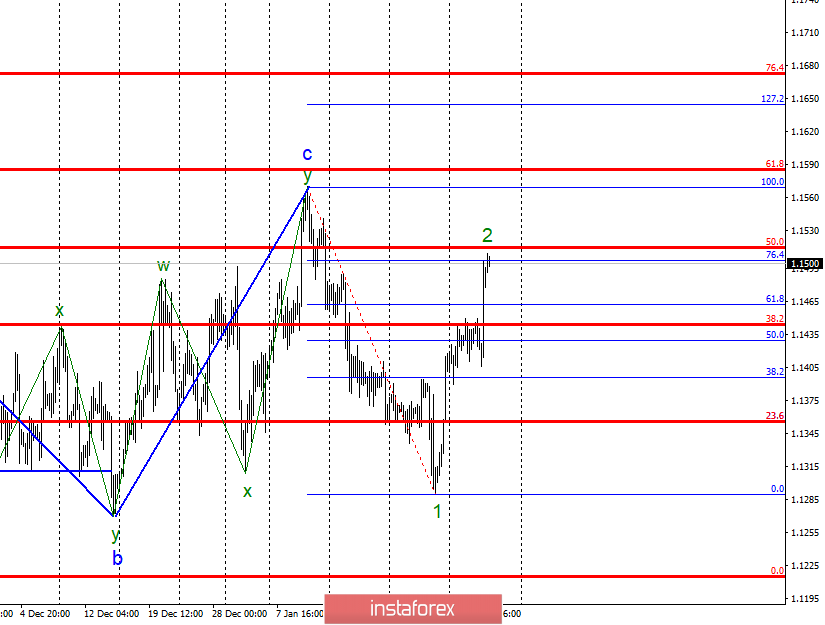

Wave counting analysis:

The trading on Wednesday, January 30, ended with a 50 bp rise. Thus, the estimated wave 2 in the composition of the new downtrend of the trend took too long. The rise of the pair was associated with too soft statements by the Fed in the covering letter. Now the whole wave counting can be transformed into the next three wave structure. If this is true, then the growth of the instrument can be maintained up to the maximum of wave c, after which we are waiting for a decline in the region of 13 figures.

Sales targets:

1,1289 - 0.0% Fibonacci

1.1215 - 0.0% Fibonacci

Shopping goals:

1.1502 - 76.4% Fibonacci

1.1569 - 100.0% Fibonacci

General conclusions and trading recommendations:

The pair remains in the stage of building a correctional wave 2. Thus, its completion should lead to a resumption of the instrument's decline with targets located near the marks of 1,1289 and 1.1215, which equates to 0.0% and 0.0% Fibonacci. Since wave 2 has taken on too deep a look, the downward wave should still be there, but it can even start from the 1.1569 mark.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română