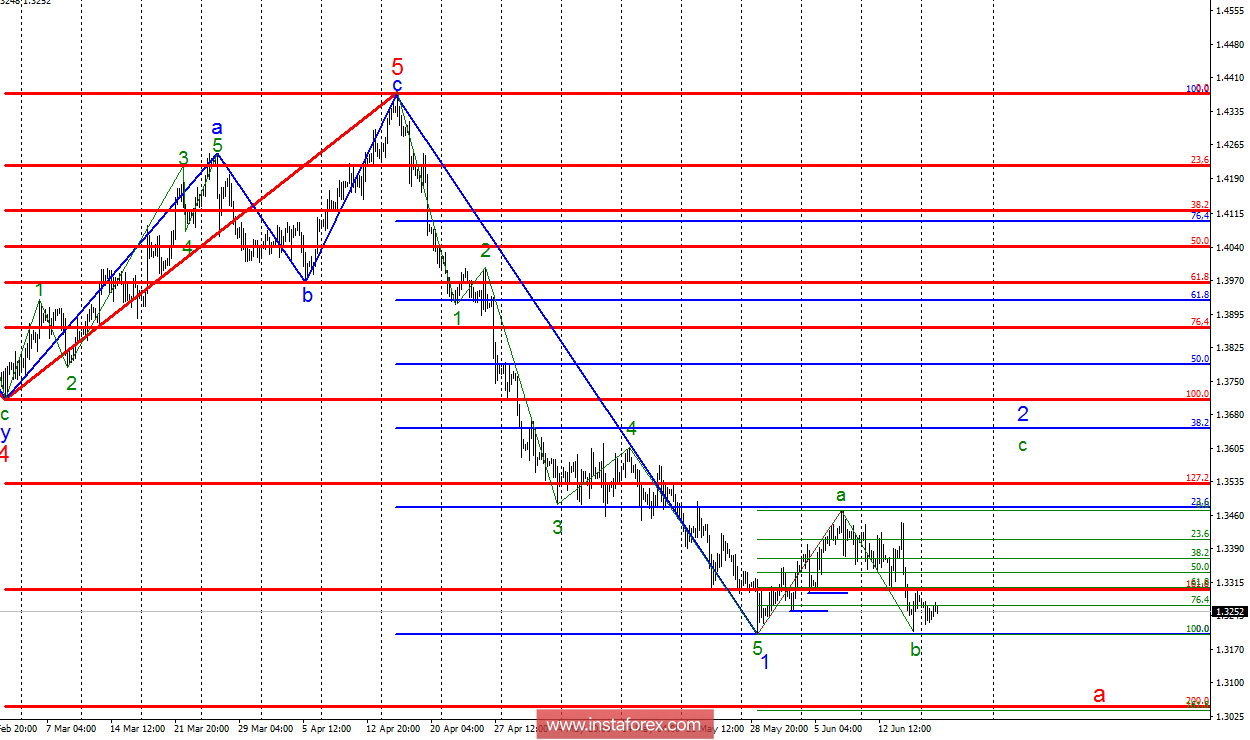

Analysis of wave counting:

During the trades on June 18, the GBP / USD currency pair lost about 40 percentage points, thus, in the near future, a breakthrough of the minimum of May 29, which is still a support for the possible construction of a wave c, 2, in the future a. A breakout of the minimum of 1.3203 will lead either to a complication of wave 2, which takes the form of one of the triangles, or to the beginning of the construction of wave 3, a. In the second case, wave 2, a, will take a very shortened form. The chances of further reducing the pair even more, as wave b, 2, took an extended form, which leads to the conclusion that the pound sterling is not inclined to growth now.

The objectives for the option with purchases:

1.3478 - 23.6% of Fibonacci

1.3528 - 127.2% of the Fibonacci of the highest order

1.3651 - 38.2% of Fibonacci

The objectives for the option with sales:

1.3045 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The assumed wave 2 can take a shortened form without a 3-wave internal structure. The break of the minimum of May 29 will indicate the willingness of the instrument to build the wave 3, in the downward part of the trend or to complicate the wave 2, a. One way or another, but now I recommend that you remain open to small purchases, with a view to building a wave c, 2, with targets near the marks of 1.3478 and 1.3651, which corresponds to 23.6% and 38.2% of Fibonacci. I recommend returning to sales after the breakthrough mark of 1.3203.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română