The speech of the European Central Bank President yesterday, as well as the weak data on the European economy, put considerable pressure on the rate of the single European currency.

Despite the fact that Mario Draghi started talking again about the asset buy-back program, but in the wrong direction which already expect by most investors. The fall of the European currency was very restrained which indicates the presence of large players near the current support levels, where the main trade is currently underway.Yesterday, ECB President Draghi said that the uncertainty surrounding the prospects for economic growth in the eurozone has recently increased, and the main risks are related to protectionism, oil price hike and the volatility of financial markets.

Mario Draghi also signaled that the regulator could announce at any time the extension of the bond purchasing program and the delay in interest rate hike. It will be done if necessary to prevent a sharp slowdown in the growth of the euro area economy.

The ECB head noted that the expected completion of the asset purchase in December this year will directly depend again on the incoming data, confirming the medium-term inflation forecast.

As mentioned above, weak data on the euro area economy also put pressure on the single currency. Apparently, the protectionist measures of the US are beginning to work against a number of countries.

According to the European Central Bank, the surplus of the current account of the EU's balance of payments continued to decline in April. Thus, the positive current account of the balance of payments in April 2018 fell to 28.4 billion euros against 32.8 billion euros in March. For the 12-month period ending in April 2018, the euro area's current account balance surplus amounted to 413.7 billion euros. This is approximately 3.7% of GDP.

Data on the growth of bookmarks of US new homes did not have a serious support for the US dollar.

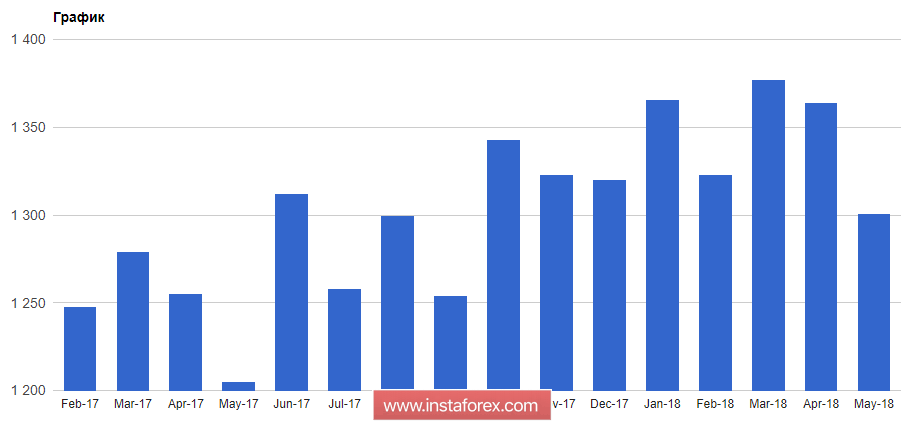

According to the report of the US Department of Commerce, bookings of new homes in May this year increased by 5% compared to April and amounted to 1.350 million per year. But building permits, on the contrary, fell by 4.6%, to 1.301 million a year. Economists had expected a 1.8% increase in bookmarks and a 0.1% decrease in permits.

As for the technical picture of the EUR/USD pair, the buyers of risky assets have a very good chance to regain their advantage. For this, it is necessary to return to the resistance area of 1.1600, where the demolition of stop-limit orders of sellers will lead to a larger upward trend in euro, with an update of the weekly highs in the resistance range of 1.1650 and 1.1690. If you reach 1.1600 and does not work, then the pressure on the euro will resume with a new force.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română