The British Prime Minister, inspired by the support of the American president, headed for the country's exit from the EU for any scenario. It seems that he decided to end this horror endlessly in the form of a permanent Brexit, cutting the problem as a Gordian knot with one blow.

This news on Wednesday collapsed the British currency by more than one figure and despite the sterling paired with the American dollar compensated for almost half of these losses, the risk of its further decline remains in force.

In our opinion, this decision is correct, although very painful for the British economy. Brexit's problem is already fully affecting it, as recent economic statistics have vividly demonstrated. Given this state of affairs, we believe that sterling can, at best, be up to an hour "x," until October 31, when Britain will have to finally solve the problem of the country's exit from the European Union and nervously move sideways with respect to the US dollar. This is due to the fact that investors will take a wait-and-see attitude without showing noticeable activity. Any weakening of the US dollar against the background of the expected lower interest rates will be compensated by the weakness of the British currency. This state of affairs may persist until the end of October, unless, of course, something extraordinary happens.

Today, the focus of the market will be the publication of US GDP data for the second quarter. This is another revised release, which is expected to show a slowdown in the US economy from 2.1% to 2.0%. If the data are no higher than expected, this will be a serious reason for the Fed's decision to continue the cycle of lowering interest rates until the end of this year.

Forecast of the day:

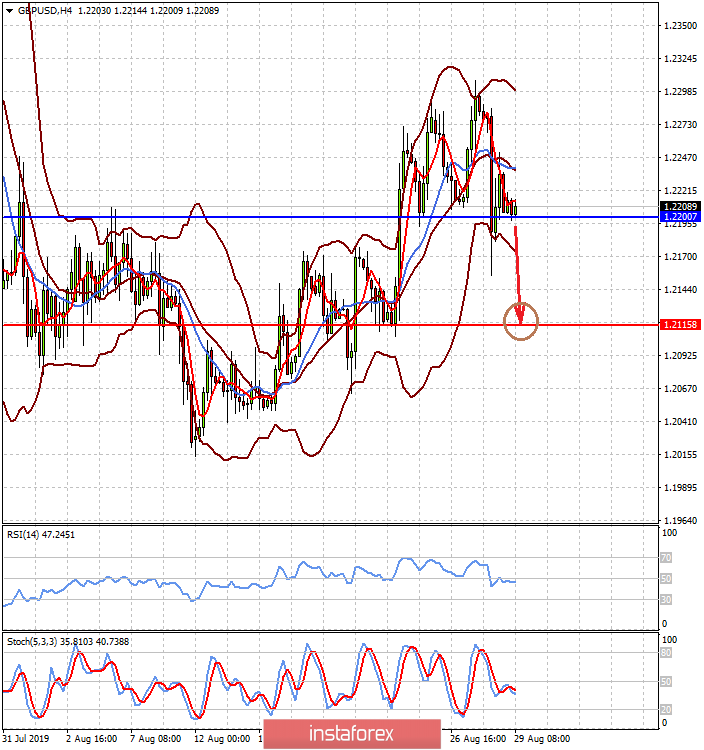

The GBP/USD pair is consolidating above 1.2200. Any further negative in relation to the situation with Britain's exit from the EU will lead to a local price drop. A decrease in the pair below this mark will be the basis for its decrease to 1.2115.

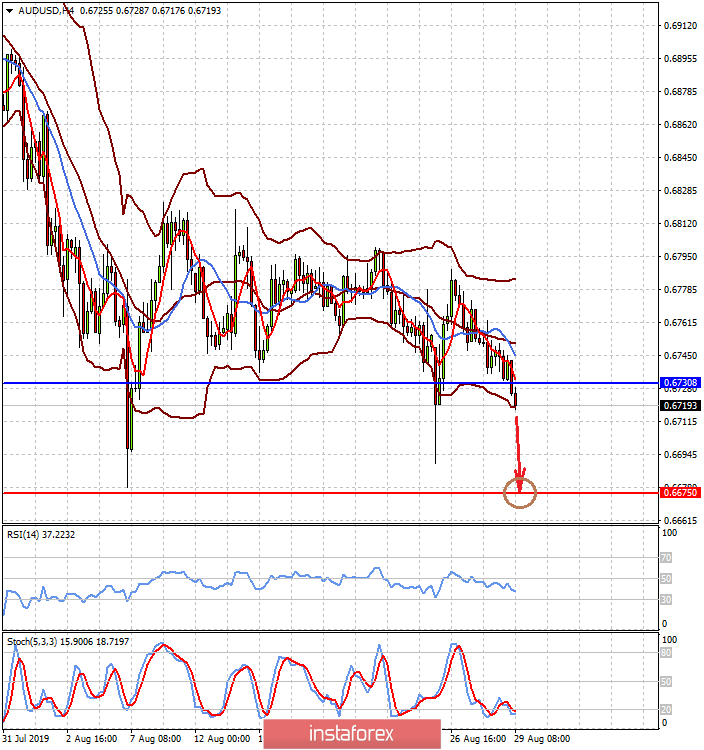

The AUD/USD pair remains in a short-term downtrend amid the uncertainty of the future monetary policy of the RBA against the backdrop of a trade war between the United States and China. The pair fell below the level of 0.6730, which will be the basis for its decline to 0.6675.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română