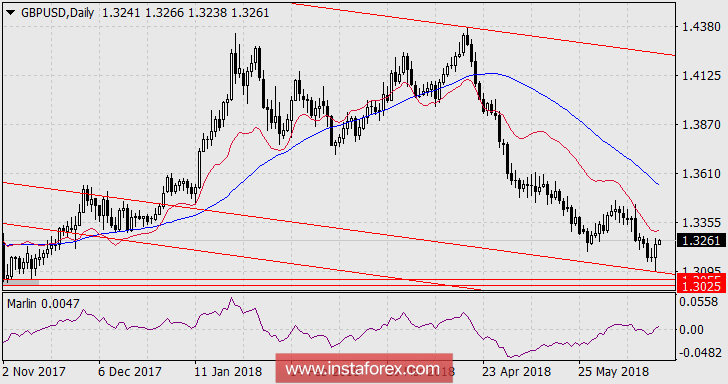

GBP / USD

On the daily chart, the price reached the support of the lower boundary of the descending channel and rebounded upwards as shown in the the results of the Bank of England meeting. The Monetary Policy Committee voted three votes for the rate hike, while the markets expected the results to remain as 2-7. The Bank of England also announced that it will begin to reduce the volume of bond redemption when the rate is 1.5% against the earlier target to proceed with the QE reduction with a rate of 2.0%. The market expectations for the rate hike in August jumped from 45% to 65%.But even if the rate is raised in August, the pound may soon fall lower along with the entire market. The rumors about the full market absorption of the November rate hike is also not good for the pound.

On the 4-hour chart, the price slowed at the intersection of two indicator lines - the red balance line and the blue line. To overcome this resistance, the market has no reason for today but there is a reason to turn down due to the possible decision by OPEC + to raise quotas for oil production. The main scenario is the consideration to have another attempt to overcome the price of the trendline support and test the range of 1.3025 / 55 for strength.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română