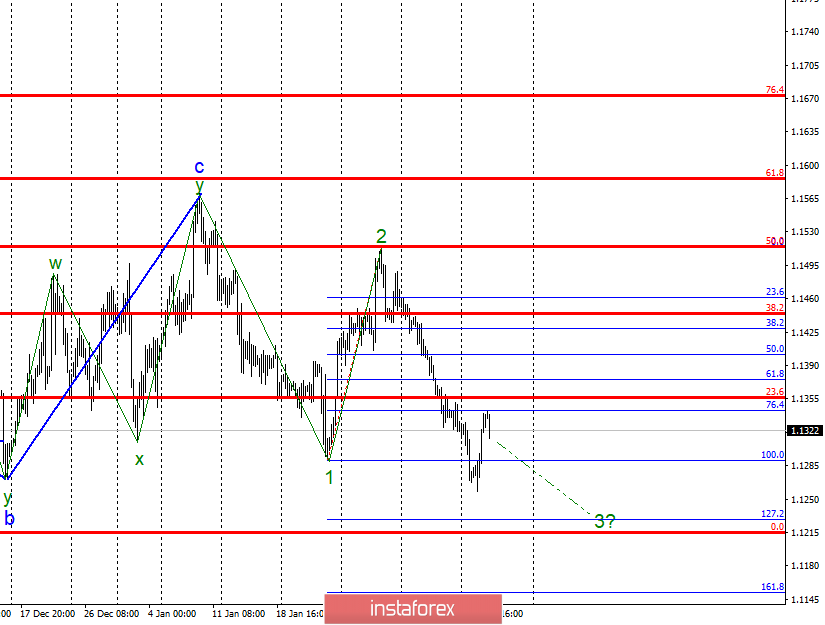

Wave counting analysis:

On Tuesday, February 12, trading ended for EUR / USD by 50 bp increase. Thus, the instrument inside the intended wave 3 clearly shows the five-wave structure of the waves. If this is true, then there should be another final impulse wave 5, 3. The unsuccessful attempt to break through the 76.4% Fibonacci level implies that the instrument is ready to build this wave. The breakthrough of the 76.4% level will indicate the pair's readiness for an increase and will suggest the completion of wave 3, which in this case can be interpreted as a wave with inside the three wave structures.

Sales targets:

1.1228 - 127.0% Fibonacci

1.1215 - 0.0% Fibonacci

Shopping goals:

1.1444 - 38.2% Fibonacci

1.1514 - 50.0% Fibonacci

General conclusions and trading recommendations:

The pair continues to build a downward wave of 3. Thus, now I still recommend selling EUR / USD, but be more cautious, with targets around 1.1228 and 1.1215, which corresponds to 127.2% and 0, 0% Fibonacci. I expect the construction of wave 5, 3, which may turn out to be small and only a few bp. It may go below the minimum of wave 5, 3, or even shorten.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română