The New Zealand dollar is going through hard times. The country's GDP demonstrates a negative dynamic, the price index for dairy products falls second auction in a row, and the foreign trade indicator declined for the first time in the last five quarters. There are more indirect negative fundamental factors. For example, the trade war between the United States and China affected the commodity market. In particular, the cost of iron ore fell to the March lows. This situation may slow the growth of the Australian economy, while Australia is the main and largest trading partner of New Zealand.

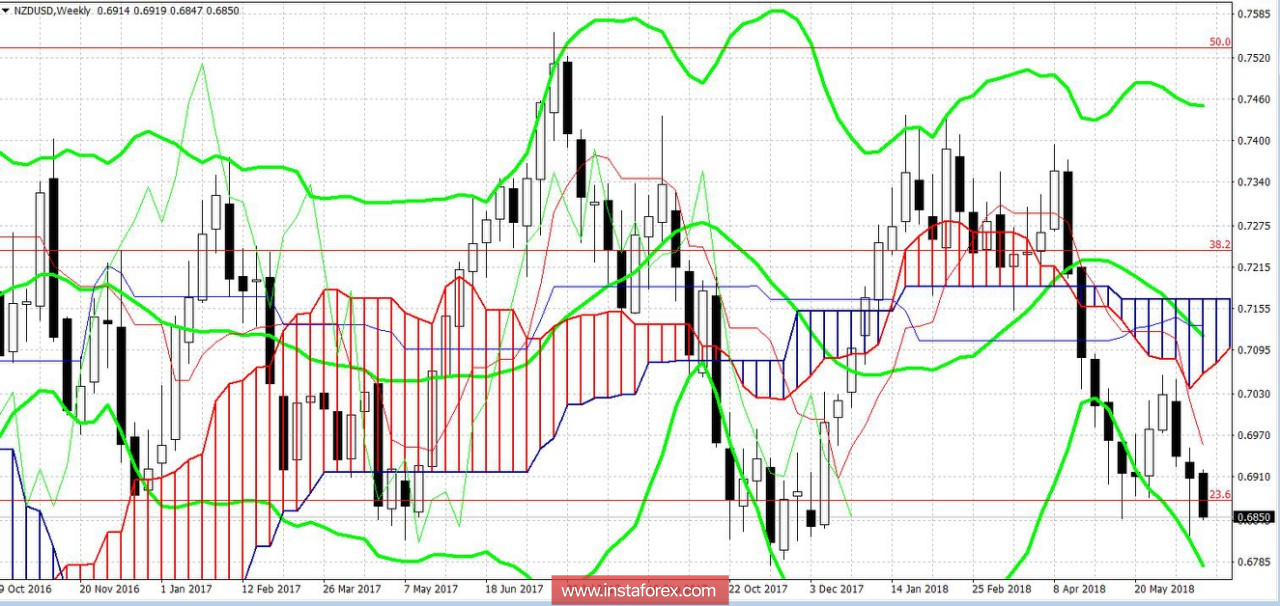

Therefore, despite the weak positions of the US dollar, the pair NZD / USD is under the influence of bearish sentiment. The price is slowly but surely heading for a second test of the low of this year, to the level of 0.6823. This dynamic is consistent with the technical picture of the pair, but this is somewhat later.

