D. Trump continues to play the game on the rise, which on Tuesday again agitated the world financial markets.

The statement by the US president on Tuesday that he is ready to expand the measures of customs war with China for another $200 billion, hit global stock markets. China's main stock index fell 3%, but also under considerable pressure were the indices in Europe and the United States. First of all, the shares of raw materials, manufacturing and technology companies suffered. At the same time, the US dollar received support in the dollar index, on the whole adding against the basket of major currencies. This is probably due to the fact that while the markets believe that the Federal Reserve will continue to adhere to plans to tighten monetary policy, and the US economy in trade wars will suffer less than others.

But here lies the danger for the dollar, which, perhaps, is really smaller than that of its counterpart in the foreign exchange markets. Of course, the continuation factor, albeit smooth, but the increase in interest rates against the background of the slowdown of this process for other currencies due to the caution of central banks, which imitate them, is the main for the dollar. Investors expect that the US isolation policy will lead to an increase in domestic prices for commodities and raw materials, and this will lead to an increase in inflationary pressures, and the Fed in this situation will do nothing but continue to raise rates.

However, here lies "the devil in the details." Increasing rates will have a cooling effect on economic growth, which will ultimately lead to a new recession or economic recession. But here the question arises, and the Fed will have time to increase the key interest rate to a much higher level, for example, 4.0%, or not. The fact that this will happen is questionable, which means that the reserve in the amount of rates may not be enough to restrain the fall of the economy with new stimulus measures. That is why there is a risk that either the Fed will slow down in the future with higher rates, trying to maintain economic growth, or Trump will significantly weaken its pressure in trade wars. If the situation develops in this scenario, the dollar's growth will slow down, and stabilization of world markets and a reduction in the degree of tension will support other major currencies against the dollar.

As for Wednesday's possible dynamics of the foreign exchange market, a possible reduction in tension can exert local pressure on the dollar exchange rate in pairs with commodity and commodity currencies, and the demand for safe haven assets may decrease.

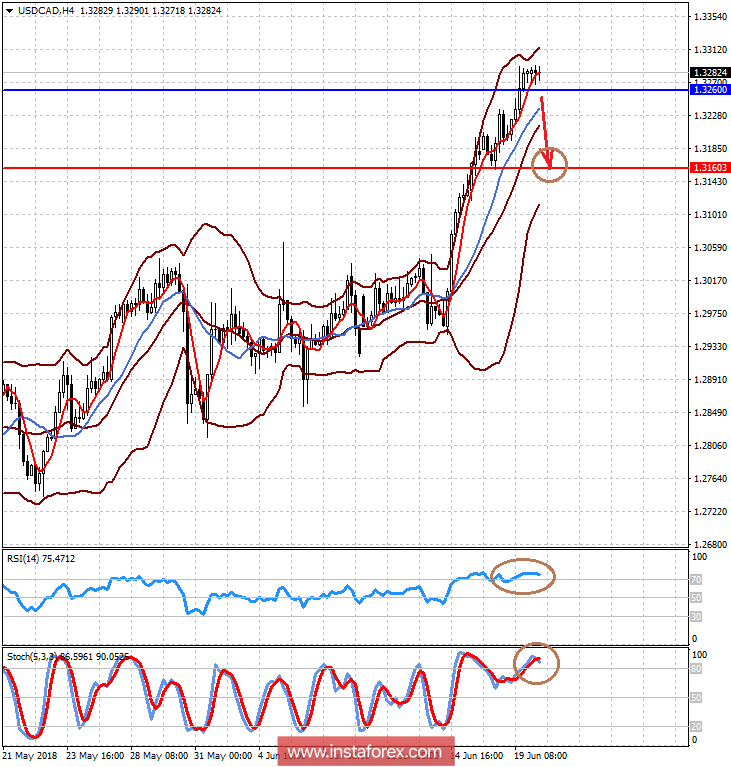

The forecast for today:

The USDCAD pair shows a decline in the upward potential against the backdrop of a recovery in demand for risky assets and a certain easing in tension. It is likely that this situation will support the Canadian currency, and the pair, falling from 1.3260, may drop to 1.3160, which will correspond to a 23% pullback on Fibonacci.

The AUDUSD pair adjusted upwards on the wave of the easing of tensions in the markets and the recovery of commodity prices and raw materials assets. The pair may rise to 0.7425 against this background and then to 0.7475 if it holds above 0.7400.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română