EUR / USD

On Monday, the euro continued a moderate upward correction (15 points) on a calm, external background. Italy's trade balance for April came in worse than the forecast: 2.94 billion euros against 3.21 billion and 4.53 billion in March. The data may indicate somewhat worse. Also, the balance of payments of the euro area for April was published today with the forecast of 30.3 billion euros versus 32.0 billion a month earlier. The German Central Bank released a monthly economic report yesterday. The Bundesbank expects some growth in the economy for the second quarter, noting positive trends in inflation. In the US, the business activity index in the housing market from the NAHB for June showed an unexpected decline from 70 to 68.

According to the US, data on bookings for new houses for May will be released today. The forecast is 1.31 million YoY against 1.29 million YoY in April. But the number of issued permits for the construction of new houses could fall from 1.36 million to 1.35 million.

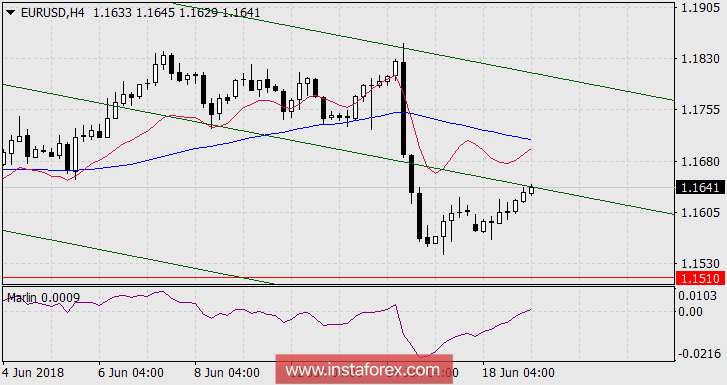

The technical aspect of EUR/USD shows the resistance of the pair during the Asian session on the side of the trend line and Marlin oscillator indicates the signal line had touched the border value of 0.00.

On the 4-hour timeframe, the Marlin indicator is also on the zero line, from which the signal line can be reversed and prices are down.

In general, investors are waiting for the opening of the ECB conference in Portugal, as Jerome Powell, Haruhiko Kuroda, and Philip Lowe are invited. The speakers will talk tomorrow, and Mario Draghi will make an opening speech today. Investors do not expect high-profile statements at this event. More important is acquired by a new round of increases in trade tariffs imposed by the US on China. We are waiting for the euro at 1.1510 - the low of May 29.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română