Whatever one may say, the Bank of England today has no other options at all, except to pose as an ostrich and hide its head in the sand. After the ECB has extended the quantitative easing program and Mario Draghi said that he does not rule out its further extension in the future, raising the refinancing rate for the Bank of England becomes akin to suicide. Even though the UK withdrew from the European Union, it is economically very closely connected with continental Europe.

If the refinancing rate in the UK is significantly higher than in Europe, for the British economy it promises only losses. The piquancy of the situation is due to the change in the rhetoric of the ECB, which now justifies the policy of zero rates and the action of the quantitative easing program. It is not because of the need to accelerate economic growth but by the trade war with the United States. If the Bank of England will raise the refinancing rate, and the economic conditions in the UK itself have long been ripe for such a decision, then, depending on the economic situation in Europe, the victim of this war will be just Foggy Albion. The most ridiculous thing is that if the ECB continues to extend the program of quantitative easing, then the Bank of England may even think about lowering the refinancing rate. So today, the Bank of England will leave everything unchanged, and for many, it will signal that at the end of the year the department of Mark Carney can surprise everyone unpleasantly.

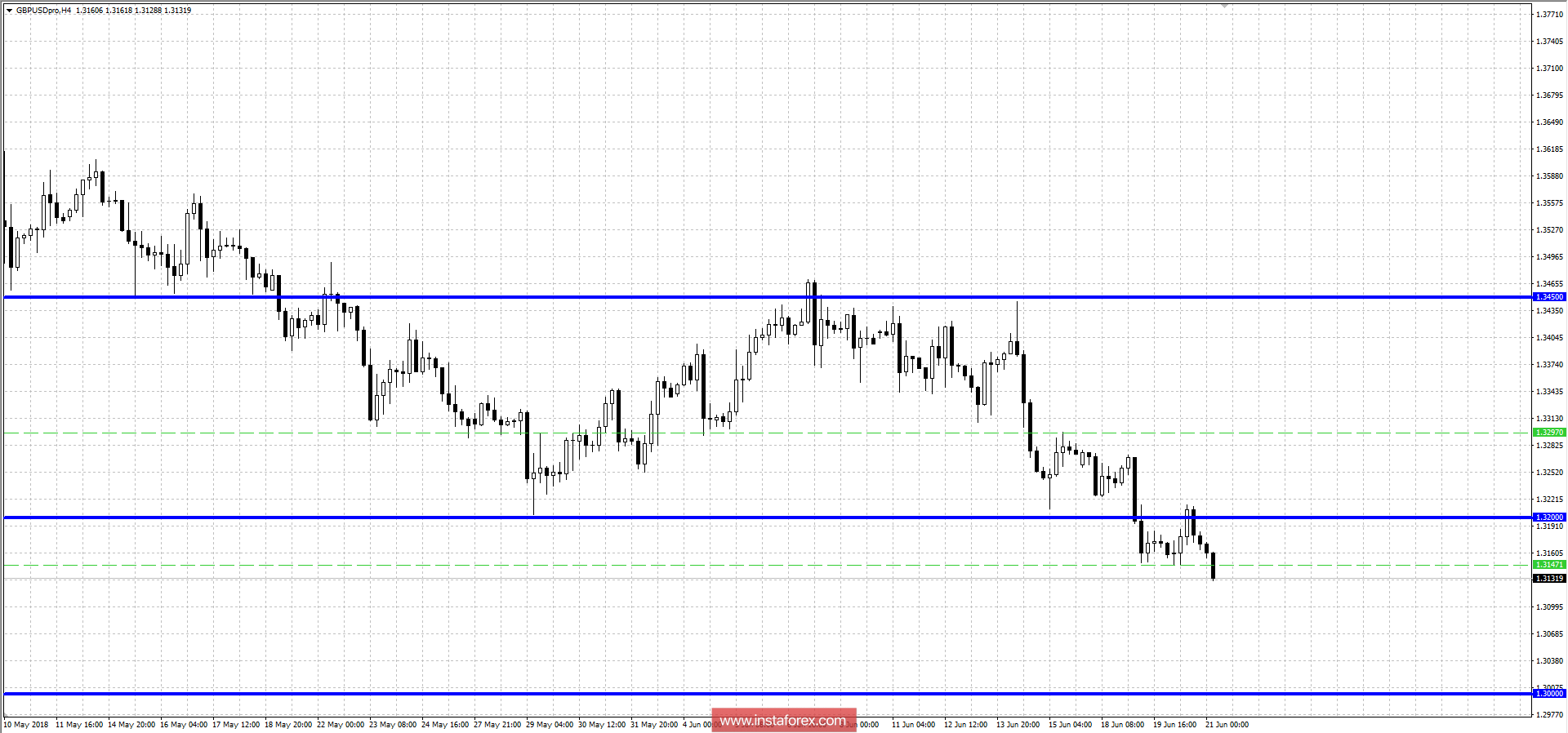

The GBP / USD currency pair managed to restore the downward movement after a slight pullback to 1.3200 level, overcoming the previously formed stagnation. It is likely that there will be a further decline in the psychological range of 1.3000 (1.3000 / 1.3050).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română