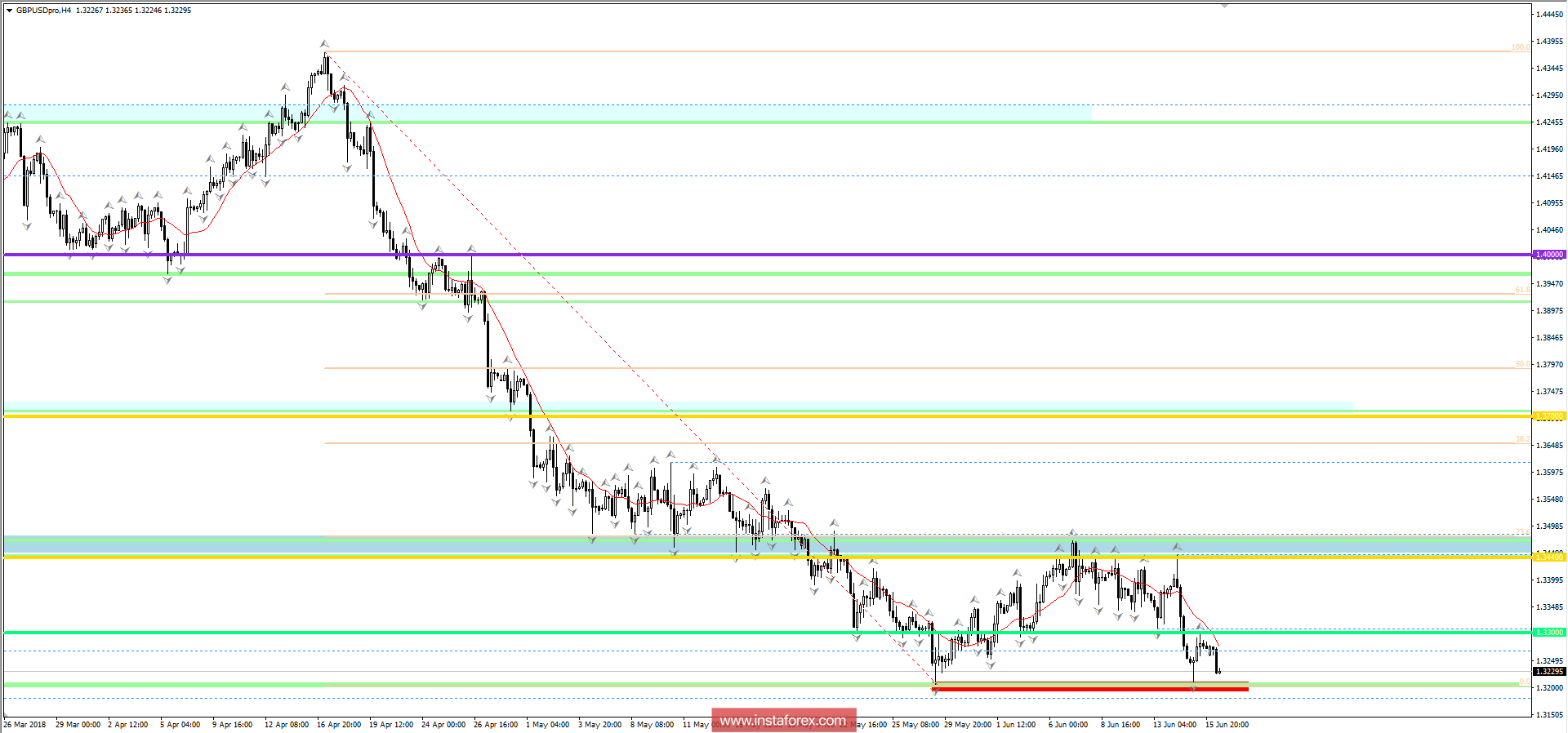

The pound/dollar currency pair managed to roll back to the level of 1.3300 after Mario Draghi's speech, but the joy of the bulls was short-lived, and the new week began with another market collapse. As we discussed in the previous review of June 15, there are still a lot of sellers in the market and they can not escape from them. The current week does not shine with positive news for Europe and Britain. We are waiting for ECB meeting where Mario Draghi will continue to "stimulate" the interest of the traders.

Further development

There is nothing positive for the strengthening of the British Pound, but the banquet will continue for the dollar. Now the quotation is rapidly approaching the local lows of 1.3200, which at the same time reflects the range level. While the level holds the quotation, but if it lasts long enough, this would become the issue.

