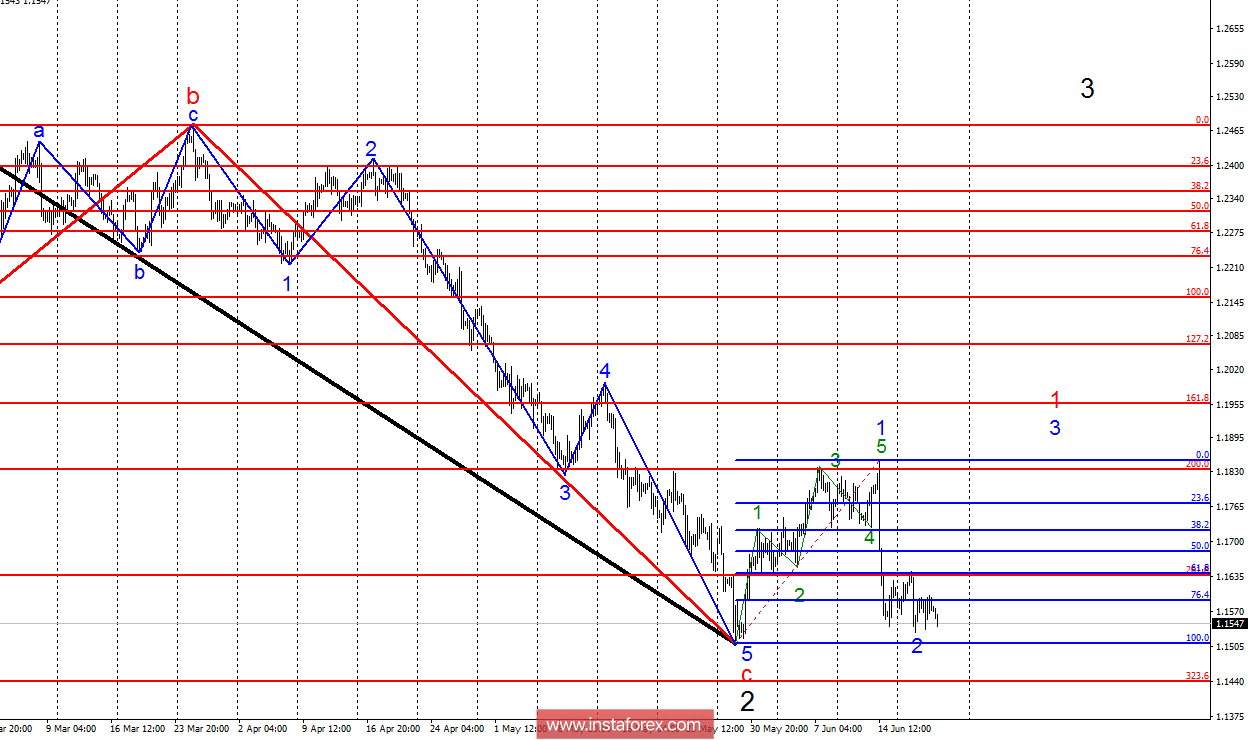

Analysis of wave counting:

According to the results of the previous trading day, the EUR / USD currency pair has declined by 20 percentage points. However, the minimum of 29 May is not broken, which retains the theoretical chance to build wave 3, in the future 1. The successful attempt to break the level of 1.1510 will lead to the complication of the internal wave structure of the proposed wave 2, which dates back to February 16. The Euro-currency urgently needs fundamental support, without it the level of 1.1510 is likely to be breached.

The options for the option with sales:

1.1439 - 323.6% of the Fibonacci of the highest order

1.1121 - 423.6% of the Fibonacci of the highest order

The options for the option with purchases:

1.1958 - 161.8% of the Fibonacci of the highest order

1.2070 - 127.2% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The currency pair EUR / USD, presumably, completed the construction of wave 2, 1, 3, but a breakthrough of the mark of 1.1510 will lead to a further decline in quotations. Up to this point, we can expect a resumption of the pair's increase with the targets near the calculated marks of 1.1958 and 1.2070, which is equivalent to 161.8% and 127.2% of Fibonacci. Proceeding from what, I recommend to continue holding small purchases. The break of the May 29 low will mean the resumption of the construction of the downward trend section. In this case, I recommend starting selling the pair with the targets of 1.1439 and 1.1121.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română