The oil market on the eve of the OPEC summit on June 22-23 is stormy. Investors estimate the size of the increase in production volumes and the timing of the plan. Russia expects to increase production by 1.5 million b / s, Saudi Arabia - by 0.5-1 million b / s, Iran, Iraq, and Venezuela categorically against. All countries have their own arguments in favor of their position, so the meeting promises to be hot. Interest in it is fueled by rumors that the reason for changing the cartel's worldview should be sought in the States.

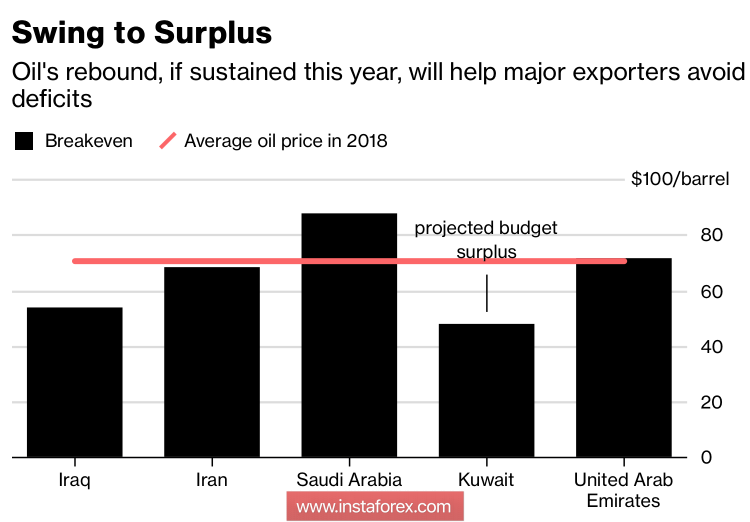

Donald Trump previously expressed the idea that OPEC artificially inflates the price of black gold, which is reflected in the rise in the cost of gasoline and a heavy burden falls on the shoulders of American taxpayers. The United States is a strategically important partner of Saudi Arabia, and only the desire to please them can explain the actions of Riyadh. The Saudis have the most serious budget surplus among the TOP-5 oil producers in the cartel. At the same time, a paradox arises, the country that has the greatest interest in price increases is actually promoting a plan aimed at reducing them.

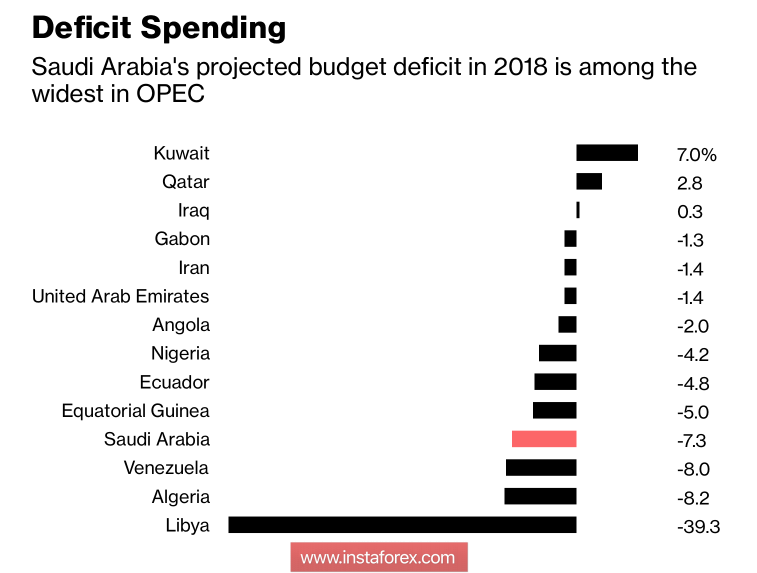

The budget deficit in OPEC countries,% of GDP

Break-even point for OPEC countries

Russia is shielded by fears about increasing production volumes by competitors from the United States. The topic is far from new, and the problems of the limited capacity of American pipelines can make it clear that its shirt is much closer to Moscow than what it is trying to show it. The figure of 1.5 million b / s may be the usual start in negotiations, a factor of pressure on dissenters. Subsequently, OPEC will finish trading at a level of 0.3-0.6 million b / s, and everyone will be satisfied.

