Eurozone

Mario Draghi confirmed the ECB's intention not to hurry with the growth of interest rates. In his opinion, it is necessary to carefully study the incoming data to make a decision on tightening monetary policy. The markets took Draghi's speech in Sintra (Portugal) calmly. There was no illusion that the ECB could begin to tighten in the foreseeable future.

Moreover, Draghi explained that even the completion of the asset purchase policy, scheduled for December, does not mean that the ECB is ready to abandon the policy of monetary stimulation. Thus, Draghi clearly blessed the acceleration of capital outflow from the euro area, and for the euro pointed direction, down and only down. The last support under the feet of bulls was knocked out by a commentary on the topic of inflation. According to Draghi, structural factors will prevent the growth of consumer prices, even if wages continue to rise.

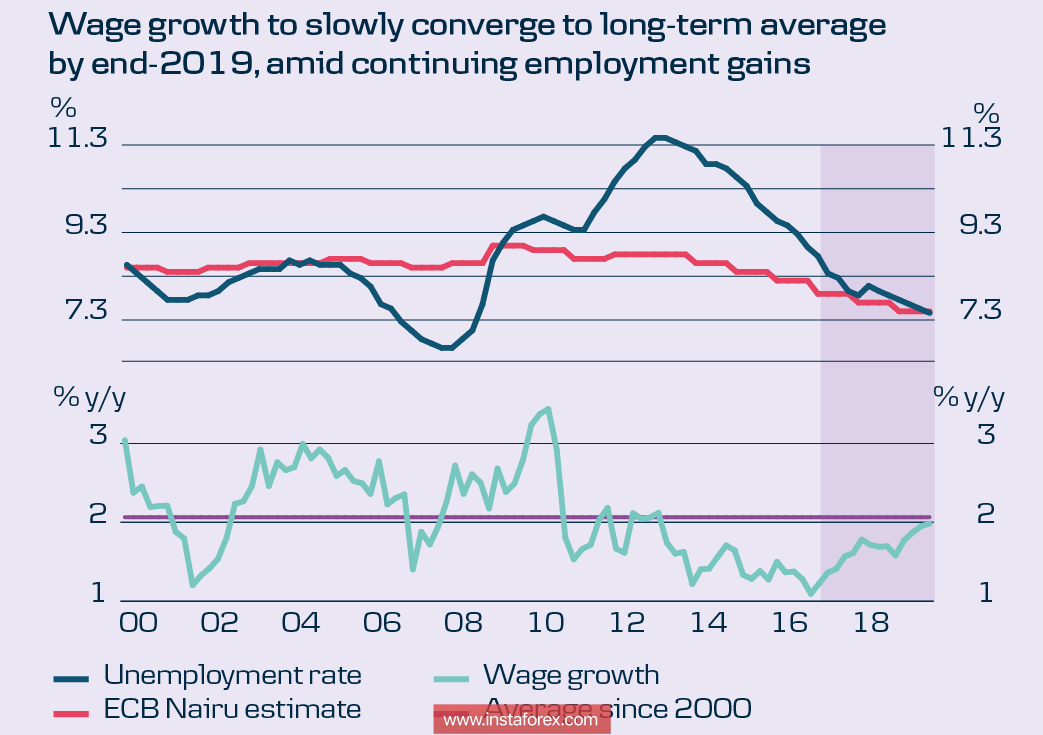

In fact, it is. Despite a fairly noticeable decline in the unemployment rate, the non-inflationary component of the NAIRU employment market also declined quite noticeably, and the average wage growth observed in the past 2 years has only just climbed to the average, that is, outpacing growth, capable of accelerating inflation.

However, the main threat, most likely, comes from the geopolitical risks for the euro area. Draghi noted the growing uncertainty in three areas, global protectionism, rising oil prices and increased volatility in financial markets. The latter factor is a direct consequence of the first, and for the euro area, it is of key importance, since the US protectionist policy is aimed, in fact, to strangle the free trade of European companies. The demand to curtail cooperation with Iran, or to block the construction of the North Stream-2 in practice means voluntary restriction of economic growth. Perhaps soon follow the order to limit cooperation with China?

