The financial markets continue to be volatile amid trade wars. Actually, investors stopped responding to the emerging economic data or some events that are not associated with the trade confrontation between the US and China or, for example, issues with the European Union.

Further threats and real actions of Washington increasingly drive markets into the Procrustean bed, preventing traders from thinking broadly and actively working in financial markets. Over the past two weeks, the "fear index" of the S&P 50 VIX jumped from 12.79 points to 19.52 points, showing the strongest growth in the negative sentiment towards buying risky assets, primarily shares of companies.

In foreign exchange markets, there is an interest reversal to defensive assets from the currencies of emerging economies. State bonds of the US Treasury and other economically strong countries, such as German bonds, are still in demand. In addition, interest remains in the asylum currencies - the Japanese yen and the Swiss franc. At the same time, commodity and commodity currencies remain weak. The Canadian dollar was able to hold its position due to the preservation of high prices for crude oil. The dollar is also in demand on the wave of increasing fears for the global economic growth prospects. As soon as there is an exacerbation, like the threats of Donald Trump to sanctions countries if they buy crude oil from Iran, while the US currency rate begins to receive support. The reason for this, which was already mentioned earlier, is the firm belief that the US economy will suffer significantly less than other countries under the trade wars scenario.

Observing the current situation, we believe that the current state of affairs will remain at least in the short term. Most likely, the dollar will continue to receive local support.

Forecast of the day:

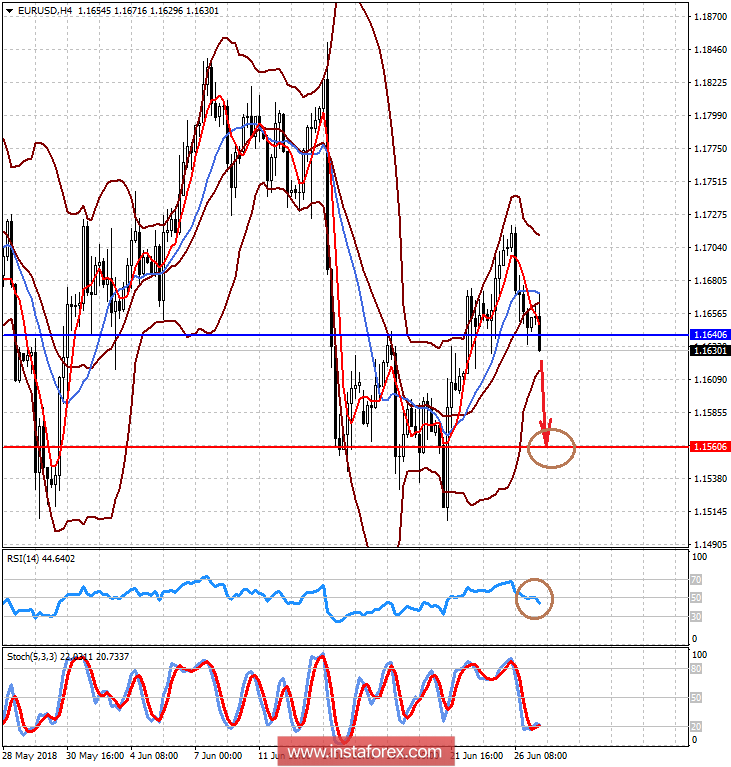

The EUR/USD pair is trading below the level of 1.1640 on the wave of strengthening the US dollar's position due to the aggravation of trade wars between the US and a number of its main trading partners. Given this fact, we believe that the currency pair may fall to 1.1560.

The GBP/USD pair is moving after the euro/dollar pair. Crossing the support level 1.3190 may be the basis for further price fall to the local minimum of 1.3100. The pressure on the pair maintain its position despite the UK withdrawal from the EU, as well as the economic slowdown in the country and the declining expectations that the Bank of England will allow to raise interest rates until autumn, at least.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română