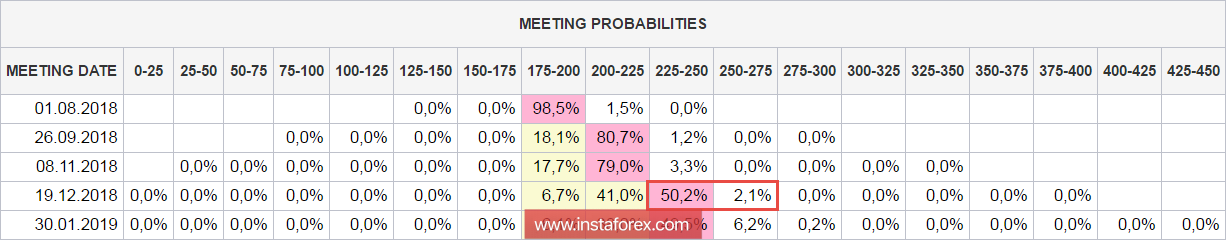

The FOMC minutes of meeting on June 13 was published on Friday and did not have a significant effect on market rate expectations. Markets are certain that the next increase will take place in September, there is no sustainable opinion regarding the fourth year in this year. According to the CME, the probability of an increase in the futures market data is slightly higher than 50% on Monday morning.

In general, the minutes was hawkish but it contained exactly the formulations that were expected. Committee Members left themselves a loophole for raising the percentage of the rate hike in 2019/2020, linking this plan with possible strong growth of the economy and a stable fix of the rate above 2%. Opinions were also expressed that the rate on excess reserves of banks is growing more slowly than the discount rate, and this difference will encourage banks to seek the application of their reserves in other financial instruments.

There were also concerns about trade risks, but it seemed to be on duty, as it was not possible to circumvent this topic. As a result, markets did not see for themselves any new landmarks, and the dollar even lost a bit in value.

The main attention on Friday were pointed to two events - the report on the labor market and the beginning of the trade war between the US and China.

The labor market report appeared outwardly confident while the growth in the number of new jobs exceeded the forecast, there was an upward revision for April and May. The unemployment rate rose from 3.8% to 4.0%, but the markets were indifferent to this, as the level of labor participation showed a simultaneous increase, while the absence of dynamics in the rate of average wage growth (2.7% year-on-year versus the forecast of 2.8%) crossed all positive.

Market expectations for the Fed rate are inevitably hawkish and associated with the increasing the growth of Treasury yields. Therefore, insufficient wage growth serves as a strong cooling factor and raises doubts about the effectiveness of the chosen policy.

After the publication of the report, the dollar began to weaken and closed the week with a slide against most G10 currencies.At the beginning of a full-fledged trade war between the US and China, the markets reacted calmly. The US imposed duties on Chinese goods worth 34 billion dollars, and China immediately responded with retaliation. For multi-trillion economies, these amounts are small, but the increasing conflict will significantly affect higher volumes. Global growth slows down, and business activity peaked by mid-2017 since then has been declining, the demand for metals is even more rapidly, which is an accurate indicator of the economic crisis.

The escalation of the trade war is inevitable. China is actively working to integrate regional economies into trade unions that intend to jointly oppose the US economic dictates. There are 16 countries in the Asia-Pacific region, including China, Japan, India, that creates a new trade union, in which the United States did not find a place. Until the end of the year, all the necessary documents are expected to be signed and these countries will begin to pursue an agreed tariff policy, which means that the answer to the unilateral US action will be much larger.

According to the formula "16 + 1", the summit held on Sunday in Sofia was participated by the countries of Central and Eastern Europe, as well as China. On the agenda tackled exactly the same issues, which is the development of a unified position on trade. Countries rely on free trade under conditions of trade war with the United States, and intend to work out a unified strategy within the framework of WTO rules.

These events point to the obvious beginning of a full-scale trade war, and the United States risks will lose much more than it will acquire.

The Dollar has changed conditions and no longer looks like the "favorite" currency. The Fed Policy aimed at tightening financial conditions leads to the shrinkage of the monetary base and the dollar appreciation, but the threat of ousting it out of the world commodity turnover looks increasingly ominous.

On Monday, the dollar will continue to weaken against most currencies. According to the EUR/USD pair, testing the 1.18 level is probable and an attempt to gain a foothold higher. While the GBP/USD is aiming for 1.3450, today we can test the intermediate resistance 1.3370 for strength.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română