4h

The EUR / USD pair on the 4-hour chart cleared the correction level of 50.0% - 1.1680 and the growth to the correction level of 76.4% - 1.1771. The bearish divergence in the CCI indicator allowed a small drop, but now the growth process has already been resumed. Quit on July 9 from the Fibo level of 76.4% will allow traders to expect a reversal in favor of the US dollar and a slight drop in the direction of the correction level of 61.8% - 1.1721. Fixing the pair's rate above the Fibo level of 76.4% will increase the chances of continuing growth towards the next correction level of 100.0% - 1.1852.

The Fibo grid is built on the extremes of June 14, 2018, and June 21, 2018.

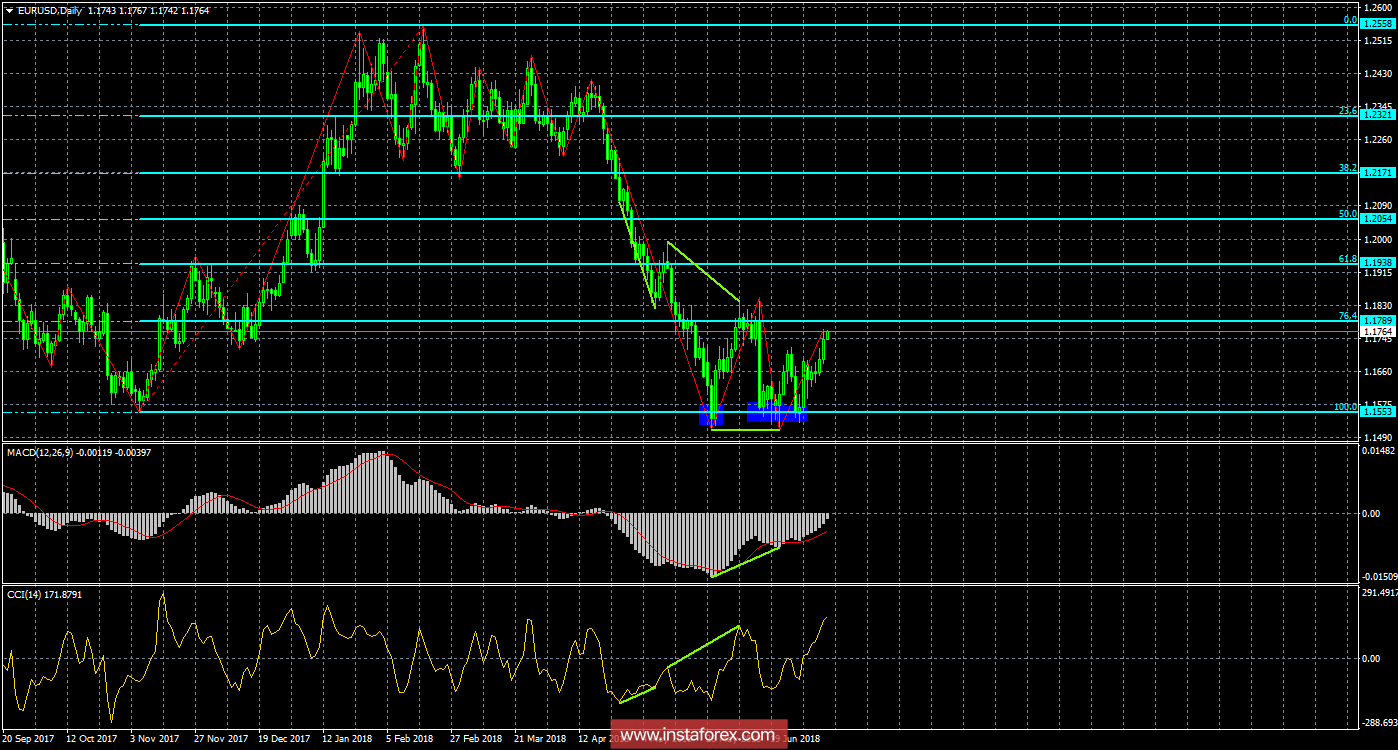

Daily

On the 24-hour chart, the growth of quotations continues in the direction of the correctional level of 76.4% - 1.1789. The maturing divergence of the CCI indicator is canceled. The fall of the rate of the pair from the Fibo level of 76.4% will allow us to count on a reversal in favor of the US currency and a slight drop towards the correction level of 100.0% - 1.1553. There are no new brewing divergences today. Fixing the pair above the Fibo level of 76.4% will work in favor of continuing growth in the direction of the next correction level of 61.8% - 1.1938.

The Fibo grid is built on extremes from November 7, 2017, and February 16, 2018.

Recommendations for traders:

Buy a pair of EUR / USD on July 9 will be possible with a target of 1,1852 with a Stop Loss level below the Fibo level of 76.4% if there is a close above the correction level of 1.1771.

Selling the EUR / USD pair will be possible with the target of 1.1721 if there is a retreat from the correction level of 76.4%, with a Stop Loss order above the level of 1.1771.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română