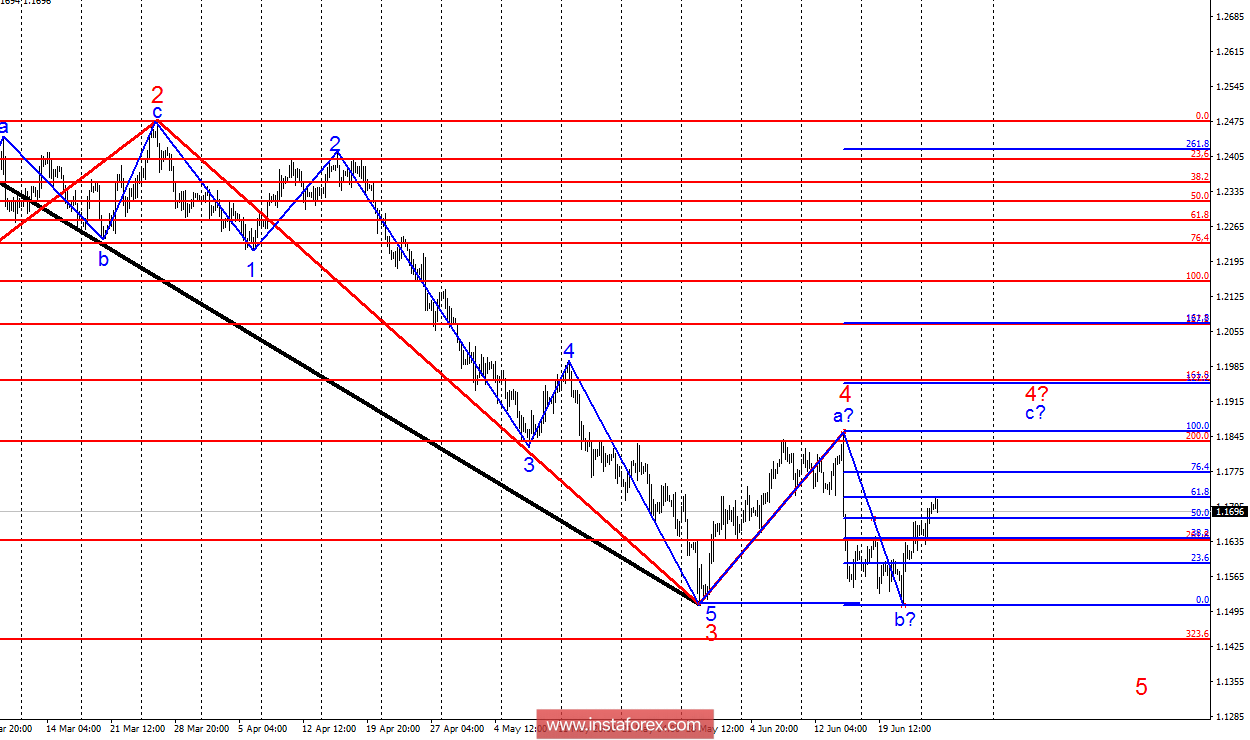

Analysis of wave counting:

As a result of the previous trading day, the currency pair EUR / USD added another 40 percentage points. Thus, the minimum of May 29 was not passed, and the pair was able to complete the full construction of the proposed wave 4 of the downward trend section. To do this, it must at least return to 1.1856, which corresponds to 100% of wave b, 4. A successful attempt to break the low from May 29 will lead to a statement of the fact of the early completion of wave 4 and the transition of the instrument to the construction of a downward wave.

The objectives for the option with sales:

1.1440 - 323.6% of the Fibonacci of the highest order

1,1118 - 423.6% of Fibonacci

The objectives for the option with purchases:

1.1866 - 100.0% of Fibonacci

1,2072 - 127.2% of Fibonacci

General conclusions and trading recommendations:

The wave counting of the EUR / USD currency pair is a little confused, mainly because of the too deep wave b, 4. As before, the option with the construction of the supposed wave c, 4, remains the most likely. Thus, I recommend buying a pair with targets near the calculated marks of 1.1856 and 1.2072, which corresponds to 100.0% and 127.2% of Fibonacci. I recommend returning to sales only after a successful attempt to break through the mark of 1.1510.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română