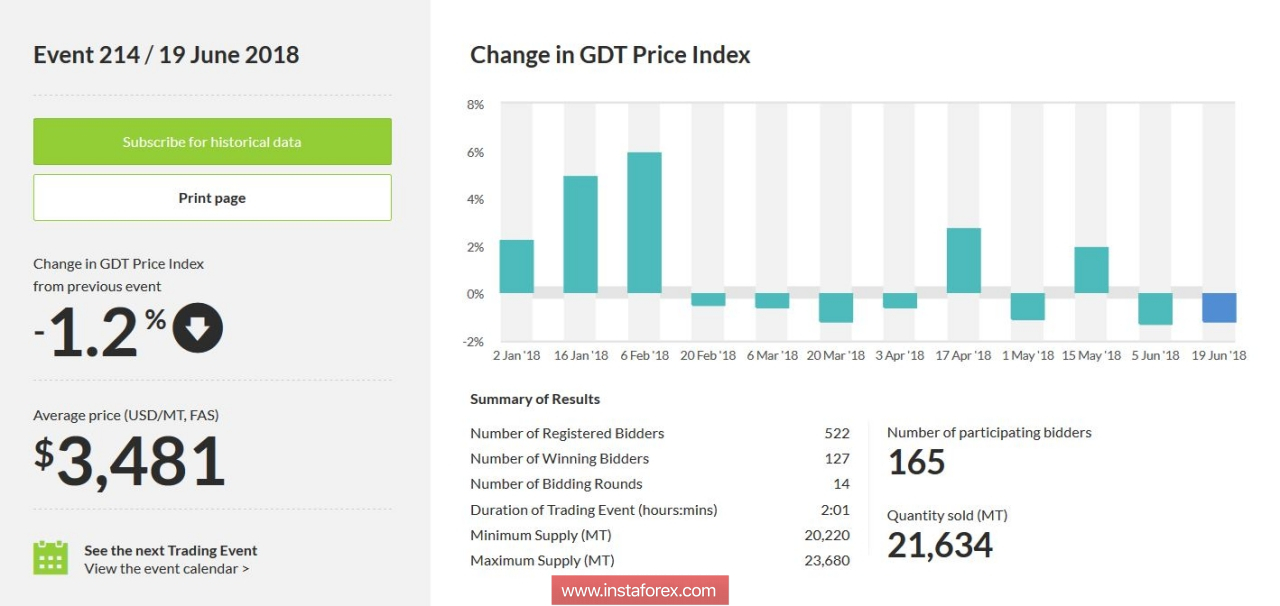

Let's start with the most acute problems of the New Zealand dollar. A week ago, another auction took place on the Global Dairy Trade trading platform, which was held in gloomy colors. The prices for the vast majority of "milks" continued to fall. The cost of whole milk powder decreased by one percent, the price of low-fat dried milk fell by 1.1%, and cheddar cheese fell by 3.8% at once. In general, the index fell -1.2%, continuing the negative trend, as in early June, the auction closed with a fall of 1.3%.

The next auction of GDT will take place on July 3, but, according to most experts, the negative dynamics will continue in the next month. According to the latest data, export prices in New Zealand in the first quarter decreased by 2.2%. Speaking directly about export prices for dairy products, there was a decline of almost seven percent. It is worth noting that dairy products account for more than 20% of the country's total exports, so the aforementioned recession is cause for concern. At the same time, the weather conditions in the first half of the year in New Zealand were favorable for agriculture. Milk production increased compared to last year.

The problem is in demand. Experts note a decrease in interest in dairy products in New Zealand. Primarily from the nearest and main trading partners, the PRC and Australia. The EU is also in no hurry to compensate for the gap. In the EU countries, the price of "milk" is steadily declining amid growth in production. For example, the cost of a liter of milk this year in all EU countries (except France) declined, while the milk production increased by 2.5% compared to the previous year.

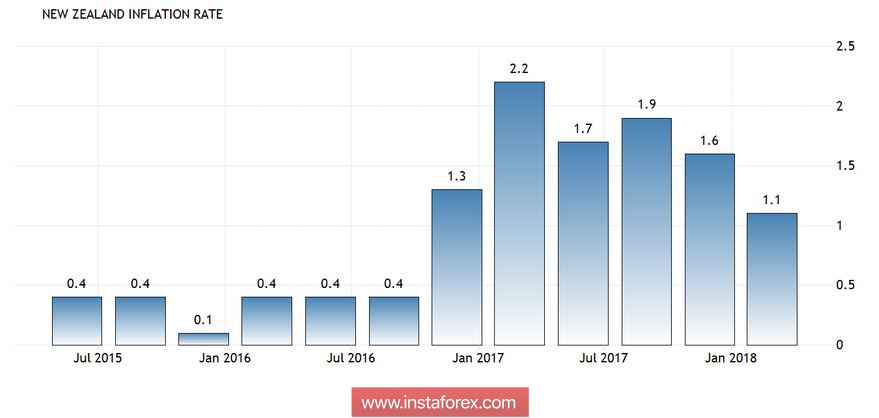

Thus, the negative dynamics of the GDT index is likely to continue in July, putting pressure on the New Zealand dollar. However, this is not the only currency problem. Last week, the country's GDP growth indicator was published, which showed a slight slowdown in the economy. The construction sector and exports have brought down. The expenditures of households (primarily on cars, clothing and gasoline) were also unclear. Inflation in New Zealand has also slowed. In the first quarter of this year, consumer prices rose by only 1.1%, while for the same period last year the indicator increased by 1.6%.

Summarizing the above, it should be noted that the current fundamental background does not contribute to a large-scale recovery of the New Zealand dollar. Any more or less significant growth of the pair NZD / USD can be used to open short positions, with the main price target in the area of the annual minimum of 0.6823.

Moreover, a gloomy fundamental picture may soon be exacerbated: on June 28, the Reserve Bank of New Zealand will meet. According to the absolute majority of experts, the regulator on this Thursday will not only leave the parameters of monetary policy in its previous form, but also take a rather "dovish" position. The central bank certainly will not ignore the slowdown in GDP growth and inflation as demand for dairy products declines.

In general, analysts do not expect any decisive action from the RBNR until the end of 2019. But if the regulator allows the possibility of easing the terms of monetary policy, the New Zealander will collapse all over the market. However, this is an unlikely scenario. Most likely, members of the Central Bank will take a cautious and wait-and-see attitude, focusing on the slowdown of key macroeconomic indicators.

Technically, the situation for the pair is as follows. The pair is between the middle and bottom lines of the Bollinger Bands indicator, which in turn demonstrates the extended channel. This indicates a predominance of the bearish trend. The confirmation of the south direction is also the generated signal "Line Parade" indicator Ichimoku Kinko Hyo, this is the strongest signal, foreshadowing the bearish movement. The support level is the price minimum of the year, namely the 0.6823 mark. And the resistance level is the middle line of the Bollinger Bands indicator and the price is 0.7040.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română