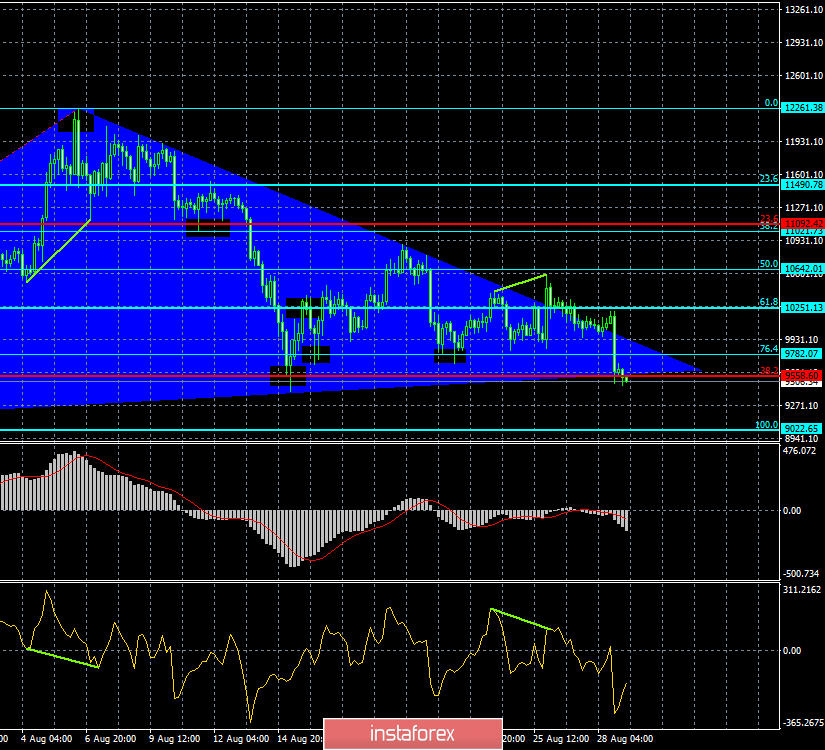

Bitcoin – 4H.

Over the past two weeks, I have repeatedly referred to well-known experts and analysts of the cryptocurrency world, who called the increase in the value of a "cue ball" coin to $12,000 - $15,000 throughout a week/until the end of the month, it was practically decided. The reasons were also called various. Ranging from the escalation of the trade war between China and the United States, which allegedly causes a demand for protective assets, to the "very essence of bitcoin and blockchain technology", which cannot fail to rise in price. Moreover, it is still unclear how Bitcoin, or other cryptocurrencies, can be used as a means of preserving value with growing global risks and the threat of recession for the global economy. Over the past 24 hours, traders could get a clear answer to this question, since BTC fell by almost $ 1,000 per day.

Thus, I still believe that the movement of the bitcoin exchange rate is virtually unrelated to various geopolitical risks, increasing threats of slowing the world economy. These factors can influence. Large investors, experts, and analysts continue to move bitcoin, predicting the astronomical cost of the "cue ball" for a year or two, as well as one-day investors, who on the waves of cryptocurrency growth increase demand, which causes even greater demand. However, the hamsters, as they call short-term investors as the main goals, "fast profit", you need to properly manage. Hamsters will not wait a year or two to make a profit so that bitcoin continues to rise in price, they need to be kept in the market and constantly attract new ones. First, the bearish divergence of the CCI indicator, then the rebound from the correction level of 61.8% ($10,251). Now, the collapse and closure under the Fibo level of 38.2% ($9,558). Accordingly, bitcoin quotes will continue to fall in the direction of the correction level of 100.0% ($9,022).

The Fibo grid is based on the extremes of July 17, 2019, and August 6, 2019.

Forecast for Bitcoin and trading recommendations:

Bitcoin performed consolidation under the Fibo level of 38.2% ($9,558). Thus, I recommend selling cryptocurrency with a target of $9,022, with a stop-loss order above the level of 38.2%.

I recommend buying bitcoin with a target of $9,558, and with a stop-loss level of $9,022, if a rebound from the correction level of 100.0% is performed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română