The criticism of Tehran, Baghdad, and Caracas is quite understandable. They are afraid of losing their market share because of internal problems. Iran thinks what to do with American sanctions, Iraq with production capacities, and Venezuela with a political and economic crisis. The situation is aggravated by the penetration of militants into the oil pipelines in Libya, which, according to the official version, reduced production by 400 thousand b / s. A holy place is never empty, and Saudi Arabia and Russia are trying to occupy it.

The pressure on prices is exacerbated by the trade conflict between the US and China. Donald Trump threatens the Celestial import tariffs by $ 200 billion, and investors assess their implications for the global economy. The slowing of the latter under the influence of trade wars threatens to reduce the global demand for oil, which is a bearish driver for Brent and WTI.

Do not discount and strengthened in recent times, the dollar. The readiness of the Fed to continue the cycle of normalizing monetary policy accelerates the growth of the US currency, which increases the cost of imports of black gold in the largest consumer countries.

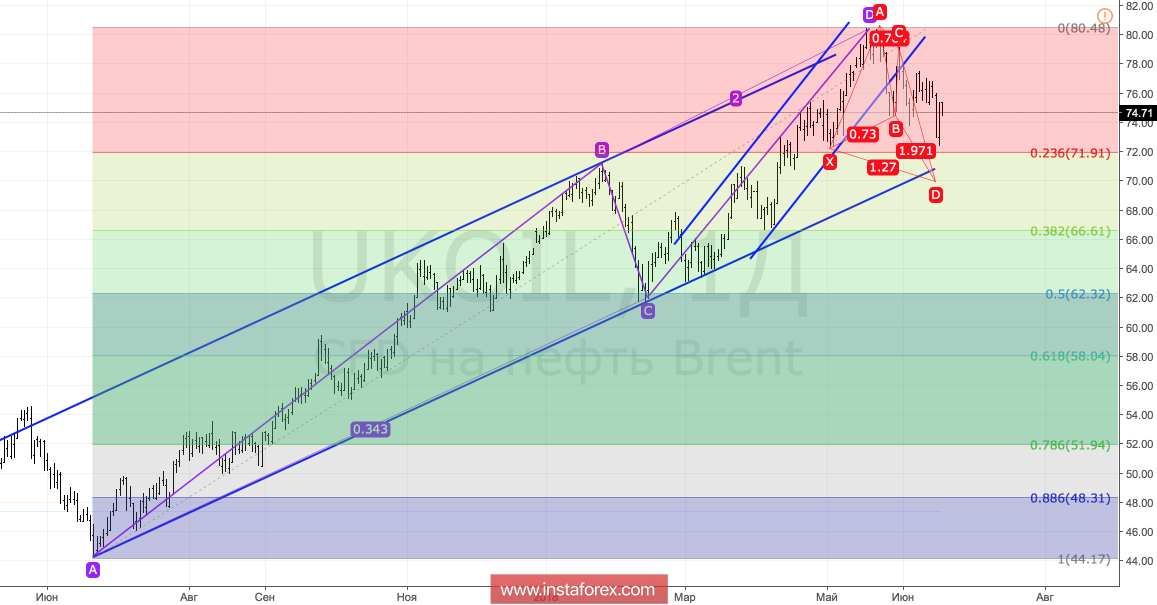

Technically, the Brent correction continues in the direction of targeting by 127.2% on the "Perfect Butterfly" pattern. It corresponds to the lower border of the ascending trading channel. Withdrawal from it will allow the market to move to the stage of consolidation in the range of $ 70-80 per barrel, which, most likely, Russia and Saudi Arabia are extracted.

Brent, the daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română