To open long positions for GBP/USD, it is required:

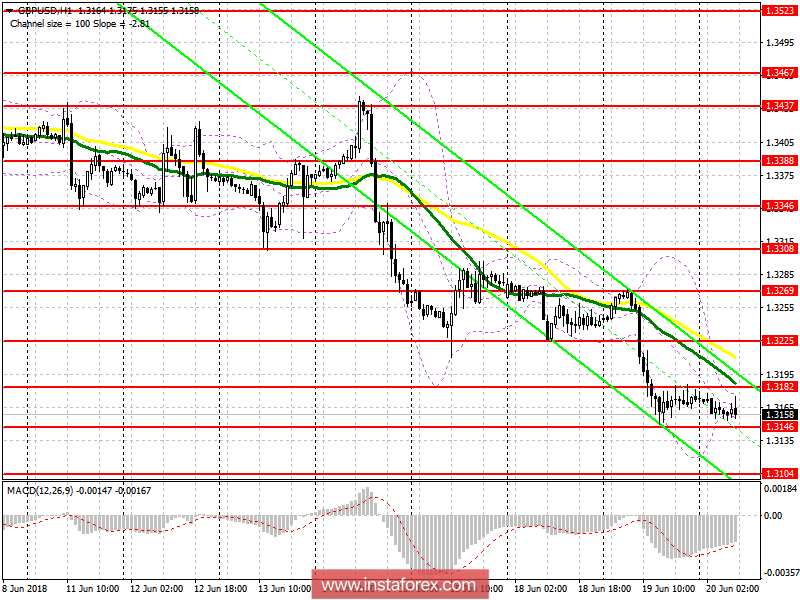

The formation of a false breakout at 1.3146 and its confirmation by the divergence on the MACD indicator will be the first signal to buy the pound. The main purpose of buyers is to return and consolidate above 1.3182, where you can count on an upward correction in the area of 1.3225, where I recommend to lock in the profit. In the event of a breakdown of 1.3146, long positions in the GBP/USD are best sought in the area of 1.3104 and 1.3077.

To open short positions for GBP/USD, it is required:

Sellers will try to gain a foothold below the support of 1.3146, which will lead to the formation of a new downward wave in the area of 1.3104 and 1.3077, where I recommend to lock in profit. In case of an increase in the resistance of 1.3182 in the first half of the day, the sales of the pound can be returned to the rebound from 1.3225 and 1.3269.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română