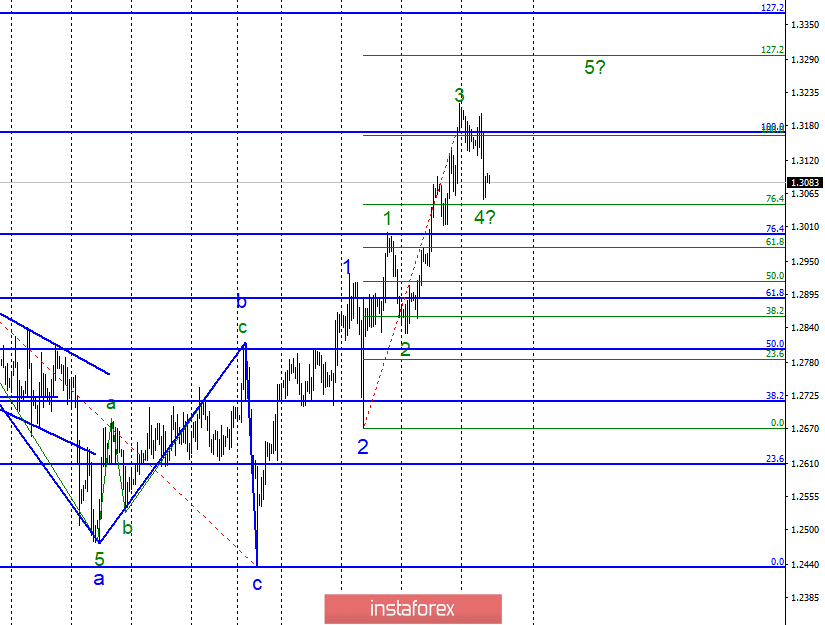

Wave counting analysis:

On January 29, the GBP / USD pair fell by 90 bps, thus completing the construction of the estimated wave 3, in the 3 uptrend segments of the trend. If this is true, then the tool is now in the framework of building wave 4, 3, which may be completed soon or has already been completed. Therefore, I expect the resumption of increase in quotations with targets that are near the level of 127.2% Fibonacci. . On the other hand, the results of the Fed meeting, which will become known today, can support the pound sterling, then wave 5 will get even more chances for its development. Voting on the final Brexit bill postponed to February.

Shopping goals:

1,3297 - 127.2% Fibonacci

1.3367 - 127.2% Fibonacci

Sales targets:

1.2996 - 76.4% Fibonacci

1.2889 - 61.8% Fibonacci

General conclusions and trading recommendations:

The wave pattern assumes the construction of wave 5, 3. Thus, I expect the resumption of the increase and recommend still buying the instrument with targets located near the estimated level of 1.3297, which equates to 127.2% Fibonacci. If support gets a dollar today, it can break all current wave markings, which will require adjustments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română