At the moment we have two trading variations:

First, the level of 1.3200 keeps sellers, which is moving into a temporary flat between 1.3200 and 1.3300, where it will probably work with a small amount.

The second, "sit on the fence" while tracking clear fixations below the level of 1.3200. In the event of its breakdown, we will decline quite quickly to the range of 1.3150-1.3100, where in there will be a rapprochement in the the medium term at the psychological level of 1.3000.

Technical picture

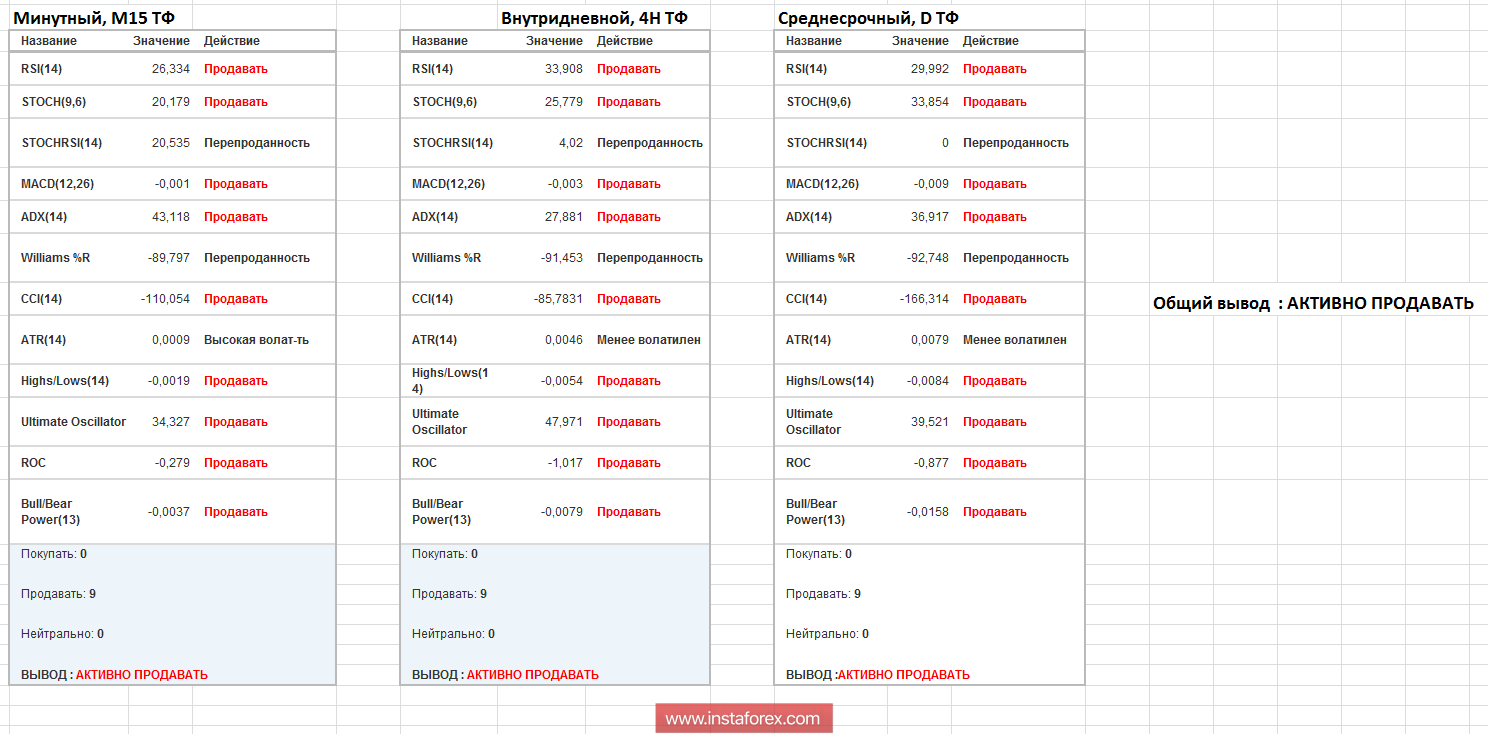

Analyzing different sector of timeframes (TF), we see that indicator analysis is more inclined to sales than to purchases. The general conclusion: We actively sell.

Key Levels

Resistance zones: 1.3300 *; 1.3440 **

Support zones: 1.3200; 1.3000 **

* Periodic level

** Range level

*** We sit on the fence - slang expression, we are out of the market

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română