In any case, the eurozone is going through a severe crisis, which tests the basic principles on which the monetary union was created, against which even the negotiations on Brexit, which until recently became dilapidated as one of the main destabilizing factors, recede into the background. The euro is under pressure, which is exacerbated by the inevitable growth in the yield spread in favor of the dollar and the outflow of capital from the eurozone.

We should expect to test again the support level of 1.15, this time more successful, and move to 1.12 in the next few days.

United Kingdom

On Thursday, a meeting of the Bank of England will take place, the results of which will be evaluated by the market in terms of the likely rate increase in August. I must say that the chances are not very high, according to Bloomberg, while the probability is close to 50%, that is, the markets do not have a common opinion on this.

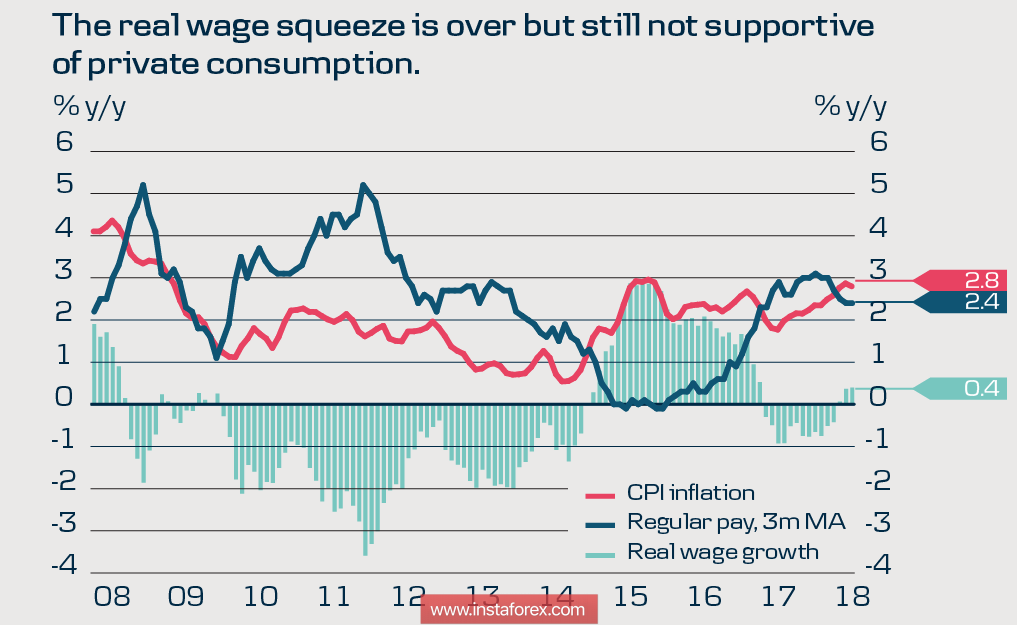

The UK economy looks weak, and the low level of GDP at the beginning of the year does not allow hawks from the WoE to seize the initiative. Despite the rather strong growth of the labor market and the reduction of unemployment, the key parameters of the health of the economy, such as real incomes of the population and consumer demand, look extremely weak.

The surge in inflation occurred as a consequence of the fall in the rate of GBP / USD, this factor completes its influence, but the second main engine, real wages, remains at an extremely low level, barely getting away from negative values.

The pound quotes include one increase this year and one in 2019. If tomorrow's meeting disappoints the bulls, then the expectations for the rate will be shifted from August to October, and the pound will go below current levels.

Uncertainty over Brexit in the coming days will not be relevant, there are no comments from officials on it, and before the EU summit at the end of the month the pound will not react to this factor.

The pound is likely to continue to decline, until the end of the week is likely a successful test at 1.30, since serious reasons preventing the weakening of the pound, has not yet been observed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română