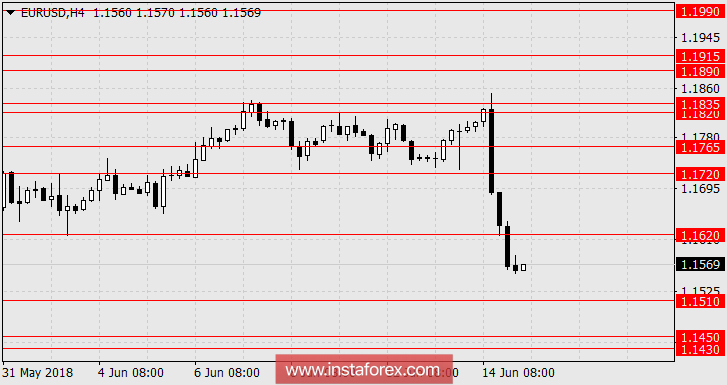

EUR/USD

As a result of yesterday's ECB meeting, the euro fell by 220 points. According to media reports, the ECB has taken a "sensational" decision to reduce asset purchases to its balance sheet (QE program) from the current 30 billion euros a month to 15 billion euros from October to complete the program in December this year. But in reality, nothing has changed for the markets - at any speed the QE program was planned to be completed in December. Of course, simply on this news in other circumstances, the euro could not lose more than two figures, the markets in this decline took into account the previous increase in the rate of the Fed. Moreover, we believe that it was the decision of the Federal Reserve to tighten up policy is the basis of yesterday's powerful market movements. This is a fundamentally important point-to identify the main player, since it is under this scenario that further developments will develop. And this player is the Fed.

Trading volumes were the highest since February of this year-those investors (stop losses) who bought the Euro against the fundamental picture were taken out of the market...

In this regard, the euro will continue to fall with every negative phenomenon in Europe and the world in general, and positive developments in the US. In the US, so far all is well. Retail sales in May increased by 0.8% against the forecast of 0.4%. Underlying sales, excluding cars, added 0.9% against the forecast of 0.5%. Import prices for the same month increased by 0.6% against expectations of 0.5%. Inventories of companies in April increased by the expected 0.3%.

Data on the trade balance for April will be published today in the eurozone. It is expected to fall from 21.2 billion euros to 20.2 billion. The final estimate for May consumer price indices of the eurozone will be released today, with no change expected: 1.1% y/y on the base index and 1.9% y/y on the general CPI.

The US industrial production in May will be released - the forecast is 0.2%. The capacity utilization rate is expected to increase from 78.0% to 78.1%. Another indicator - the consumer confidence index from the University of Michigan - for June is expected to increase from 98.0 to 98.5 points.

We are waiting for further decline of the euro. The nearest target is 1.1510, then the range is 1.1430/50. On Tuesday next week, there will be data on the construction of new homes in the US in May, the forecast suggests an increase of 1.4%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română