you need:

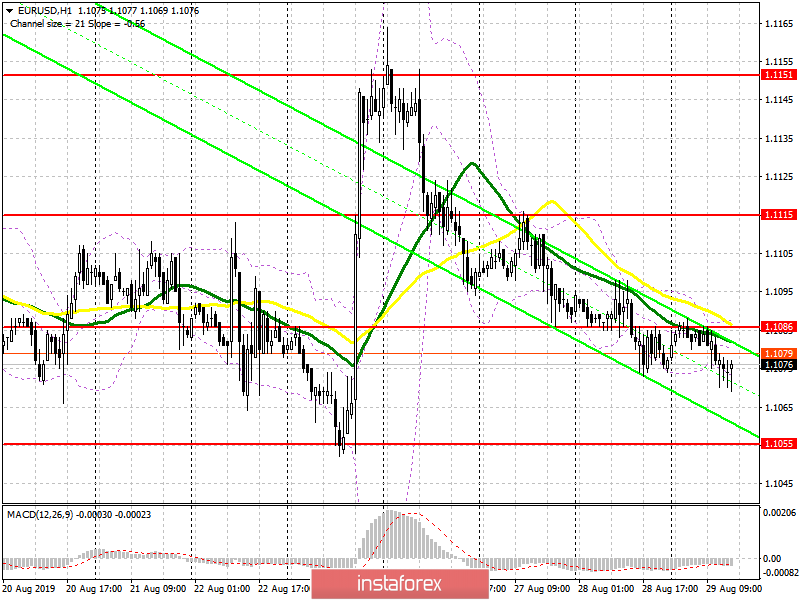

Eurozone data, in particular, we are talking about consumer confidence, which remained unchanged, and the fall in the consumer price index had only slight pressure on the euro in the morning. Buyers still need to return to the level of 1.1086, and only this will be the first signal to open long positions in the hope of updating the resistance of 1.1115, from which sellers will return to the market. However, the more distant goal will be the maximum of 1.1151, where I recommend taking the profit. If the pressure on the euro continues, which is expected, it is best to consider long positions after updating the minimum of the month in the area of 1.1055 or a rebound from the new support of 1.1028.

To open short positions on EURUSD, you need:

A weak report on the eurozone helped the euro sellers but the US GDP was no better, which scared off potential new bears. However, while trading is below the resistance of 1.1086, there is a fairly high probability of continuation of the downward trend to the low of 1.1055, where I recommend fixing the profits in the first half of the day. The main weekly target of sellers will be at least 1.1028. In the case of a pair growth in the second half of the day, to open short positions after the formation of a false breakdown near the resistance of 1.1086, but I recommend postponing larger short positions to the test highs of 1.1115 and 1.1151.

Signals of indicators:

Moving Averages

Trading is close to about 30 and 50 moving averages, indicating more market uncertainty with the prospect of further euro declines.

Bollinger Bands

The break of the lower limit of the indicator in the area of 1.1075 will lead to a further decrease in the euro.

Description of indicators

- MA (moving average) 50 days-yellow

- MA (moving average) 30 days-green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română