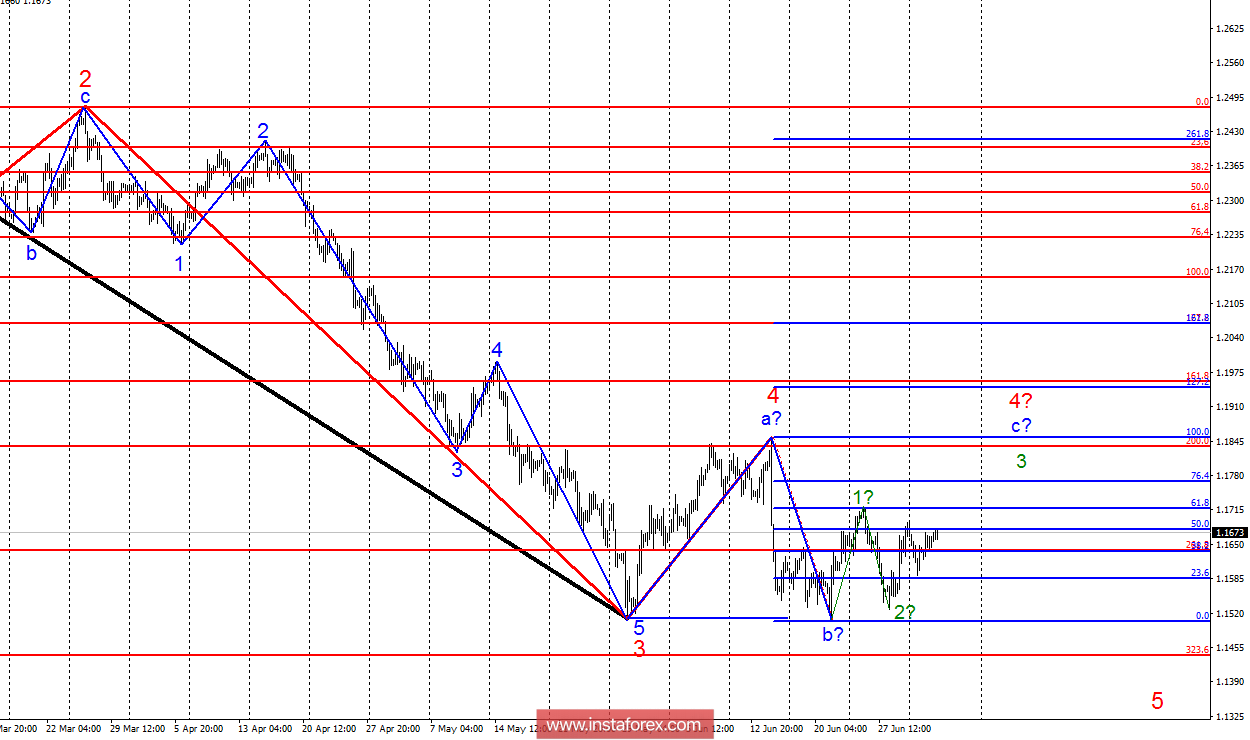

Analysis of wave counting:

As a result of the previous trading day, the currency pair EUR / USD added about 20 percentage points. And though it is a little, nevertheless, the pair remains within the limits of construction of a prospective wave 3, c, 4. Thus, wave counting does not change, and we continue to expect growth of euro. Wave c, 4 can take the form of a 5-wave structure, but it should be remembered that, according to current wave counting, this is still a corrective wave with targets located near the calculated mark of 1.1856. In the global plan, a resumption of the decline in quotations is expected in the framework of the construction of wave 5 of the downward trend section.

The objectives for the option with sales:

1.1440 - 323.6% of the Fibonacci of the highest order

1.1118 - 423.6% of Fibonacci

The objectives for the option with purchases:

1.1866 - 100.0% of Fibonacci

1.2072 - 127.2% of Fibonacci

General conclusions and trading recommendations:

The currency pair EUR / USD continues to rise within wave 3, c, 4. Thus, I recommend remaining in purchases with targets located near the calculated marks of 1.1856 and 1.2072, which corresponds to 100.0% and 127.2% of Fibonacci. I recommend returning to sales not before a successful attempt to break the minimum of the proposed wave b. In this case, the pair will most likely proceed to build the wave 5 of the trend-bearish section with the targets that are about 12 and 11 figures.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română