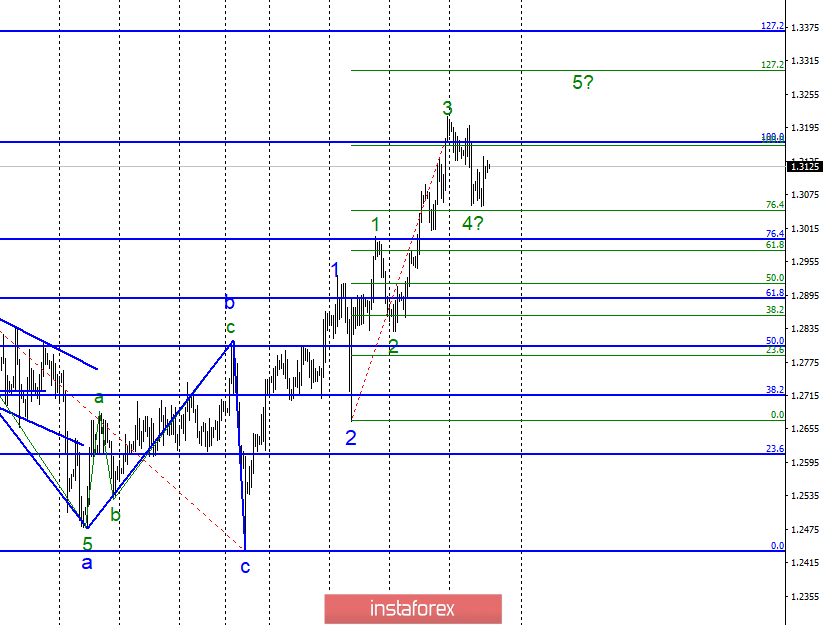

Wave counting analysis:

On January 30, the GBP / USD pair rose by 50 bp, presumably completing the construction of wave 4, as part of the future 3 uptrend trend. If the current wave counting is correct, then the increase in quotations will continue within wave 5 with targets located near the Fibonacci 127.2% level. Wave 4, at 4 at the moment looks fully equipped, a breakthrough of its minimum will lead to the need to clarify the wave pattern. The greatest doubts in the option with the increase is the lack of a specific and intelligible decision on the issue of Brexit s well as the preliminary refusal of the EU to conduct new negotiations with Britain. More so, Theresa May's parliament rejected the plan.

Shopping goals:

1,3297 - 127.2% Fibonacci

1.3367 - 127.2% Fibonacci

Sales targets:

1.2996 - 76.4% Fibonacci

1.2889 - 61.8% Fibonacci

General conclusions and trading recommendations:

The wave pattern assumes the construction of wave 5, 3. Thus, I expect the resumption of the increase and recommend buying the instrument with targets near the estimated level of 1.3397, which equals 127.2% Fibonacci . Breakthrough of the minimum of wave 4, in 3 will cancel the execution of the variant with the construction of an upward wave.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română